The yellow metal couldn’t face the downward pressure and declined abruptly on Friday. What happened, and why did it fail?

Friday was a brutal time for gold. The price of the yellow metal dropped sharply from around $1,795 to $1,775 in the early morning hours in the U.S.

Am I surprised? Not at all. In Thursday’s edition of the Fundamental Gold Report, I wrote that “gold may struggle until the Fed’s tightening cycle starts. You have been warned!” Then, as if on cue, gold wasn’t able to maintain its position around $1,800 and declined. Actually, gold prices have been testing and failing to hold this key psychological level for the last three weeks.

What exactly happened on Friday?

Well, the Bureau of Economic Analysis published the report on personal income and outlays in September 2021. The publication shows that U.S. nominal consumer spending increased 0.6%, while the disposable personal income declined 1.3%, reflecting a decrease in government social benefits.

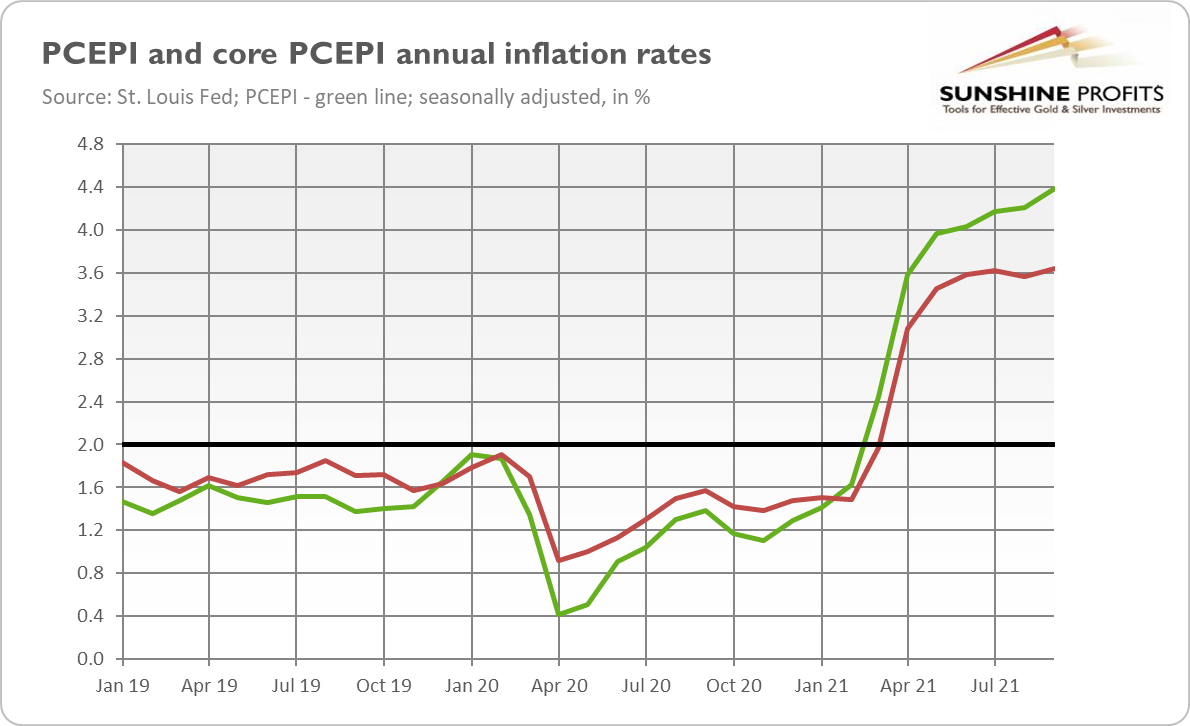

Additionally, the annual rate of change in personal consumption expenditures price index accelerated from 4.2% in August to 4.4% in September (see the chart below), the highest pace since January 1991.

Wait. Inflation rose, but gold prices declined? Exactly. Inflation is fundamentally positive for gold in the long run, but so far – as I explained last week – “inflationary worries have been counterweighted by the expectations of the Fed’s tightening cycle.” The relationship is simple: higher inflation translates into higher expectations of a more hawkish Fed. The odds of an interest rate hike in June 2022 increased from 23.1% – recorded at the end of September – to 61.6% on Oct. 22 and 65.7% on Oct. 29. As a result, the bond yields increased, while the greenback strengthened.

There is also another possible driver of rising interest rates and an appreciating U.S. dollar. CPI inflation in the euro area accelerated to 4.1% in October from 3.4% in September, reaching the highest value since July 2008. However, the ECB kept its monetary policy unchanged last week despite quickly rising prices. Moreover, it’s not signalling any tightening of its stance, maintaining that high inflation is transitory even though Christine Lagarde acknowledged that the decline in inflation would take longer than the central bank had initially expected.

The point here is that the ECB remains an outlier among central banks, which either have already tightened or signalled tightening of their monetary policy. This means that the U.S. dollar is likely to appreciate against the euro, which should be another headwind for gold. Having said that, this scenario will occur if the markets believe in a dovish stance of the EBC. The rising yields on German bonds indicate that the markets don’t entirely trust Lagarde’s rhetoric and expect a more hawkish stance of the ECB, which would be fortunate for gold.

Implications For Gold

What does higher U.S. inflation imply for the gold market?

Well, not so much in the short run. Even though I’ve seen some signs of a bullish revival in the gold market, the bulls remain too weak to challenge the $1,800 level. That’s too much, man!

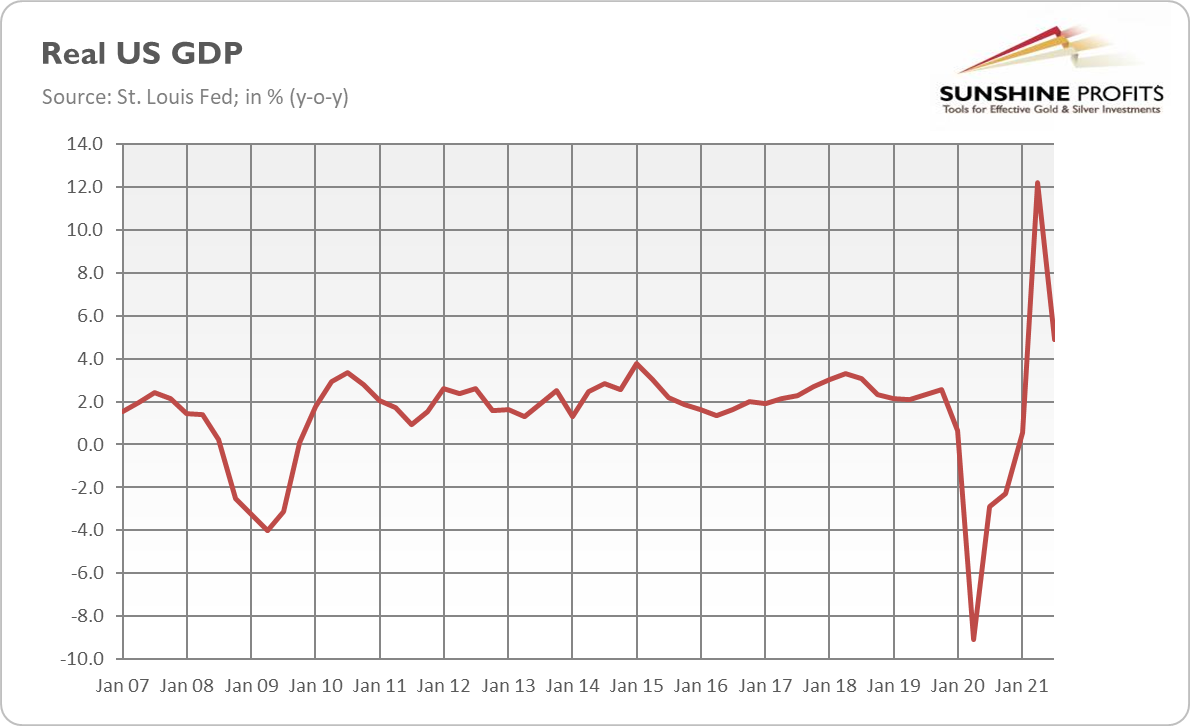

Luckily, better times are coming for gold. Have you seen the advance estimates of the durable goods orders (0.4% decline in September) or of the GDP in the third quarter of this year? According to the BEA, real GDP increased at an annual rate of 2.0% (annualized quarterly growth), much below the 6.7% reported in Q2 and much below the expectations of 2.8% growth. When it comes to the annual percentage growth year-over-year, real GDP rose 4.9% compared with 12.2% in Q2, as the chart below shows.

So, the pace of growth remains historically fast, but it’s decelerating quickly. Given that the economy has already reopened and energy and transportation crises are hurting growth (not to mention inflation wreaking havoc), we should expect a further slowdown on the way. And this brings us closer to … yes, you guessed it, stagflation.

To be clear: we are still far from stagnation, but the economic slowdown after a spectacular post-pandemic recovery is already unfolding. When we add it to high inflation, we should get an environment supportive of gold prices. However, supportive factors won’t be able to fully operate until the Fed starts hiking interest rates and gold prices bottom out. Sometimes one needs to hit rock bottom to succeed later; perhaps that’s also the case with gold. Time will tell.