I am old enough (fortunately??) to be able to remember when interest rates were last at this level. Even higher – I can remember in my first job, at technical analysis firm Technical Data, being tasked with updating the point-and-figure chart of the 10 3/8 – 2012 as it rallied from 9% I mention this because, as interest rates have headed back higher I have noticed that a lot of people don’t remember some of the investment implications of higher rates. So, I want to review one of them today. Next week, I’ll write about how the rise in rates will tend to make bond futures negatively convex after years of positive convexity. There aren’t many bond basis traders left, because it’s been years since there has been a shift in bond deliverables, but it makes a lot of things more interesting and I suspect will resurrect some old relative-value trades that haven’t been seen in a dog’s age.

But today, I want to point out one big effect on the hedge fund industry: higher interest rates leads to lower hedge fund risk-adjusted returns, directly and significantly. If you’re a hedge fund, you already know this. If you’re an allocator, you may or may not realize that you need to carefully monitor any changes in the risk-taking of your existing hedge fund portfolio, and start to ask tougher questions of hedge funds touting high returns.

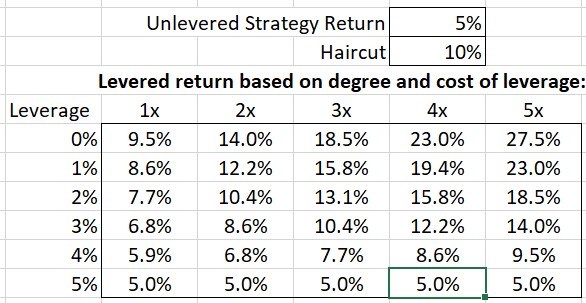

The dirty little secret of hedge fund returns is that you can make a good edge look like a fantastic return if leverage is cheap enough and if you lever enough. If I buy a bond yielding 5% with $100, and then borrow $90 at a 0% borrowing rate, by pledging that bond as collateral…and invest in another bond yielding 5%, then magically I have turned a simple bond-buying strategy into one that yields 9.5% (5% on 100, plus 5% on another 90, divided by the 100 in unlevered principal). Yes, I have almost doubled my risk but I have created a return that looks really nice.

But if instead of borrowing at 0% I am borrowing at 2.5%, then levering to buy that bond doesn’t add as much. The $90 spent on that 5% bond now costs me 2.5%, for a net 2.5% return on that piece. I still have the risk, but my return has gone down to 7.25%. If I can borrow another 90, and do the trick again, I’ll get back to my 9.5% return but now I’m 3x levered instead of 2x. (Naturally, most hedge fund strategies are more complex but this is the basic concept).

Now, for small changes in financing rates this is of course a small effect. And for decreases in financing rates, it’s a positive effect. But when you have large increases in interest rates, it has a big effect on returns:

Yes, I know this is overly simplistic but the easiest way to think about this is with a bond strategy where you’re leveraging up a simple yield. The significance of a change in the cost of leverage, though, is felt across many hedge fund categories. There’s an exception with many CTA strategies because there is no money required to hold the natural underlying. The longs and shorts are exchanging daily P&L, and no one actually needs to hold the underlying instrument because there isn’t any. Similarly, long/short bond and equity strategies, in principle, only care about the spread between the financing of the long position (which is paid) and the financing of the short position (which is earned) rather than its level, assuming equal notionals on long and short. But most long/short strategies – including fixed-income arbitrage, weirdly – are highly correlated to stocks, which suggests that in most cases there’s net long exposure. Here are charts of the CS long/short equity hedge index, and the Bloomberg Fixed-Income Arb index, against the S&P 500.

Managed futures, not so much, although there’s a decent correlation to commodity indices (not as much as in the above examples relating long/short returns to equity returns).

If a futures strategy or a long/short strategy holds unencumbered cash, they should get some benefit from higher rates…but most such strategies don’t tend to have a lot of unencumbered cash. In the same way, commodity futures indices such as the Bloomberg Commodity Index or the Goldman Sachs Commodity Index (and many others) get some benefit in expected returns because they earn more on the collateral they hold against futures positions, and they do hold a lot of cash and Tbills.

However you slice it, the sharply higher financing rate environment we are now in is likely to have a meaningful effect on the returns (and the risks, if more leverage is used to chase a higher return) of many hedge fund strategies. All else being equal, this will be a lower penalty on less-levered strategies; which means investor money should flow to less-levered strategies for a better risk-reward tradeoff.