Last week, see here, we showed, by using the Elliott Wave Principle (EWP), that a local top for Bitcoin was approaching and found,

“it is still wrapping up the … green W-1, which … can be raised to around $37,500+/-1000. From there, we should expect BTC to drop to approximately $28,500-32,500 for the green W-2 before the green W-3 targets at least $45K, but possibly much higher. The alternative is that BTC is in a one-degree lower, aka more minor, 3rd wave, and instead of wrapping up one more set of a 4th and 5th wave, it needs a set of two more before the larger W-2 pullback occurs.”

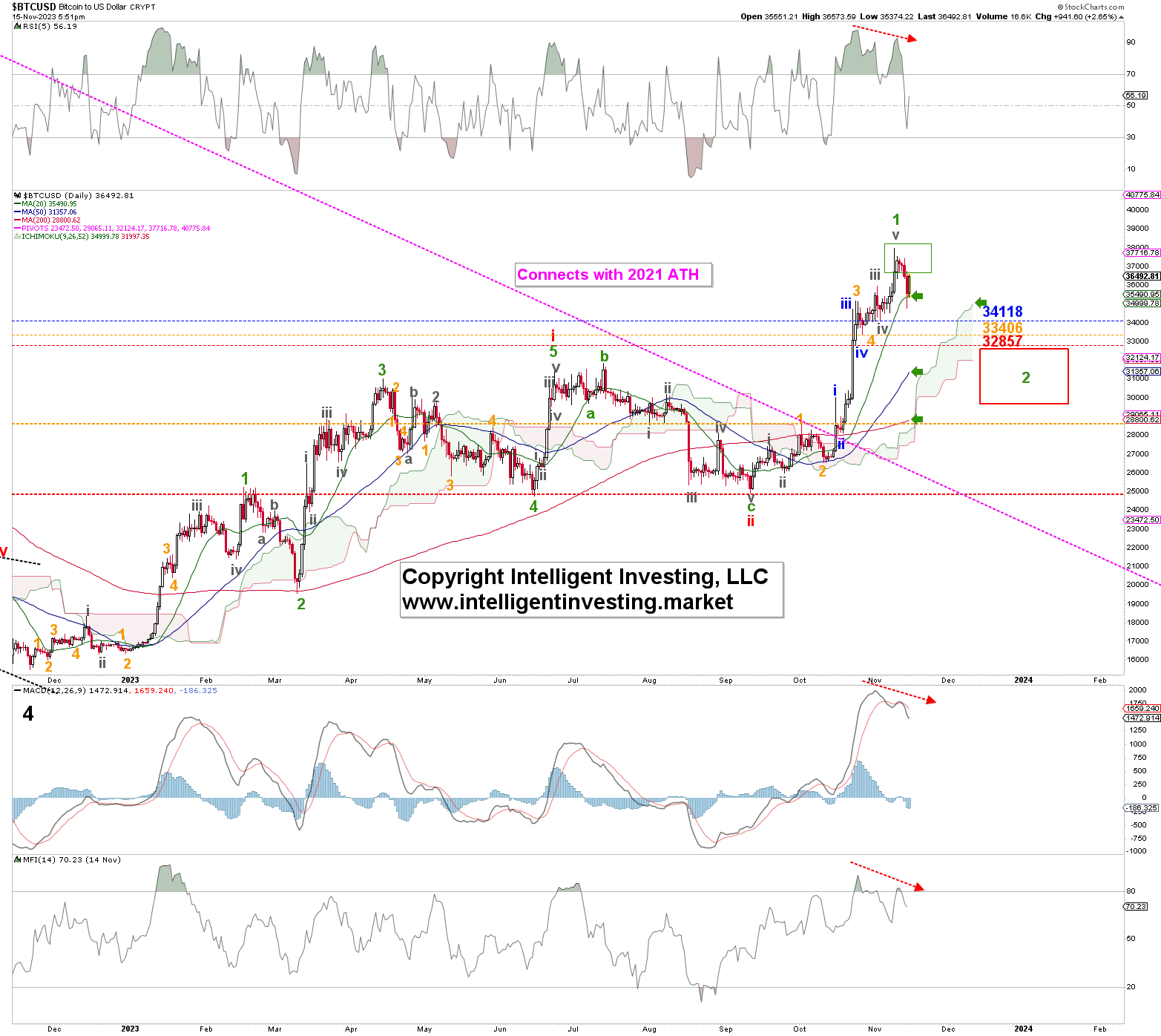

Fast forward, and our assessment that BTC would continue to move higher and top out was again correct, as it reached as high as $37990 on November 9. Right inside the ideal (green) target zone: see Figure 1 below.

Figure 1. The daily chart of BTC with several technical indicators Since that high, BTC dropped to as low as $34788 yesterday and could thus have peaked for the green W-1, with W-2 down to ideally $30.5+/-2K now underway. Although there are now plenty of negative divergences on the technical indicators (red dotted arrows), it still requires at least a daily close below the 20-day Simple Moving Average (SMA) followed by a move below at least $34118 to confirm the local top is in place.

Since that high, BTC dropped to as low as $34788 yesterday and could thus have peaked for the green W-1, with W-2 down to ideally $30.5+/-2K now underway. Although there are now plenty of negative divergences on the technical indicators (red dotted arrows), it still requires at least a daily close below the 20-day Simple Moving Average (SMA) followed by a move below at least $34118 to confirm the local top is in place.

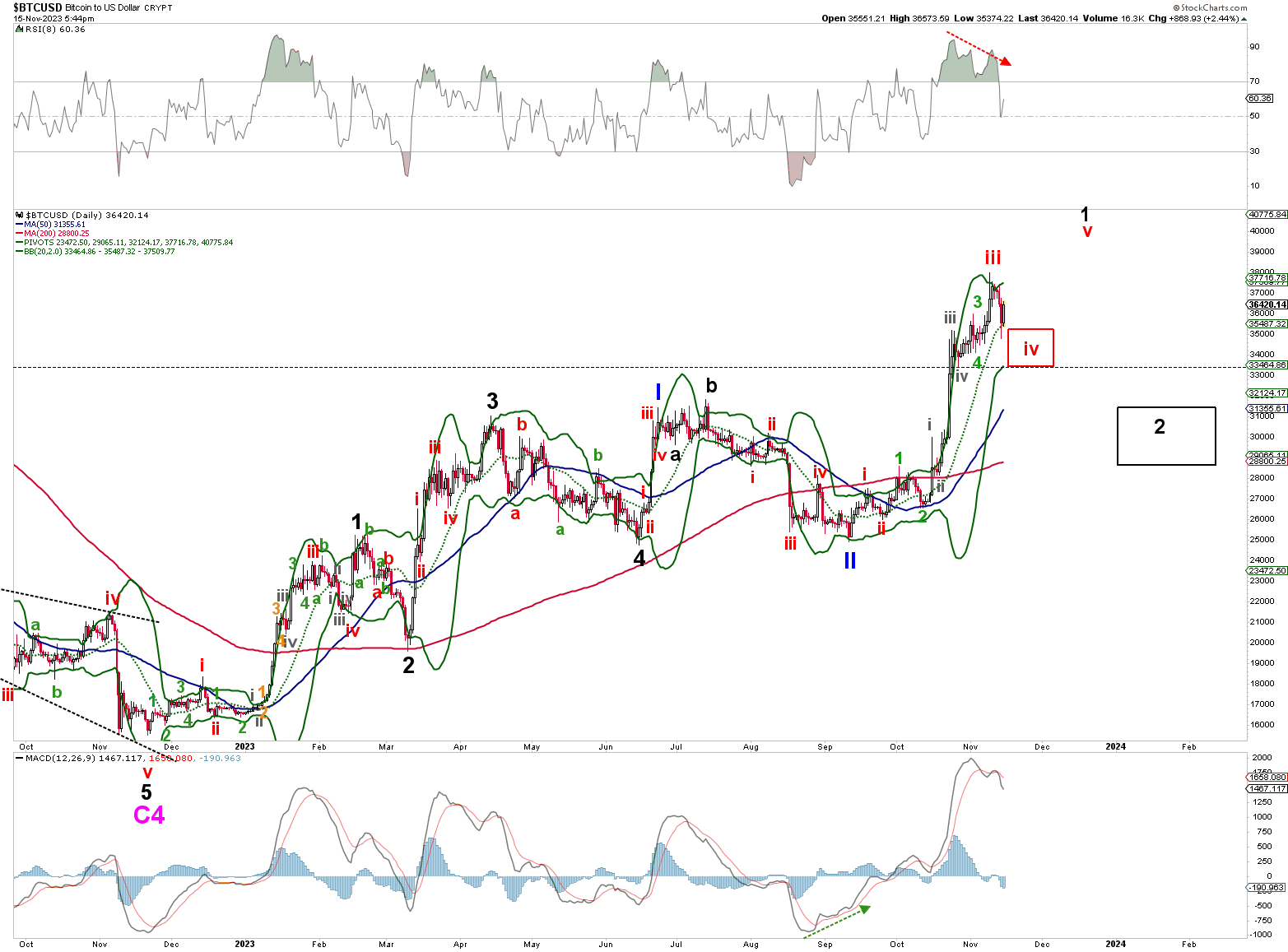

As shown in our last up, the alternative remains that BTC needs to wrap up one more set of a 4th and 5th wave before the larger W-2 pullback occurs. Last week, it completed the red W-iii, and yesterday’s low may have been the red W-iv, with the red W-v now underway. See Figure 2 below. This sequence would target slightly higher at around $40K. It will require a break above the November 9 high to confirm while holding above the critical $33406 level (black dotted horizontal line).

Figure 2. The daily chart of BTC with several technical indicators As you may recall, we have been Bullish on BTC for quite some time, and our prognostications in recent updates have come to fruition. However, our Bullish scenario is entirely invalidated below $25K. This price level is our insurance level to prevent potentially more extensive havoc on our portfolio. However, only when that happens will we change our overall, longer-term Bullish POV, which BTC is proving more and more correct for each update we provide in that,

As you may recall, we have been Bullish on BTC for quite some time, and our prognostications in recent updates have come to fruition. However, our Bullish scenario is entirely invalidated below $25K. This price level is our insurance level to prevent potentially more extensive havoc on our portfolio. However, only when that happens will we change our overall, longer-term Bullish POV, which BTC is proving more and more correct for each update we provide in that,

“Based on BTC’s past cycles, made up of four more minor phases, it is currently in the accumulation phase and thus close to the next Bull run, which can target $100-200+K by the end of 2025.”