On Tuesday, the dollar index rose to 102 after a period of growth. Investors are in a wait-and-see mood in anticipation of the U.S. inflation data to be released this week, as it could influence Federal Reserve policy.

According to the New York Fed's latest survey, consumer expectations for short-term inflation in the United States fell in December to the lowest level in three years.

However, last week's economic data showed that the U.S. economy created an impressive 216,000 jobs in December, exceeding forecasts of 170,000.

This shows the resilience of the labor market despite tighter financial conditions. In our analysis today we will examine the forecast for the dollar and how markets might react to its possible strength in the coming months.

While many expect a weak dollar, I have a different view.

The focus this week is on inflation data, which are closely monitored by the Fed. Based on the December employment and unemployment rate data, we saw an increase in jobs and wages.

This makes the inflation data announced on Thursday even more relevant.

I am confident that we will see a surprise in Thursday's data, and I think inflation will be down less than expected. Meanwhile, markets have lowered expectations for an interest rate cut by the Fed in March to 64 percent.

Given that the probability was 90% just last week, we can conclude that the market has reduced its risk appetite. This trend has also led to an increase in demand for dollars.

In the first quarter of this year, I expect the dollar to remain strong. Recent macroeconomic data are positive, and even in the event of a decline in inflation, this outcome has already been taken into account.

With the dollar rising strongly, it would be unwise to invest in natural gas and opt instead for a medium-term trade in EUR/USD.

Also, it is best to avoid investing in Bitcoin as the news of ETF approval has already been included in prices and seasonality during halving years is not favorable.

As for the NASDAQ, which is greatly influenced by the dollar, I expect a healthy correction in the first quarter.

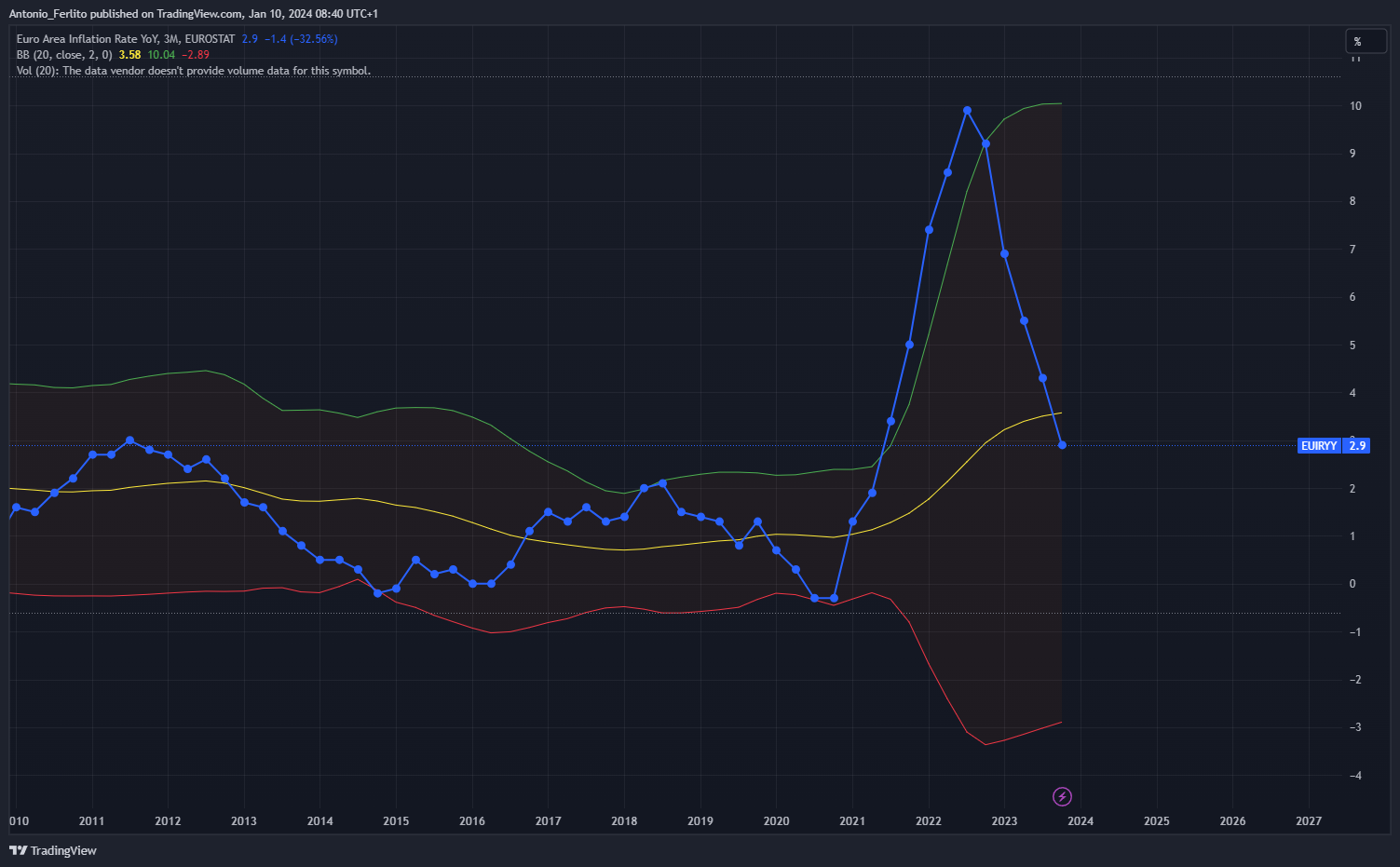

To take full advantage of the dollar's strength, the best instrument is EUR/USD. Inflation in Europe is falling rapidly, and macroeconomic data are extremely negative.

In December, inflation in the euro area reached 2.9 percent, slightly below expectations of 3 percent. The increase was mainly influenced by energy-related factors.

At the same time, we saw an expected cooling of the core rate to 3.4 percent, the lowest since March last year.

My bearish thesis goes against the thinking of other analysts. In my opinion, the ECB will be the first to cut interest rates rather than the Fed, which will lead to the EUR/USD exchange rate falling to 1.07 in the coming quarters.

Although the technical analysis shows a positive trend, a violation of the key level of 1.09 (corresponding to the EMA 100) could lead to a new bearish trend.