Every trader dreams of that perfect trade. Where they smelled blood on the street, could feel the panic selling, and calmly swooped in like a falcon to pick up a huge bargain. I had two of those opportunities over the past month. Sweet right? But it is not enough to just find the opportunity. You need the proper execution as well. You need to be able to put all biases aside and take profits when the market gives them to you, not when you want them to be there. Let’s look at my Smith Micro Software (NASDAQ:SMSI) and Cameco (NYSE:CCJ) trades to explain what I mean.

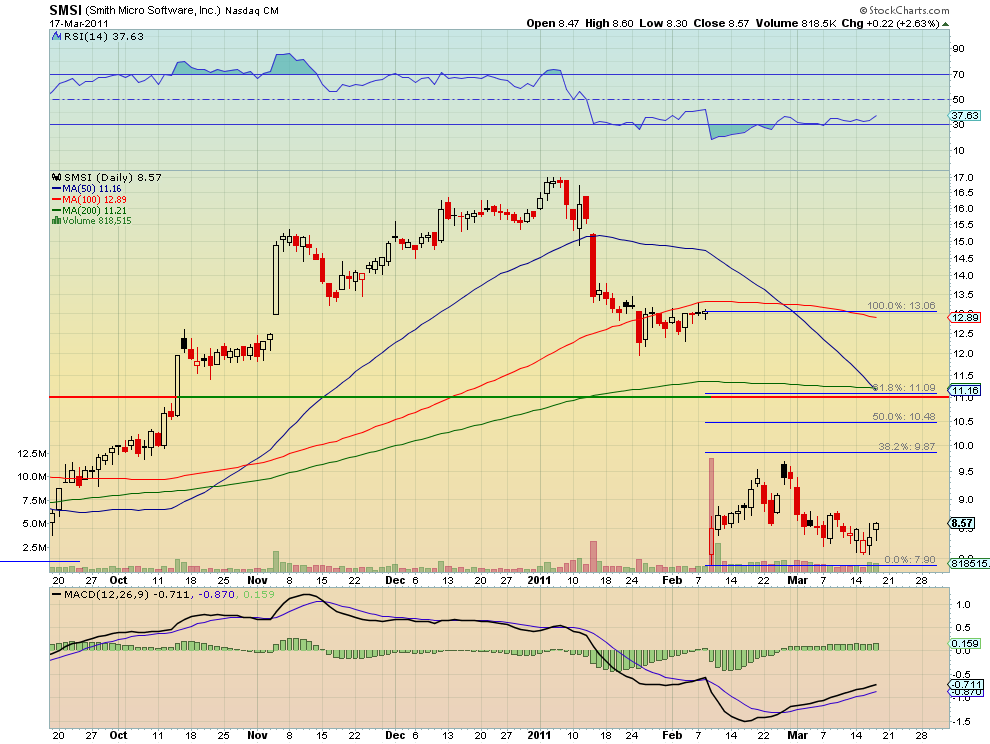

Smith Micro had it’s steep fall after releasing earnings in February. I bought the March 10 Strike calls for 20 cents. At the time I wanted to buy more at 15 cents as well. Turns out that being light was a good idea. I was looking for a retracement of the down move of between 38.2 and 50%. If it did, my options could more than triple in value. As you can see from the chart below the stock never made it to 38.2% (unless it jumps $1.50 today!). Also note that it did run up and peaked February 25. Near that point the March 10 calls traded briefly at 45 cents. I could have more than doubled my money then and it looked like my thesis was playing out. 4 days later they were trading for less than what I paid and have never recovered. My bias cost me a double and will end up with me riding it into the ground.

Cameco (NYSE:CCJ) is a much better example of getting it right the whole way through. This nuclear name took a hammering on Monday off of the problems in Japan. It was off more than 20% in the premarket trading Monday and opened 20% lower. This was a mass sell off on a big problem, but one limited to 4 nuclear reactors. Assuming that the alternative being touted, solar, could not be implemented anytime soon, and had in fact been seeing government subsidy cuts, I bet that this was overdone. I bought at 31.73 in the premarket and then again at 29.05 shortly after it opened, for a basis of 30.39. Again I was looking for a 38.2% to 50% retracement. I let it ride overnight and when it rose again the next day took half of it off at 31.92, for a 5% gain in one day, and put a stop at 30.60 for the rest, to protect gains. From the chart below you can see that my stop got hit just after 11:00 on Wednesday, executing at 30.57. This reduced my trade to a 2.8% gain.

There is nothing wrong with setting targets and giving them some time to work out. But these examples illustrate how using nothing but a target can cloud the judgment of a trader. It can lead to fumbling that great knife catch and you bleeding out in the emergency room. Take what the market gives you when it gives it to you. I hope that these real life examples help to illustrate that point.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.