The second-quarter earnings season is approaching its tail end, with 70% members of the elite S&P 500 Index having reported already.

Per the latest Earnings Trends, the performance of 350 index members (accounting for 79.3% of index’s total market capitalization) that have already reported their financial numbers this quarter, indicate that total earnings have increased 11% on 5.9% higher revenues.

The beat ratio is impressive with 74% companies surpassing bottom-line expectations and 68% outperforming top-line estimates.

Let us focus on Healthcare within the Medical ambit, which is one of the seven sectors in the S&P 500 group. As of Aug 2, 72.7% of the total Medical sector reported second-quarter results. The beat ratio is strong with 85% companies surpassing bottom-line expectations and 70% beating on the top line.

The sector has been in the limelight since the change of power at the White House. President Donald Trump, who is keen to repeal and replace the Healthcare Reform Act popularly called Obamacare, has injected a fresh dose of uncertainty in the industry.

Earnings for the players in the industry will be driven by their continued efforts to provide high-quality, cost-effective care and the ability to adjust to changes in the regulatory and operating environments.

Mergers and acquisitions in the space are rife as companies try to grow inorganically in a tough market. We thus expect earnings to benefit from acquisitions, branching out into ancillary businesses, new product and services, and enhancements to the existing ones. Increase in a number of patient admissions from the fast-growing Medicare and Medicare Advantage programs will be one of the revenue drivers.

On the flipside, increasing expense to manage operations, higher cost to comply with changing regulations, increased investment in technology, and acquisition and integration costs are expected to weigh on earnings.

Let’s take a sneak peek at two healthcare companies that are gearing up to report their second-quarter results on Aug 4.

WellCare Health Plans, Inc. (NYSE:WCG) provides managed care services targeted exclusively at government-sponsored healthcare programs, focusing on Medicaid and Medicare.

The company has an Earnings ESP of +4.93% as the Most Accurate estimate of $2.34 per share is higher than the Zacks Consensus Estimate of $2.23. Moreover, it has a Zacks Rank #3 (Hold) which is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

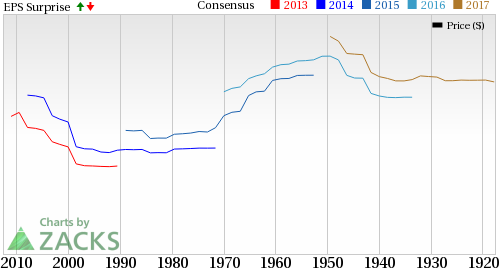

Last quarter, WellCare Health Plans, beat the Zacks Consensus Estimate by 35.3%. The company surpassed expectations in each of the last four quarters with an average positive surprise of 59.23%. This is shown in the chart below:

WellCare Health Plans, Inc. Price and EPS Surprise

PharMerica Corp. (NYSE:PMC) is an institutional pharmacy services company in the United States. It offers services to healthcare facilities, pharmacy management services to hospitals, specialty infusion services to patients outside hospitals, and oncology pharmacy services.

The company has an Earnings ESP of 0.00% as the Most Accurate estimate of 47 cents is in line with the Zacks Consensus Estimate. This makes surprise prediction difficult despite the company’s Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Last quarter, PharMerica beat the Zacks Consensus Estimate by 5%. This time, however, the company is unlikely to come up with a beat.

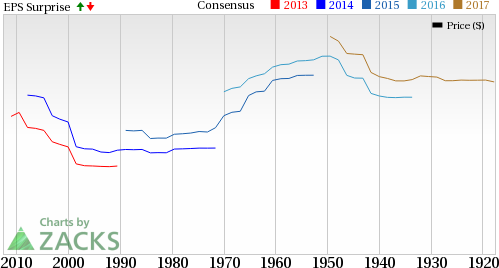

With respect to the surprise trend, PharMerica Corp. surpassed expectations in two of the last four quarters, with an average positive surprise of 1.25%. This is shown in the chart below:

Pharmerica Corporation Price and EPS Surprise

WellCare Health Plans, Inc. (WCG): Free Stock Analysis Report

Pharmerica Corporation (PMC): Free Stock Analysis Report

Original post

Zacks Investment Research