Today I want to show you how to do the unthinkable and retire in seven years—starting with a $0 nest egg. Our plan hinges on two things: being frugal and investing in closed-end funds (CEFs), which throw off big, steady dividends on the regular.

I know a plan like this sounds impossible. Stocks, after all, are testing 52-week lows; the Fed is quickly raising interest rates; inflation is still on a tear; and a war is raging in Eastern Europe.

To be sure, these things are all weighing on the markets now. But there is one great thing about investing these days, and it’s on the income side of things.

Thanks to a pullback in CEFs, these high-yielding (and ridiculously overlooked) assets are now yielding even more than they normally do. A year ago, CEFs were yielding an average of 6.7% and now that average is 7.8%, with many CEFs yielding north of 10%. (I’ll show you a 4-CEF “instant portfolio” yielding 11.7% below.)

The best part? Many CEFs pay dividends monthly, too!

This higher yield is a big deal because it means an aggressive saver can suddenly retire in a shorter period of time. Let’s dive into the mechanics of this strategy. Then we’ll talk about four unique and diversified CEFs we could use to make it work.

The Savings Side

Before we get too far, let me step back and admit that this plan does require a level of saving that’s tough for most people: it requires about half of pre-tax income to be set aside every year for seven years.

But even if you can’t hit the savings target, getting anywhere in the neighborhood—heck if you can do half as well—could drastically shorten your timeframe to retirement. That’s the beauty of CEFs!

And some folks, especially those later in their careers, can find that, with a lot of frugality and planning, saving half of their income is possible.

For our hypothetical example, let’s assume our investor is a manager earning $100,000 gross every year who wants to retire in seven years and has no savings.

(The yearly salary, by the way, doesn’t matter. This same principle works for someone earning $50,000, $1 million or any number, really. The important thing is they save half of their income.)

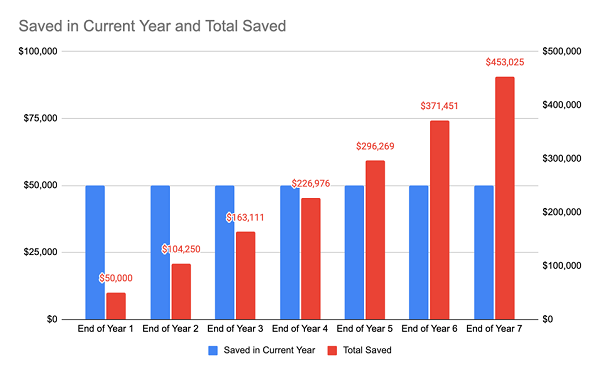

With $50,000 saved and $50,000 spent on taxes, rent, food and so on, our frugal worker will end up with a bit over $450,000 after the seven-year period.

Source: CEF Insider

Notice that we’re assuming no raises and no higher savings rate—just steady savings every month for the whole period. We’re also assuming an 8.5% total return on this saver’s portfolio, which might sound aggressive but is actually less than we’ve seen from the S&P 500 in the last seven years.

The Investing Side

Now let’s now talk about what this hypothetical saver does after the seven-year stretch. With $453,025 in the bank, our retiree-hopeful doesn’t have enough cash to sustain a $50,000 income stream—not in a world where the S&P 500 index is paying a measly 1.3% dividend yield.

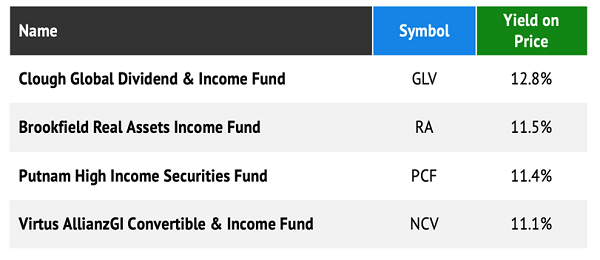

This is where CEFs come in. Here’s a diversified four-CEF portfolio that would provide more than enough income for our investor to retire on today.

Source: CEF Insider

(I know we’re basing our plan for seven years from now on today’s yields, but payouts like these are often available with CEFs, especially if our investor buys in during a downturn, as they would be today.)

Above we have a four-fund portfolio of CEFs that combines US and global stocks through Clough Global Allocation Fund (NYSE:GLV)—Visa (NYSE:V) and Microsoft (NASDAQ:MSFT) are among the fund’s top holdings—infrastructure and real estate stocks with Brookfield Real Assets Income (NYSE:RA), and corporate bonds with Putnam High Income Securities Closed Fund (NYSE:PCF) and AllianzGI Convertible & Income Closed Fund (NYSE:NCV).

This portfolio yields 11.7%, based on these funds’ market prices right now, largely due to the recent pullback. What’s more, some of these funds are trading at particularly attractive discounts to net asset value (NAV, or the value of the holdings in their portfolios). NCV’s 5.8% discount, for instance, is particularly deep compared to its average 2.3% premium to NAV over the last decade.

Here’s how that 11.7% yield shakes out for our near-retiree:

Source: CEF Insider

Their nest egg is now paying out nearly $4,500 on a monthly basis, which is more than enough for most people to retire on, and more than half of the $8,333 in monthly income our investor would have received from their job.

Moreover, this is possible without our hypothetical frugal ex-worker needing to sell a single share of stock at any time, so downturns, like the one we’re in the middle of now, won’t mean they’ll have to sell at a loss.

Selling into a downturn is particularly dangerous, of course, as it can fuel a vicious cycle of a dwindling nest egg (and income stream). Remember dollar-cost averaging, which you likely used to build your portfolio? Being forced to sell into a downturn is dollar-cost averaging in reverse!

But these CEFs, with their big income streams, help our investor avoid that fate while putting early retirement squarely on the table.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."