Before I roll out my 10 predictions for 2022, I thought we could first go back and look at how the predictions for 2021 panned out. I wrote the 10 predictions for 2021 on Dec. 25, 2020.

10. US Economy

Despite a very weak third quarter it seems that the US economy is on track to post a 5% gain in 2021 after the first half of the year easily surpassed 6%, and the fourth quarter currently tracking around 7% based on the Atlanta Fed model, the US economy should grow by more than 5% this year. CORRECT

9. Inflation

Yes inflation rates were hotter than expected in the first half of the year, but they did not come down in the second half of the year. I will give myself half credit for this prediction- 1/2

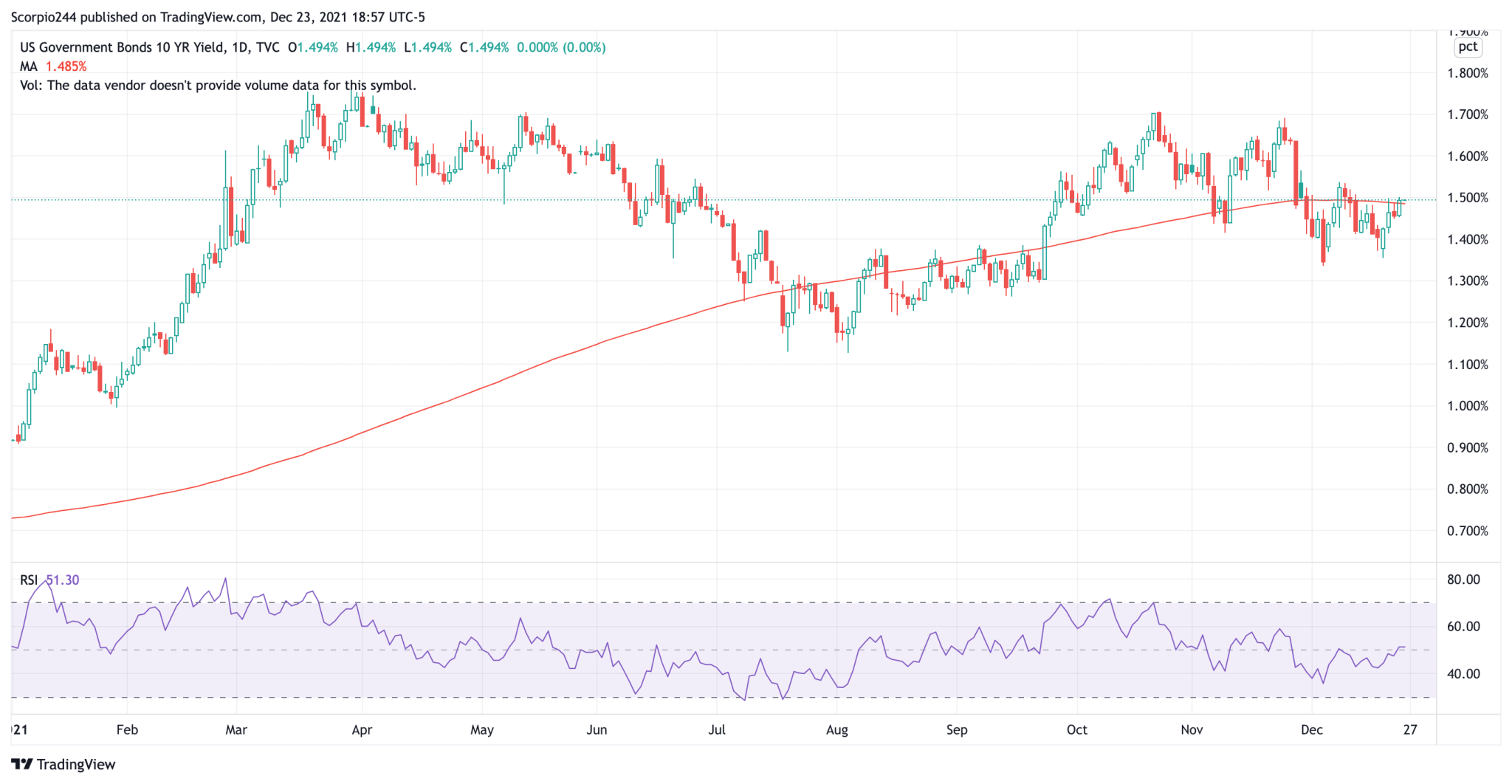

8. 10-year yield

The 10-year yield as of Dec. 23 was trading at 1.49%, so this is an easy CORRECT.

![]()

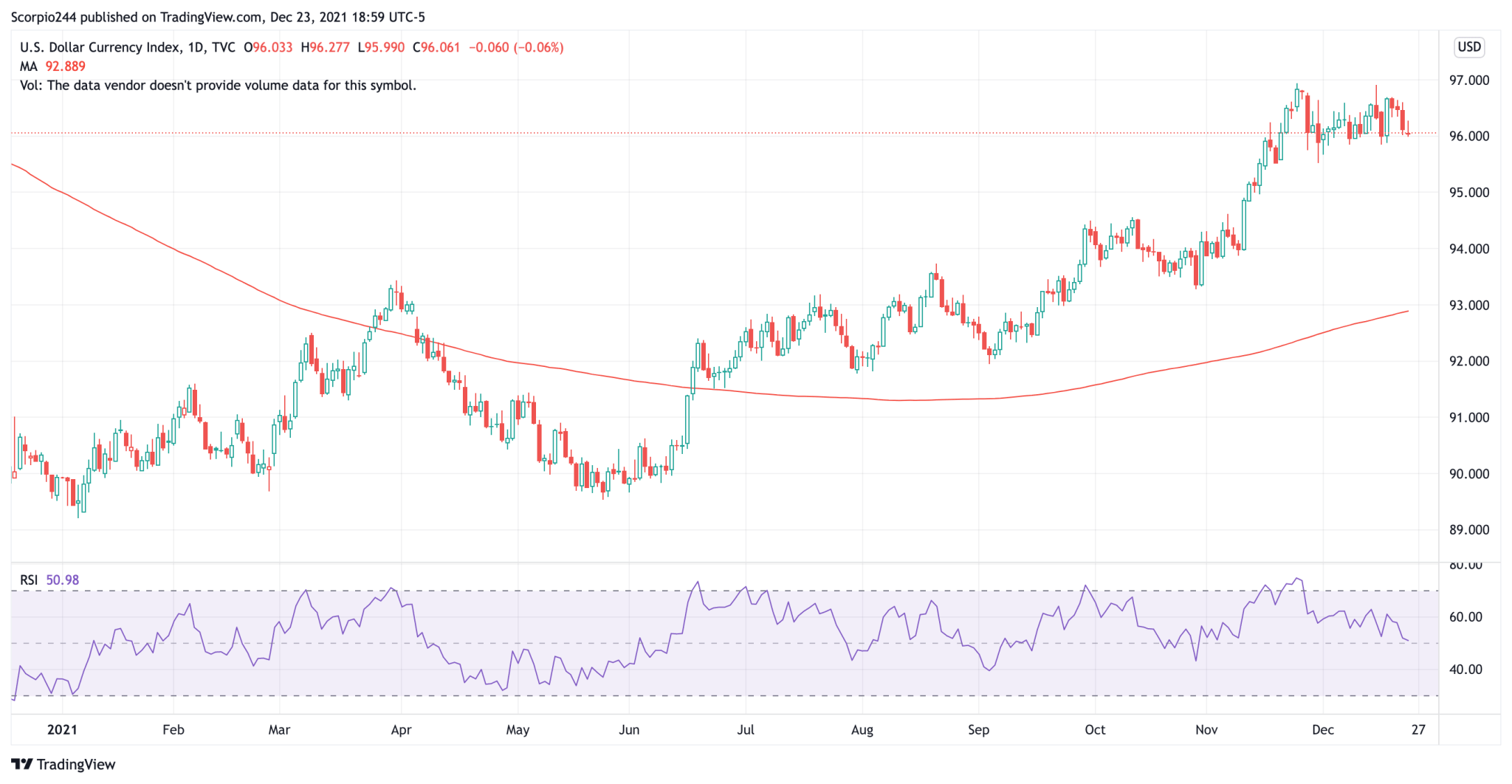

7. US dollar index

The dollar index rallied sharply in the second half of 2021 and was trading last week at 96.06 an easy CORRECT.

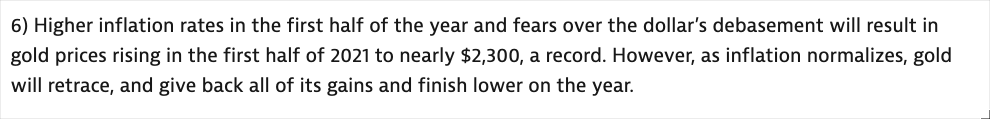

6. Gold

Gold never got anywhere close to my prediction and although it appears it will finish the year lower, I give myself an INCORRECT.

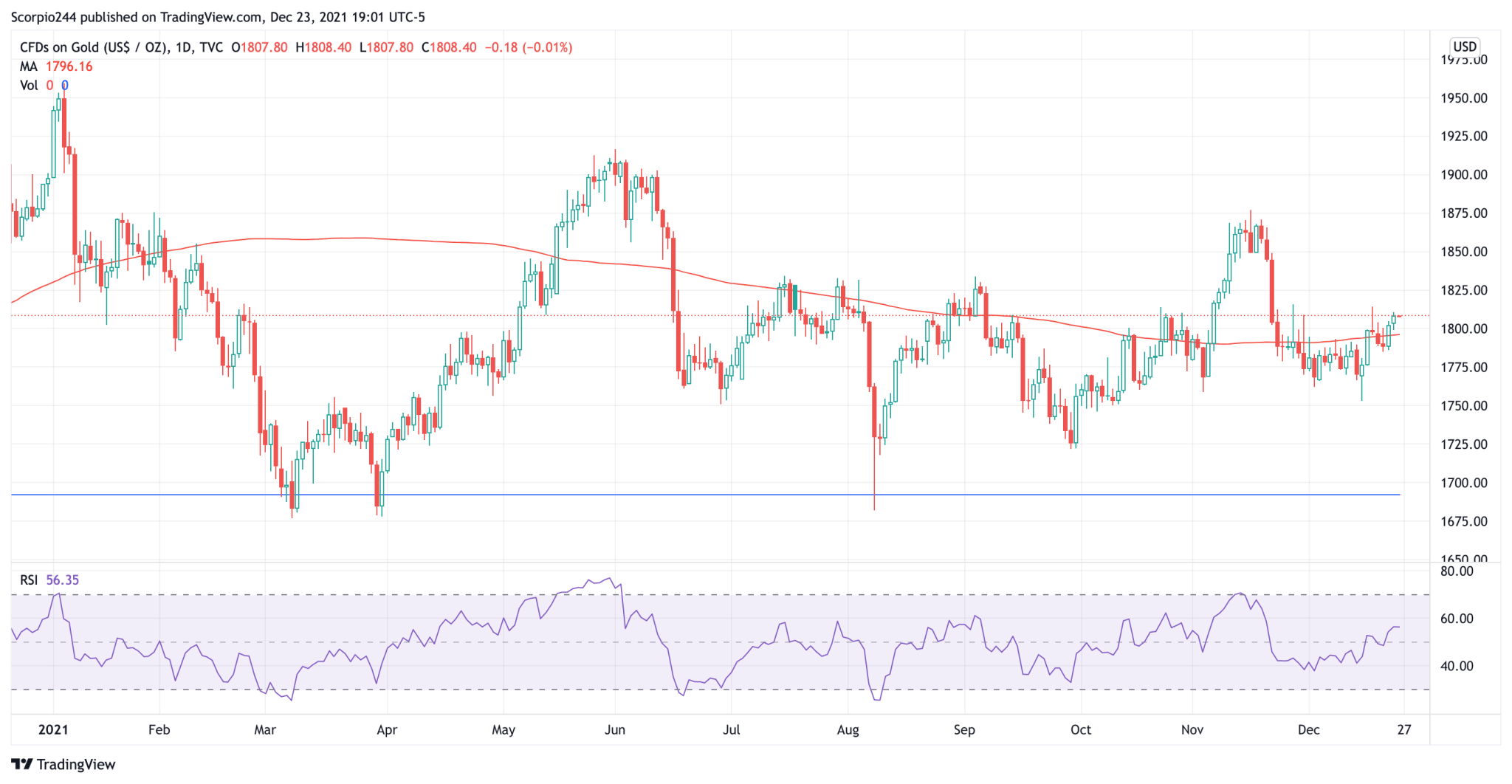

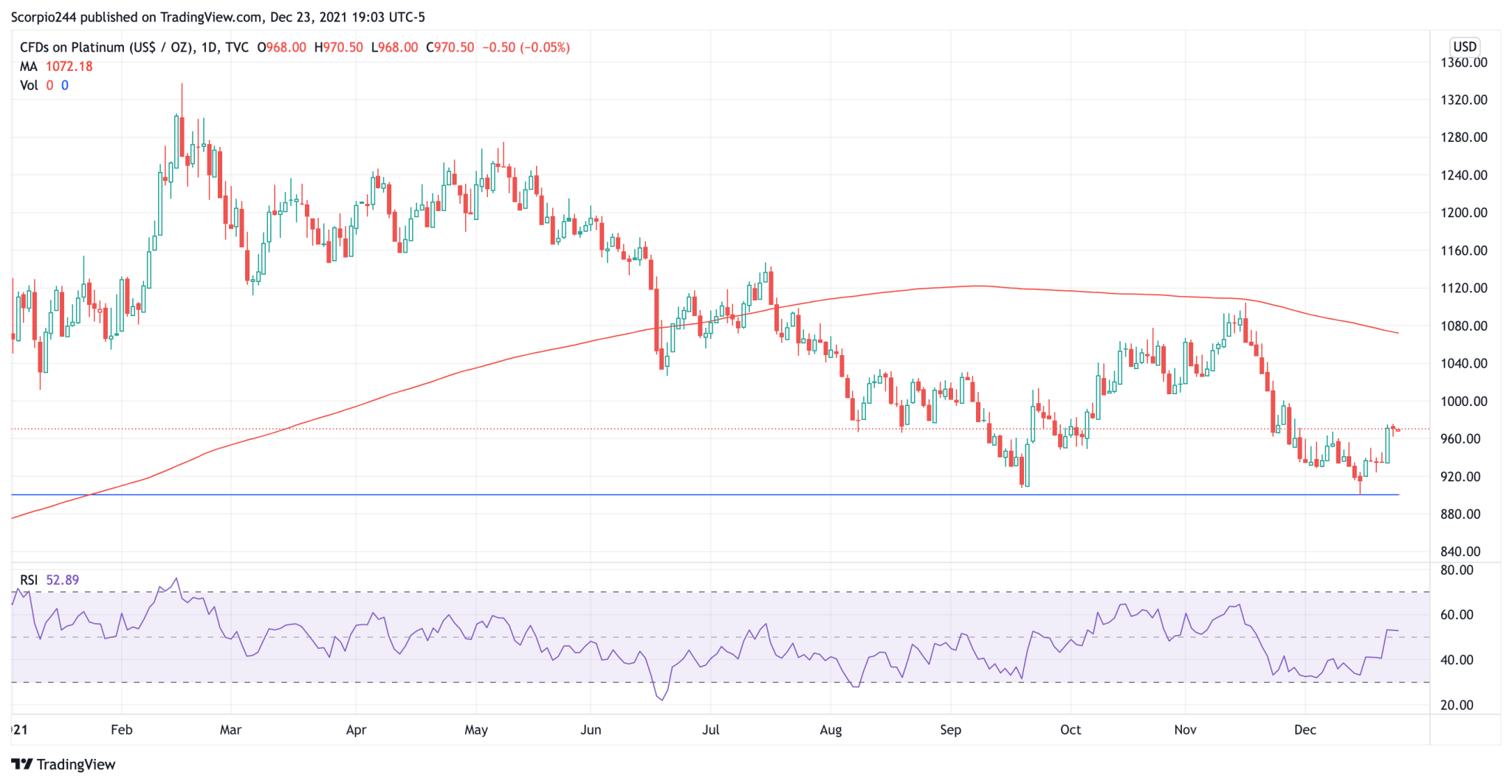

5. Platinum

Platinum never got close to my target of $1600, so this goes as an INCORRECT.

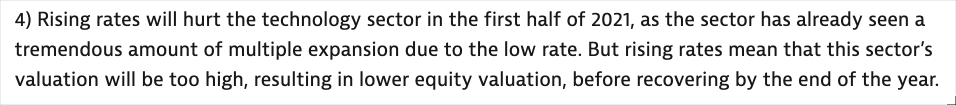

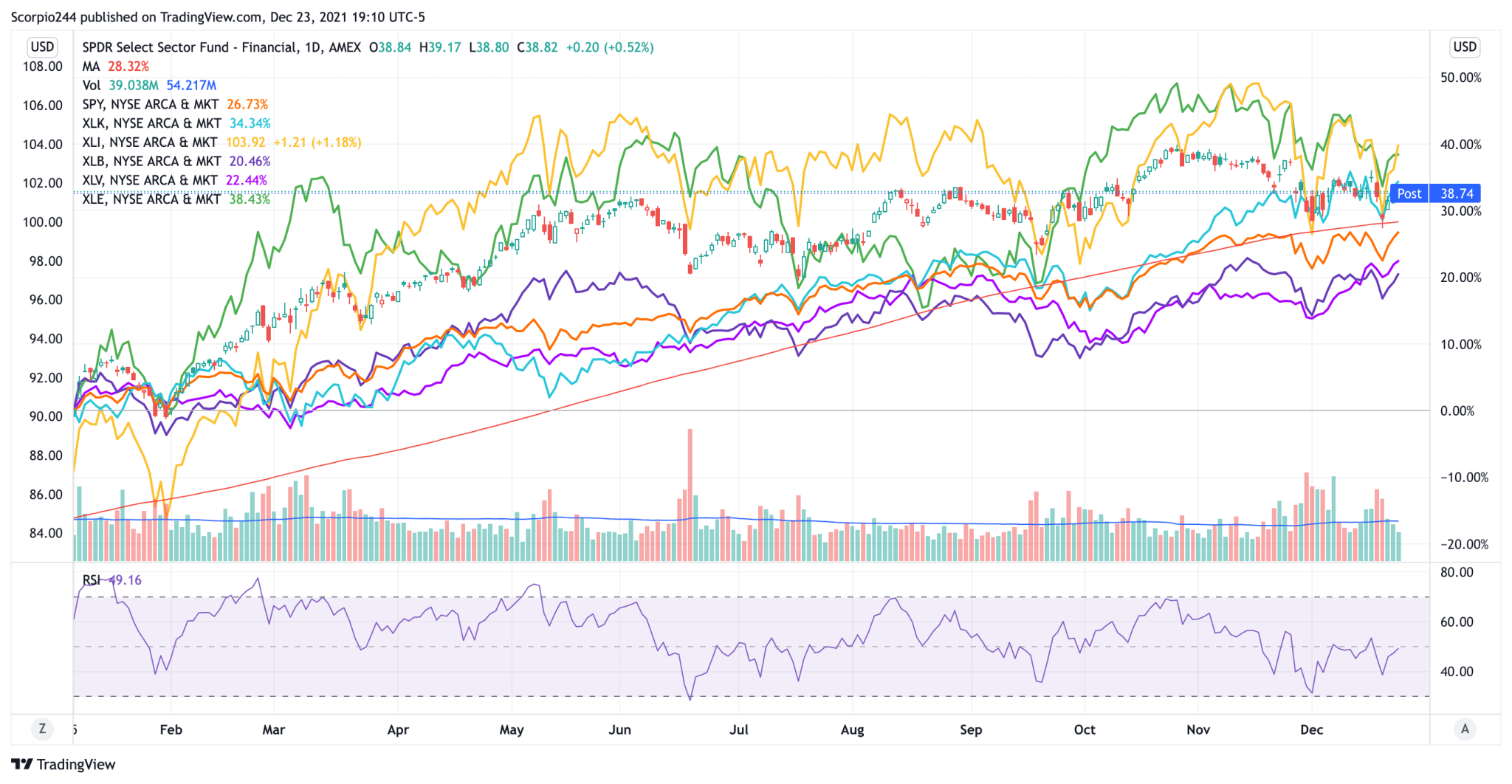

4. Technology Sector

Technology did struggle to start the year, with the Technology Select Sector SPDR® Fund (NYSE:XLK) actually trading lower through March, and underperforming the S&P 500 for the first half of the year. I will give myself CORRECT for this one.

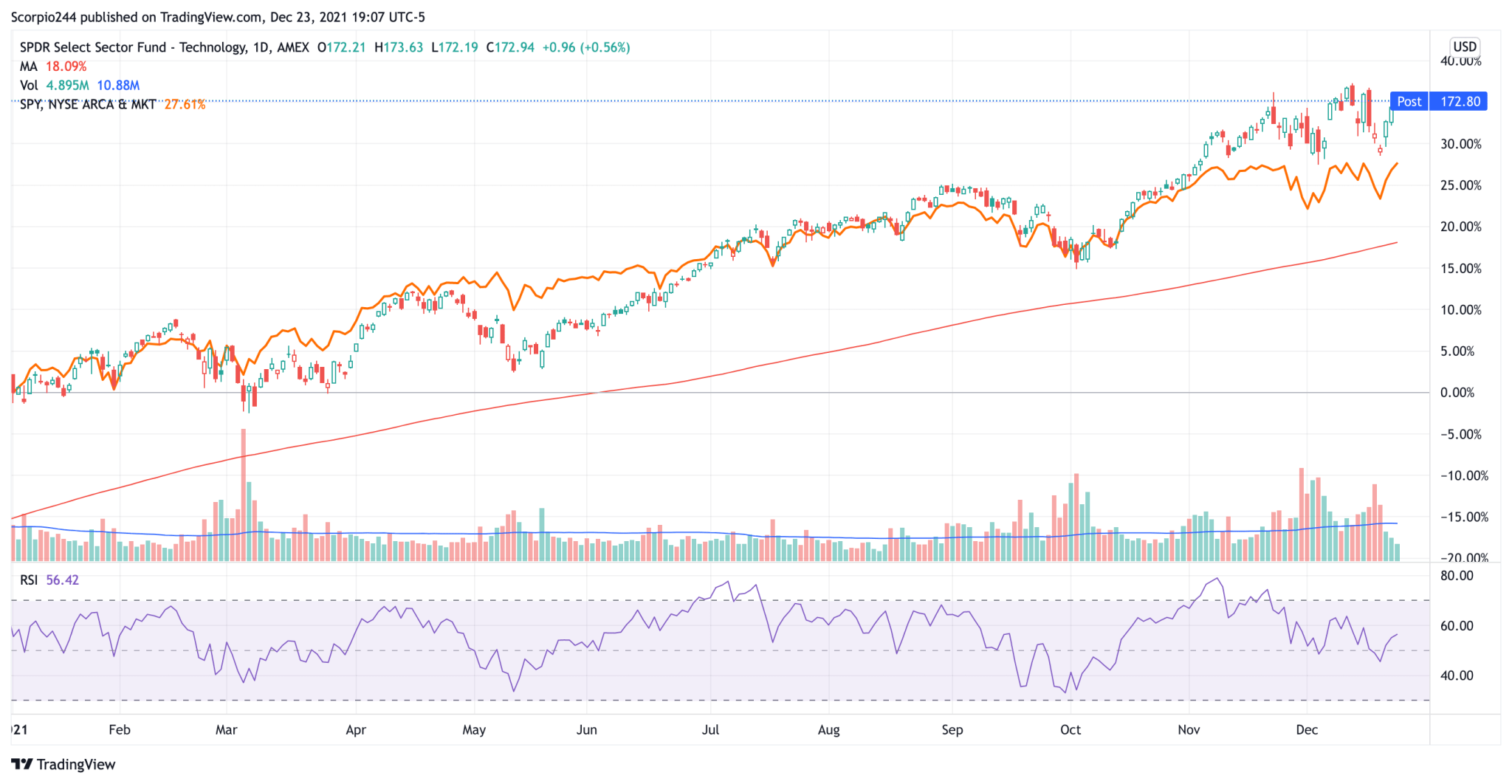

3) Banking Sector

The BKK has had a really good year, but was not THE best performing sector. It was one of the best-performing sectors, but that doesn’t cut it. So this was INCORRECT.

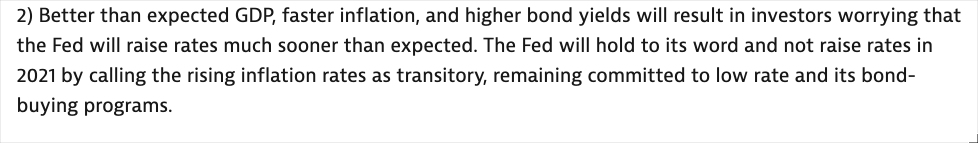

2. Monetary Policy

Clearly, the Fed stuck with the term “transitory” until the bitter end, as well as its bond-buying program and zero rate policy. This is an easy CORRECT.

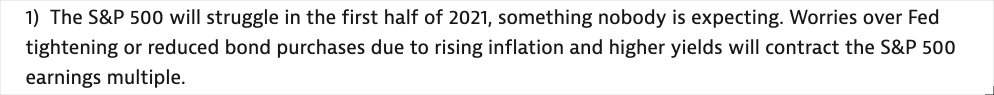

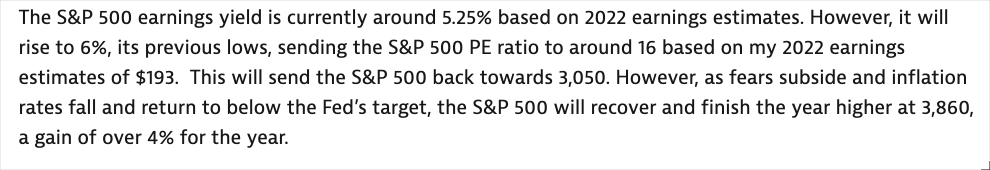

1. S&P 500

The S&P 500 rallied far more than I expected this year and is an easy INCORRECT

Total for 2021 5 1/2 out of 10. Not bad, considering how hard it is to call the market week to week or month to month, let alone a full year in advance.