With a market capitalization of approximately $10.17 billion, DENTSPLY SIRONA (NASDAQ:XRAY) reported in-line earnings in the trailing three quarters. However, the company faces margin threats and foreign exchange headwinds.

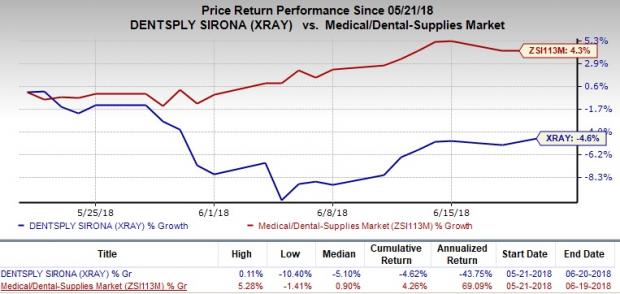

The Zacks Rank #3 (Hold) stock has lost 4.6% against the industry’s rise of 4.3% in a month’s time.

Let’s take a detailed look at the company’s performance and operations to analyze why investors should hold this stock for now.

Probable Headwinds

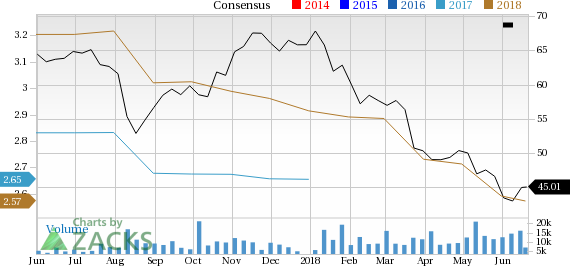

DENSTPLY SIRONA expects adjusted earnings per share for 2018 in the range of $2.55-$2.65, down from the previous projection of $2.70-$2.80. Notably, the Zacks Consensus Estimate for 2018 earnings is currently pegged at $2.57 per share, significantly lower than management’s expectations.

DENTSPLY SIRONA expects gross margins and operating margins to be flat to slightly down as underlying margin rate improvement in businesses is expected to be offset by foreign exchange effects and the headwind from the target inventory equipment reductions. By the end of the first quarter of 2018, the company confirmed that it expects full-year 2018 operating margins to be down between 100 and 150 basis points on a year-over-year basis.

DENTSPLY SIRONA has significant international foothold, particularly in Europe. Therefore, a strengthening U.S. dollar, especially against the euro, as well as emerging market currencies negatively impacts the company’s results. We believe that the currency volatility will remain a headwind for 2018. The company also faces significant pricing pressure due to intensifying competition.

What’s Favoring the Stock?

DENTSPLY SIRONA's innovations have been consistently driving its top line. Per management, the company spends more than $150 million in R&D and thus has a robust pipeline. Furthermore, efforts of DENTSPLY SIRONA’s laser team in accelerating major innovations deserve a mention.

The company’s commitment to clinical education is also praiseworthy. DENSTPLY SIRONA plans to open a state-of-the-art training center in Charlotte, NC that will help it reach more than 10,000 dental professionals per year. Moreover, its European center in Bensheim, Germany will be able to directly communicate to above 25,000 practitioners a year, supplementing its continuing education efforts. Notably, DENTSPLY SIRONA is coming up with its new Dental Academy, in the second half of 2018.

Management is bullish about the recently completed the acquisition of OraMetrix. OraMetrix software uniquely integrates digital scanning, 2D and 3D x-rays to create customized individual treatment plans for orthodontic patients. Lately, at the American Association of Orthodontists, the company launched a full clear liner and integration of OraMetrix and Omnicam, which witnessed positive reviews.

Bottom line

Unhindered by the persistent issues, analysts are optimistic about DENTSPLY SIRONA.

For current-quarter revenues, the Zacks Consensus Estimate is pegged at $1.03 billion, reflecting a year-over-year rise of 3.8%.

Key Picks

A few better-ranked stocks in the broader medical space are Genomic Health (NASDAQ:GHDX) , Abiomed (NASDAQ:ABMD) and Stryker Corporation (NYSE:SYK) .

Genomic Health has an expected earnings growth rate of 187.5% for the current quarter. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Abiomed has a projected long-term earnings growth rate of 27%. The stock sports a Zacks Rank #1.

Stryker has a projected long-term earnings growth rate of 9.7%. The stock carries a Zacks Rank #2 (Buy).

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

ABIOMED, Inc. (ABMD): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Genomic Health, Inc. (GHDX): Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY): Free Stock Analysis Report

Original post

Zacks Investment Research