- Apple's Q2 2023 earnings forecast shows a decline in revenue and earnings per share, indicating vulnerability to the challenging macroeconomic environment

- Still, the company's cash pile and low EPS expectations could potentially help propel the stock higher in the short term

- Let's take a deep dive into the company's financials with InvestingPro

After the wave of better-than-expected financial results from tech companies helped push the S&P 500 to its best month since January, the world's largest company, Apple (NASDAQ:AAPL), could preside the make-it-or-break-it moment the market has been holding its breath for.

The behemoth tech company is set to announce Q2 2023 earnings tomorrow after the market closes, with analysts forecasting a 4.6% YoY decline in revenue and a 6% YoY decline in earnings per share.

Those numbers show that even Apple may not be immune to the headwinds brought by the current challenging macroeconomic environment. This comes as Apple prepares to launch its latest iPhone models, which are expected to carry premium price tags.

As the Fed's rate-hike cycle approaches its ending without any indication of a pivot in the short term, assessing the impacts of prolonged higher capital costs on the financial health of major global companies will be essential for predicting the market's direction.

With our InvestingPro tool, we will take deep dive into Apple's financials to better understand where we stand right now. Readers can do the same for virtually every company in the market just by using the following link.

Apple's Financials

InvestingPro users would know that Apple has had nineteen negative EPS expectation revisions over the last 90 days against only ten positive, implying that analysts are pricing in a greater probability of a negative than a positive surprise tomorrow.

Source: InvestingPro

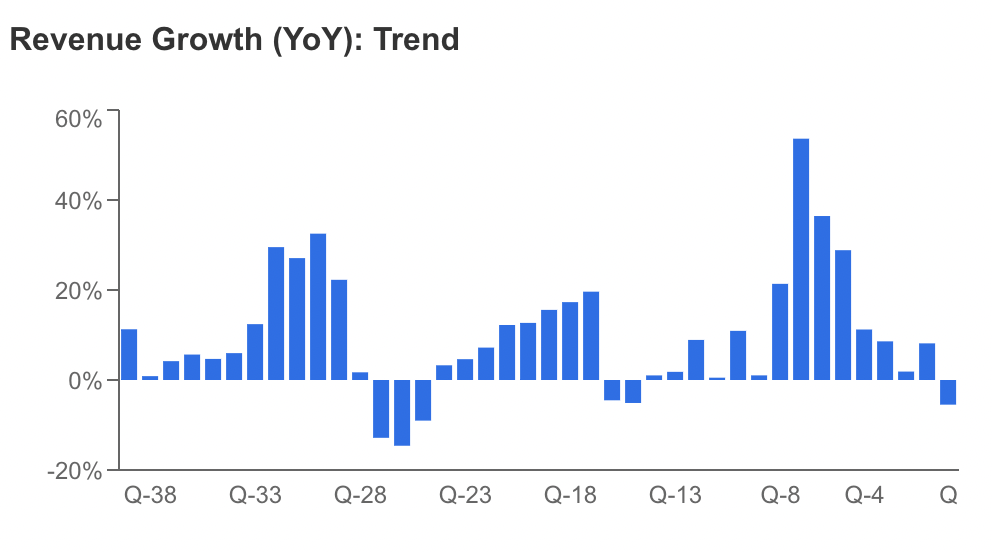

One of the main reasons for those revisions is that the slowdown in consumer spending has negatively impacted Apple's revenue growth. Despite the company's strong financial performance in recent years, there are growing concerns that high-priced products may become less attractive to consumers in a weaker economy.

Source: InvestingPro

Additionally, modest performance in consumer-facing services such as Apple Music and TV+ could limit the company's ability to improve growth rates within its Services segment.

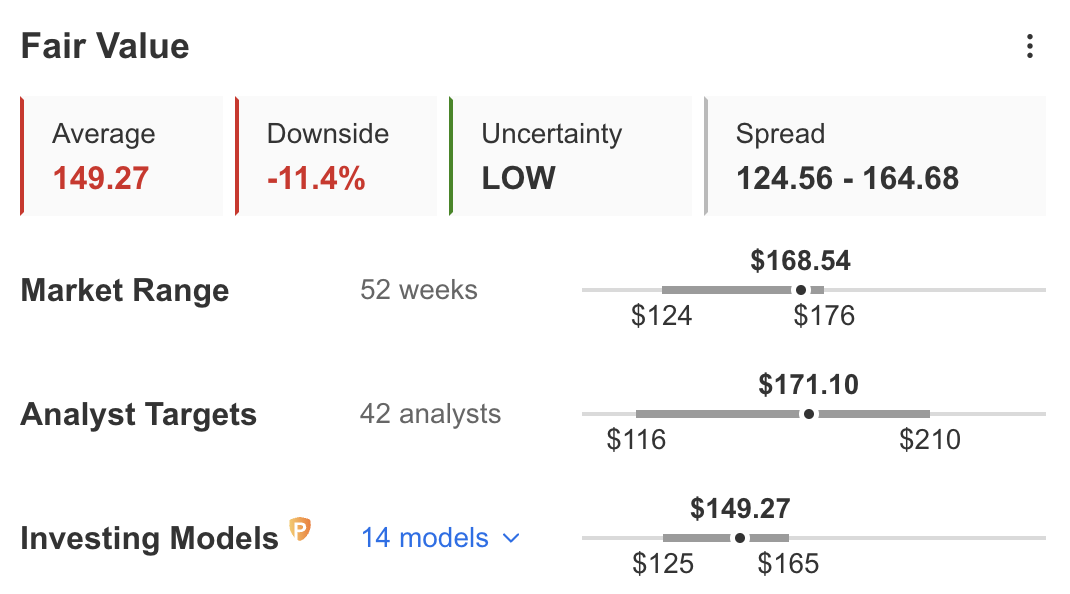

That's why InvestingPro evaluates that the company is trading at a high premium, with analysts' Fair Value estimates averaging an 11.4% downside over the next 12 months.

Source: InvestingPro

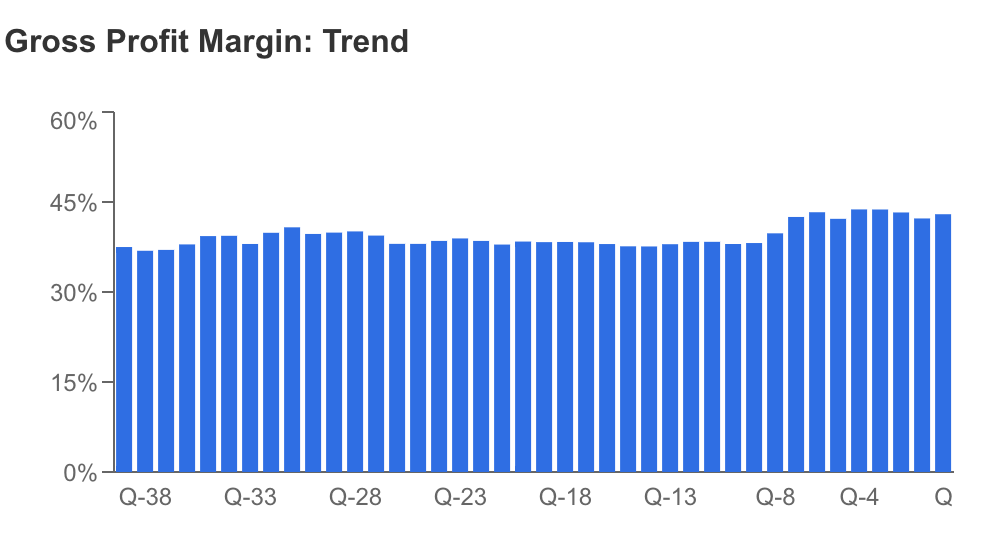

On the flip side, the behemoth company has been able to keep growing its margins, benefiting from the combination of higher inflation with still resilient economic activity.

Source: InvestingPro

The above chart is arguably one of the metrics investors should be the keenest on analyzing when assessing last quarter's performance after the company's earnings come out tomorrow. A compression of Apple's margins could likely indicate that the US economy is moving in leaps and bounds toward a stagflationary scenario.

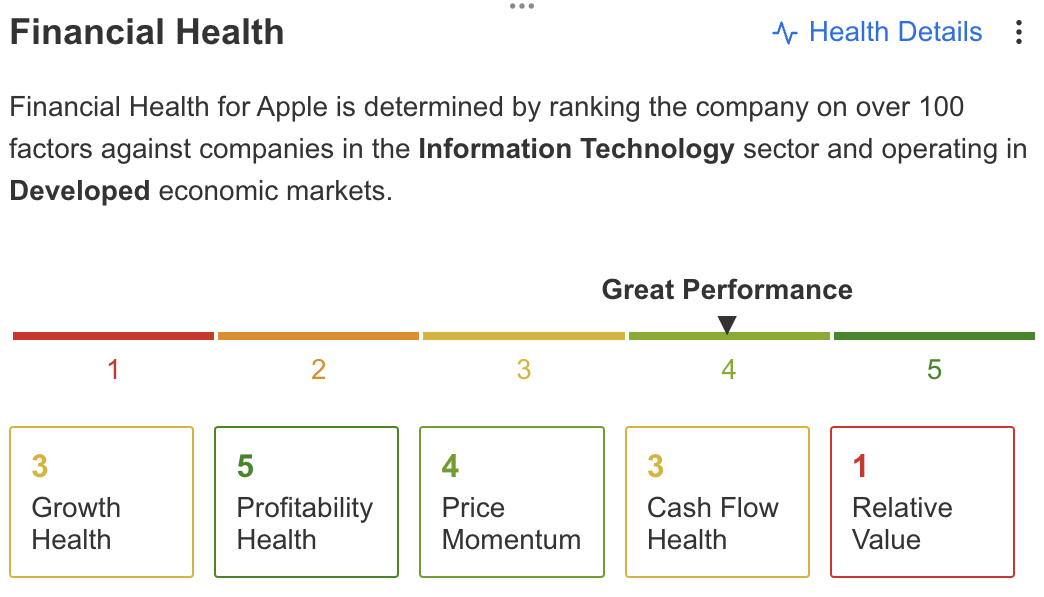

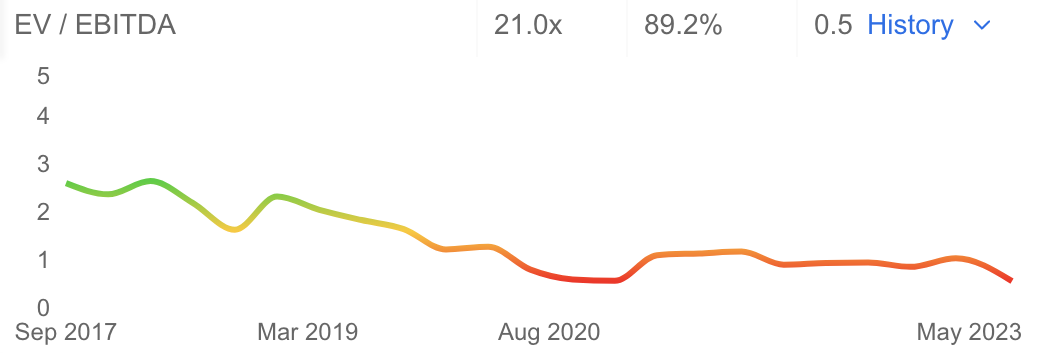

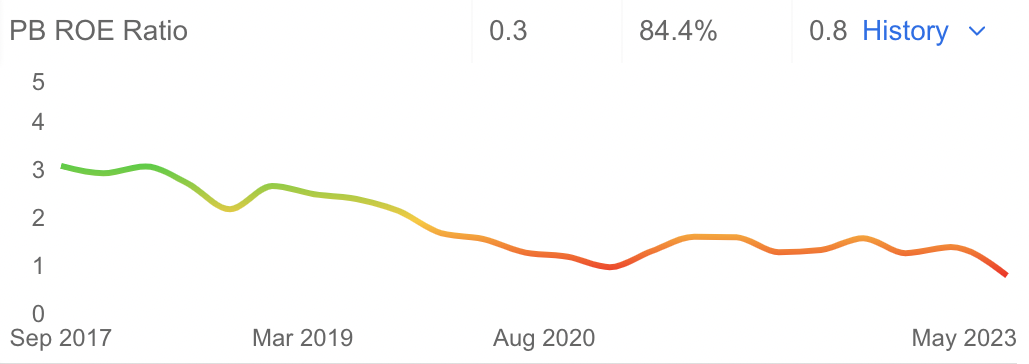

Another important point is Apple's Financial Health Score. While the metric remains positive regarding Profitability Health, Price Momentum, and Cash Flow Health, the Relative Value shows significant compression, implying that the company might be too expensive at the moment.

Source: InvestingPro

The reason for that is a higher EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization ratio) and PB/ROE (price-to-book ratio to return on equity) ratios.

Source: InvestingPro

Source: InvestingPro

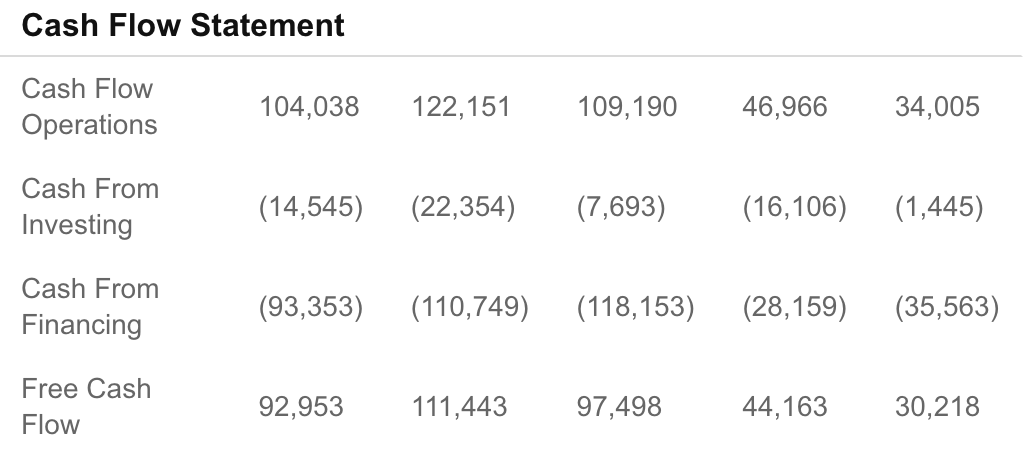

Notably, the company's cash flows have been trending lower since the end of 2021 due to higher interest rates.

Source: InvestingPro

On the flip side, however, Apple remains the world's richest company in terms of cash reserves, with roughly $54 billion in net cash. While the cash pile has been dwindling, investors expect that Apple's upcoming earnings report could reveal an increase in both share-repurchase authorization and dividend payouts, which could likely push the stock higher in the short term.

Apple has also taken steps to benefit from the current high interest rate environment. The company's new high-yield savings account has reportedly attracted $1 billion in the first four days of operation.

Furthermore, the company's EBITDA has been trending higher since topping out in September last year.

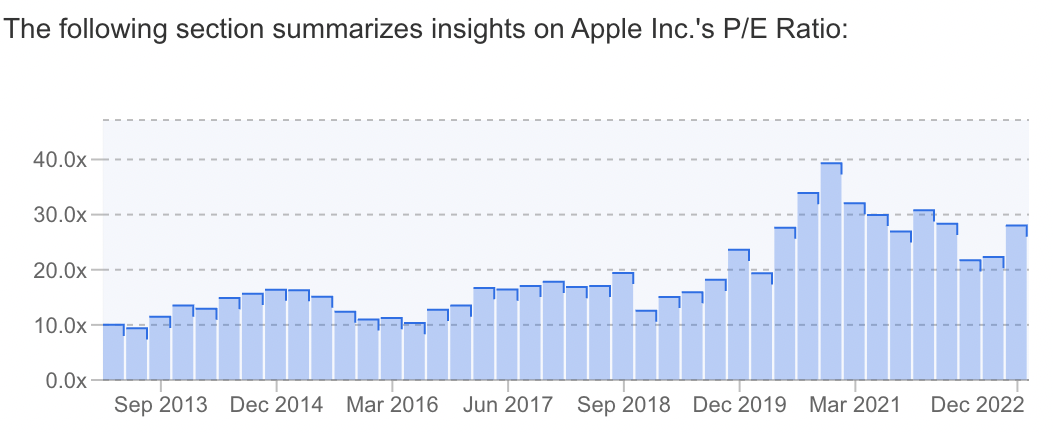

Finally, while the company's push for business expansion in India could take time to bear fruit, it represents an avenue for further growth, which could help sustain the company's 28x P/E ratio for longer.

Source: InvestingPro

Bottom Line

While Apple remains a safe haven to park your money, I wouldn't consider it an actual buy going into earnings due to its current high premium and shrinking margins. Save from a pivot from the Fed, there's a high likelihood that the company's financials will dwindle along with the broader economy, possibly providing investors with a better entry point in the future.

***

Disclosure: The author owns Apple stock for the long-term.