Rental car giant Hertz Global Holdings Inc (NYSE:HTZ) is scheduled to report first-quarter earnings after the market closes this Monday, May 7. Ahead of the event, HTZ stock has been notably quiet; the equity's 60-day historical volatility (HV) of 60% ranks lower than 94% of other such readings from the past year. However, options traders are betting on a bigger-than-usual post-earnings pop for Hertz shares.

Currently, Trade-Alert data places the implied daily earnings move at 17.3% for HTZ -- dwarfing its average post-earnings daily swing of 9.4% over the last two years. Those historical returns have been skewed to the downside, with HTZ falling the session after its earnings report in five of the last eight quarters. And of those eight most recent post-earnings performances, only one -- a 22.5% drop in November 2016 -- was large enough to meet or exceed the percentage move the options market is pricing in for Hertz right now.

Judging by recent option buying activity, many speculative players are looking for another big downside drop from HTZ after its first-quarter report. During the past 10 days, options traders on the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 3.47 puts for every call on Hertz. This ratio arrives in the 89th percentile of its annual range, confirming a stronger-than-usual skew toward bearish bets over bullish.

Meanwhile, 30-day at-the-money implied volatility (IV) on HTZ options checks in at 81.3%, in the 77th annual percentile. In other words, short-term bets are pricing in higher-than-normal volatility expectations. Plus, the 30-day IV skew of 12.3% ranks in the 85th annual percentile -- meaning short-term puts have rarely been more expensive than calls, on a volatility basis.

Short sellers have piled on, too. Nearly 56% of the stock's float is sold short -- and at HTZ's average daily volume, it would take more than 13 trading days for all of these shorted shares to be covered.

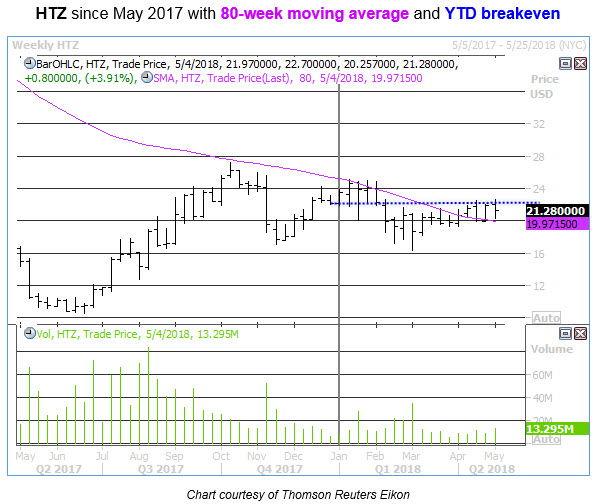

In light of the stock's unimpressive post-earnings track record, the pessimism surrounding HTZ ahead of earnings isn't too surprising. From a broader view, HTZ recently managed to notch a couple of weekly closes above formerly stiff resistance at its 80-week moving average. But the stock, last seen trading at $21.28, has been churning just below its year-to-date breakeven point of $22.10 since early February, and a long-term pattern of lower highs dating back to the second half of 2014 remains intact.

The heavy-handed pessimism toward HTZ leaves room for an upside surprise, should the quarterly results come in above expectations on Monday night. However, it's worth pointing out that a roughly 16% drop in short interest since the start of October hasn't been sufficient to snap the stock out of its long-term decline -- so while the earnings report may drum up some of the volatility Hertz stock has been missing lately, any upside could be limited as the more firmly entrenched shorts look to build their stakes on a deeper decline.