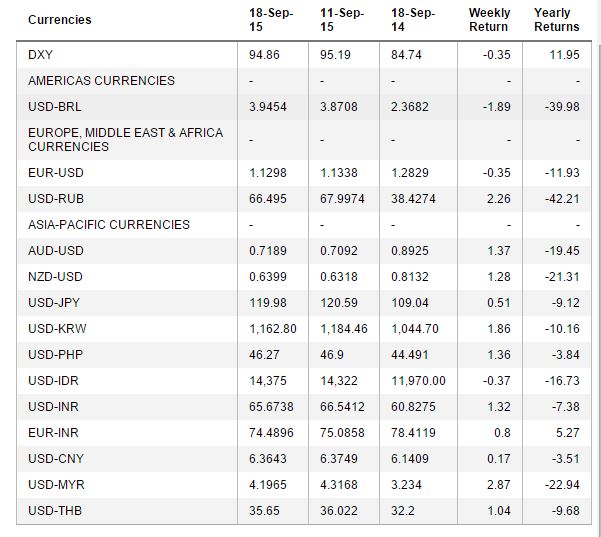

Asian currencies were broadly up last week against the USD after the Fed left interest rates unchanged, as concerns eased over potential capital outflows.

Australian dollar appreciated by 1.37%, New Zealand dollar appreciated by 1.28%, Japanese yen appreciated by 0.51%, South Korean won appreciated by 1.86%, Philippines peso appreciated by 1.36%, Indian rupee appreciated by 1.32% against USD and by 0.8% against euro, Chinese yuan appreciated by 0.17%, Malaysian ringgit appreciated by 2.87% and Thai baht appreciated by 1.04%.

The INR is likely to stay strong as the government is expected to increase FII investment limits in government bonds. RBI Rate cut expectations will drive flows into INR bonds providing strength to the INR.

The USD was highly volatile throughout last week on the expectation of outcome of Fed FOMC meeting. USD rose in the early part of the week but came under pressure as Fed commenced its two-day meeting and it declined sharply after the Fed decided to leave interest rates unchanged for the time being, stating that recent global economic slowdown played a major part in the central bank's decision. On Friday, however, USD recovered and pared some of its losses as the central bank left open the possibility of a rate hike later this year.

The USD Index (DXY), which tracks the movement of the USD against six major currencies, declined by 0.35% on weekly basis and closed at levels of 94.86.

Data released on Tuesday showed that U.S. retail sales rose by 0.2% in August against the expectations of an increase of 0.3% after a 0.7% rise in July. Core retail sales rose by 0.1% in August against the expectation of a 0.2% rise after a 0.6% rise in July.

Industrial production data showed that industrial production declined by 0.4% in the month of August against the expectation of 0.2% decline following a rise of 0.9% in the month of July.

The Federal Reserve of New York on Tuesday reported that its Empire State Manufacturing Index improved to minus 14.67 in the month of September from minus 14.92 in the month of August against the expectations of minus 0.75.

Data released by Commerce Department showed that U.S. inflation ticked down last month, which was the first in the last seven months. Data showed that consumer prices declined by 0.1% in the month of August, which was in line with expectations following a 0.1% rise in the month of July. Core consumer prices rose by 0.1%, which was also in line with expectations.

The U.S. Department of Labour on Thursday reported that number of individuals filing for initial jobless benefits in the week ended 12th September decreased by 11,000 to 264,000 from the previous week's total of 275,000 and against expectations of a flat reading.

Data released on Thursday showed that U.S. building permits rose by 3.5% to 1.170 million units in the month of August against the expectations of 0.4% rise. U.S. housing starts fell 3.0% to 1.126 million units in the month of August against the expectations of 5.1% decline.

The euro depreciated by 0.35% against the USD last week as it declined sharply on Friday erasing almost all of Thursday’s sharp gains after the Fed left interest rates unchanged.

The Fed decision may put further pressure on the ECB to step up its own stimulus program to keep the euro from strengthening too much, which may derail the eurozone’s economic recovery that relies heavily on exports.

The Brazilian real touched 13-year low levels last week at a time when other emerging market currencies gained sharply. The Brazilian real is one of the worst performing currencies on a yearly basis, depreciating 40% against the USD and last week it depreciated by 1.89% as opposition leaders took decisive steps to remove President Dilma Rousseff from office amid growing discontent over her handling of a tanking economy