We expect Zoe's Kitchen, Inc. (NYSE:ZOES) to beat expectations when it reports first-quarter 2017 numbers on May 25, after market close.

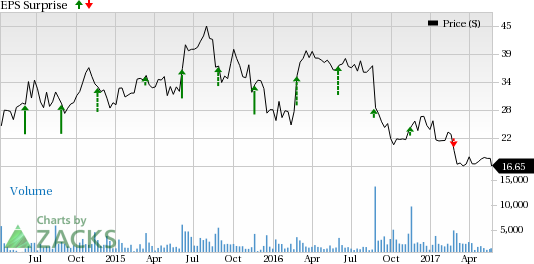

Last quarter, Zoe's Kitchen posted a negative earnings surprise of 16.67%. However, the trailing four-quarter average positive surprise is 8.33%.

Let’s see how things are shaping up prior to this announcement.

Why a Likely Positive Surprise?

Our proven model shows that Zoe's Kitchen is likely to beat earnings because it has the perfect combination of the two key ingredients.

Zacks ESP: Zoe's Kitchen has an Earnings ESP of +100%. This is because the Most Accurate estimate is 2 cents, while the Zacks Consensus Estimate is pegged lower at 1 cent. A favorable Earnings ESP serves as a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Zoe's Kitchen currently carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings estimates.

Conversely, we note that sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of Zoe's Kitchen’s favorable Zacks Rank and positive ESP makes us reasonably confident of an earnings beat this quarter.

What is Driving Better-than-Expected Earnings?

Zoe's Kitchen that specializes in Mediterranean cuisine began trading in Apr 2014. Notably, the fourth quarter of 2016 marked the company’s 28th consecutive quarter of positive comps. We expect this trend to have continued in the to-be-reported quarter as well, given its increased focus on menu innovation and marketing and promotional campaigns to promote these items.

We note that the efforts undertaken by this fast-casual restaurant to provide a superior guest experience, improve restaurant operations and expand its reach should also drive traffic this quarter. Meanwhile, rolling out of various menu ingredient prep enhancements or simplifications is likely to drive back-of-the-house efficiencies thereby resulting in increased throughput.

Additionally, increased focus on catering and delivery services, enhancing digital capabilities as well as consistent unit expansion are expected to bolster top-line growth.

However, increasing labor costs along with higher store operating expenses and expansive investments in technology may dent the quarter’s profitability. Furthermore, a soft consumer spending environment in the U.S. restaurant space might continue to hurt traffic and thereby comps in the to-be-reported quarter.

Stocks to Consider

Zoe's Kitchen is not the only company looking up this earnings season. Here are some other companies to consider as our model shows that they have the right combination of elements to post an earnings beat this quarter:

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +10.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +2.86% and a Zacks Rank #2.

Big Lots, Inc. (NYSE:BIG) has an Earnings ESP of +2.00% and a Zacks Rank #2.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Zoe's Kitchen, Inc. (ZOES): Free Stock Analysis Report

Original post