Alliance Bernstein (NYSE:AB) has a great blog post up on the key lessons they've learned in 2014. I thought Lesson 2, featured below, was especially worth highlighting:

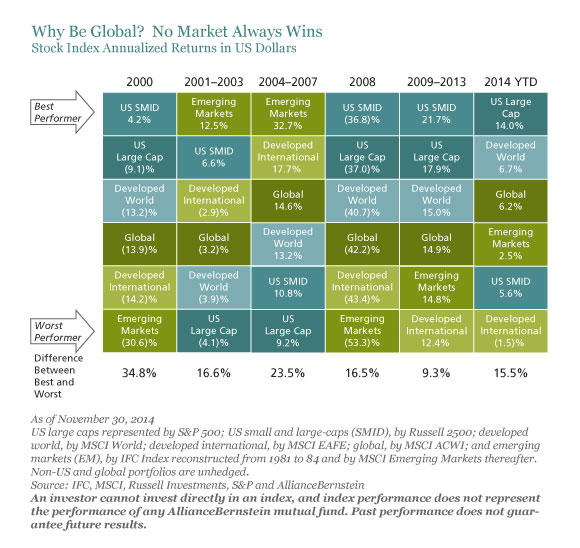

After leading globally in 2013, in 2014 through November the US stock market beat developed international stock markets by 15.5 percentage points in US Dollar terms; it beat emerging markets by 11.5 percentage points, as shown in the first Display, below. This outperformance by US stocks has some investors ready to throw in the towel on global investing.

We think selling an asset after a stretch of lagging performance is a bad decision. Often, the lagging asset may be more attractive looking ahead. And that’s what we’re seeing in developed international stocks markets, where valuations are more attractive than in the US stock market.

Since 1990, non-US stock markets have outperformed the US market more than half the time. Since no one can be certain just when this will occur, we think it’s wise to own stocks in all regions.

A similar argument can be made for diversification by size. Large-cap US stocks trounced small- and mid-caps by 8.4 percentage points so far in 2014, but large-caps trailed smaller stocks by 11.7 percentage points annualized from 2001 through 2003. The key is to hold stocks across the size spectrum.

Diversification remains a fundamental tenet of smart investing—both as a way to manage risk and as a way to maximize return.