Hurricane E (LON:HUR) has provisionally raised up to $535m through a $300m equity placing (plus $5m follow-on offer) and a concurrent $220m (with $10m over-allotment) convertible bond offer. Equity is being placed at a price of 32p/share while the convertible offers investors a 7.5% coupon and conversion price of 40p/share – a 25% premium. We had assumed EPS funding in our valuation with an approximate 60/40 equity/debt split (see our May Outlook note); confirmation of funding should provide increased confidence in Hurricane’s ability to keep to a H119 first oil target. The fall in Hurricane’s share price over the last two months has led to greater dilution than we had previously anticipated with Edison’s Lancaster NAV falling from 102p/share to 81p/share (c 21%) assuming convertible dilution.

Dilutive impact of equity and bond placing

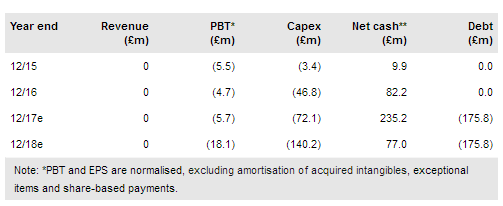

Our updated NAV includes the dilutive impact of Hurricane’s equity and bond placing announced on 30 June 2017. We assume that a $10m bond over-allotment option is exercised and an additional $5m follow-on offer is completed successfully. The net result (alongside some modest changes to our FFD farm-out assumptions accounting for +4p/share) is a reduction in Lancaster NAV from 102p/share to 81p/share. Greater Lancaster Area (GLA) RENAV, including Halifax and Lincoln moves to 104p/share from 134p/share.

To read the entire report Please click on the pdf File Below: