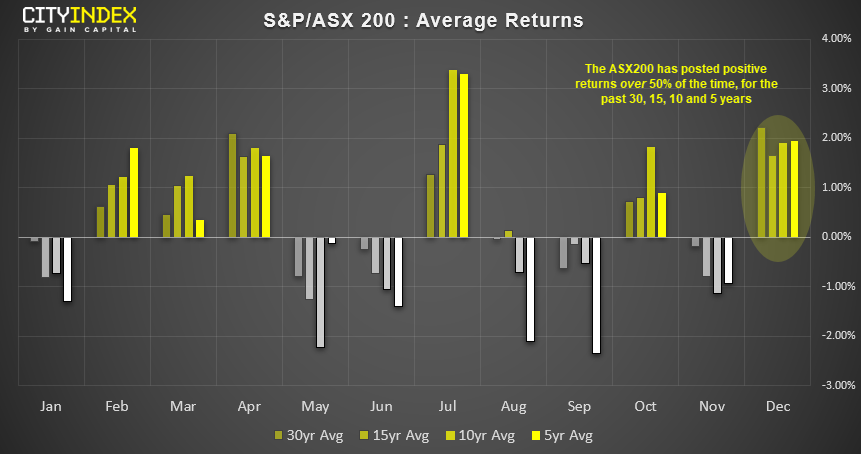

By Friday’s close, the ASX 200 had produced a bearish outside week after failing to hold above 6,800, which raises the potential for some mean reversion. Given the slight bearish divergence forming with RSI and the clear loss of momentum leading it back towards its all-time high, we explore the bearish potential of this classic candlestick pattern to see if it can pull the run from under Santa’s rally in December.

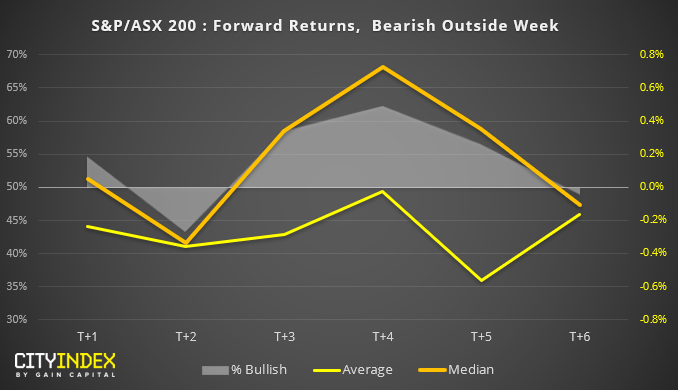

The test: Using Reuters data since April 2000, we filtered all bearish outside candles on the weekly chart. We have then calculated forward returns following a bearish outside candle, along with the % of bullish closes of the forward returns.

As we’re testing a bearish pattern, ideally we’d want to see negative returns with a % bullish rate below 50%.

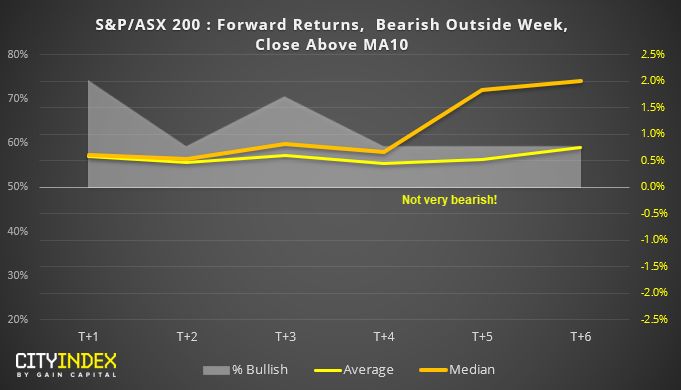

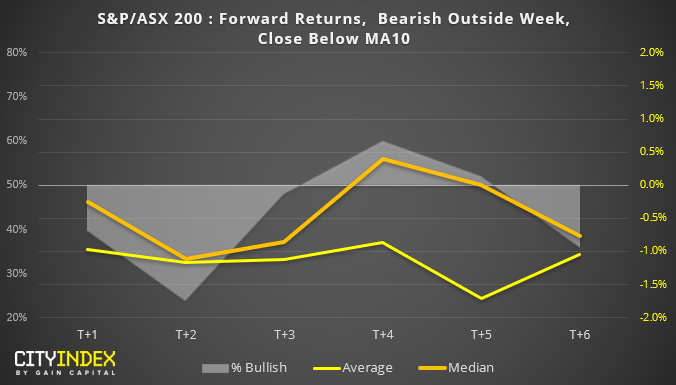

However, as this filters all bearish outside candles, trend direction has not been considered. So next we apply a rule where the pattern must close above or below its 10-week average to denote a basic trend filter.

Bearish outside day with a close above its 10-week MA

Bearish outside day with a close below its 10-week MA

Final thoughts: