Harris Corporation (NYSE:HRS) is slated to release fourth-quarter fiscal 2017 results on Aug 1, before the market opens.

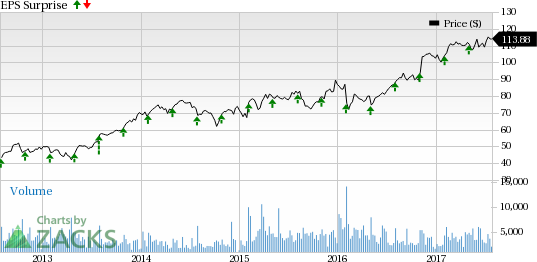

Last quarter, the company delivered a positive earnings surprise of 5.34%. Also, its earnings surpassed the Zacks Consensus Estimate in the preceding four quarters with an average beat of 3.16%.

Let’s see, how things shape up for this announcement.

Factors Likely at Play

The fact that Harris is a highly leveraged company might hurt results in the fourth quarter. The Communication Systems segment’s disappointing performance in the previous quarter is likely to continue in the reported quarter as well.

Though positive on the company’s growth on the back of acquisition strategy, we note that all buyouts have integration risks associated with them. Failure to successfully integrate the newly acquired companies into its own business model may result in trouble for Harris. This might further affect results in the quarter to be reported. Also, weakness in international markets might lead to lower-than-expected sales of tactical radio products.

However, the company’s efforts to reward shareholders are encouraging. In Apr 2017, the company’s board announced a quarterly cash dividend of 53 cents per share.

Earnings Whispers

Our proven model does not conclusively show that Harris is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as elaborated below.

Zacks ESP: Harris has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.49 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Harris has a Zacks Rank #4 (Sell). We caution against all Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Investors interested in the broader Computer and Technology sector may consider the following stocks, which per our model, possess the right combination of elements to come up with an earnings beat in their respective quarters:

AMTEK, Inc. (NYSE:AME) has an Earnings ESP of +1.61% and a Zacks Rank #3. The company will report second-quarter earnings numbers on Aug 2.

Arrow Electronics, Inc. (NYSE:ARW) has an Earnings ESP of +0.57% and a Zacks Rank #2. The company will report second-quarter earnings numbers on Aug 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apple Inc. (NASDAQ:AAPL) has an Earnings ESP of +1.27% and a Zacks Rank #3. The company will report third-quarter fiscal 2017 results on Aug 1.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Harris Corporation (HRS): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Arrow Electronics, Inc. (ARW): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research