The hawkish revolution continues. Powell, among the screams of monetary doves, suggested this week that tapering could be accelerated in December.

People live unaware that an epic battle between good and evil, the light and dark side of the Force, hard-working entrepreneurs and tax officials is waged every day. What’s more, hawks and doves constantly fight as well, and this week brought a victory for the hawks among the FOMC.

The triumph came on Tuesday when Fed Chair Jerome Powell testified before Congress. He admitted that inflation wasn’t “transitory,” as it is only expected to ease in the second half of 2022. Inflation is, therefore, more persistent and broad-based than the Fed stubbornly maintained earlier this year, contrary to evidence and common sense:

Generally, the higher prices we’re seeing are related to the supply and demand imbalances that can be traced directly back to the pandemic and the reopening of the economy. But it’s also the case that price increases have spread much more broadly and I think the risk of higher inflation has increased.

Importantly, Powell also agreed that “it’s probably a good time to retire that word.” You don’t say! Hence, the Fed was wrong, and I was right. Hurray! However, it’s a Pyrrhic victory for gold bulls. This is because the recognition of the persistence of inflation pushes the Fed toward a more hawkish position. Indeed, Powell suggested that the FOMC participants could discuss speeding up the taper of quantitative easing in December:

At this point the economy is very strong and inflationary pressures are high and it is, therefore, appropriate, in my view, to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner, and I expect that we will discuss that at our upcoming meeting in a couple of weeks.

What’s more, Powell seemed to be unaffected by the Omicron coronavirus strain news. He was a bit concerned, but not about its disturbing impact on the demand side of the economy; he found supply-chain disruptions that could intensify inflation way more important. That’s yet another manifestation of Powell’s hawkish stance.

Implications For Gold

What does the Fed’s hawkish tilt imply for the gold market?

Well, gold bulls get along with doves, not hawks. A more aggressive tightening cycle, including faster tapering of asset purchases, could boost expectations of more decisive interest rates hikes. In turn, the prospects of a more hawkish Fed could increase the bond yields and strengthen the U.S. dollar. All this sounds bearish for gold.

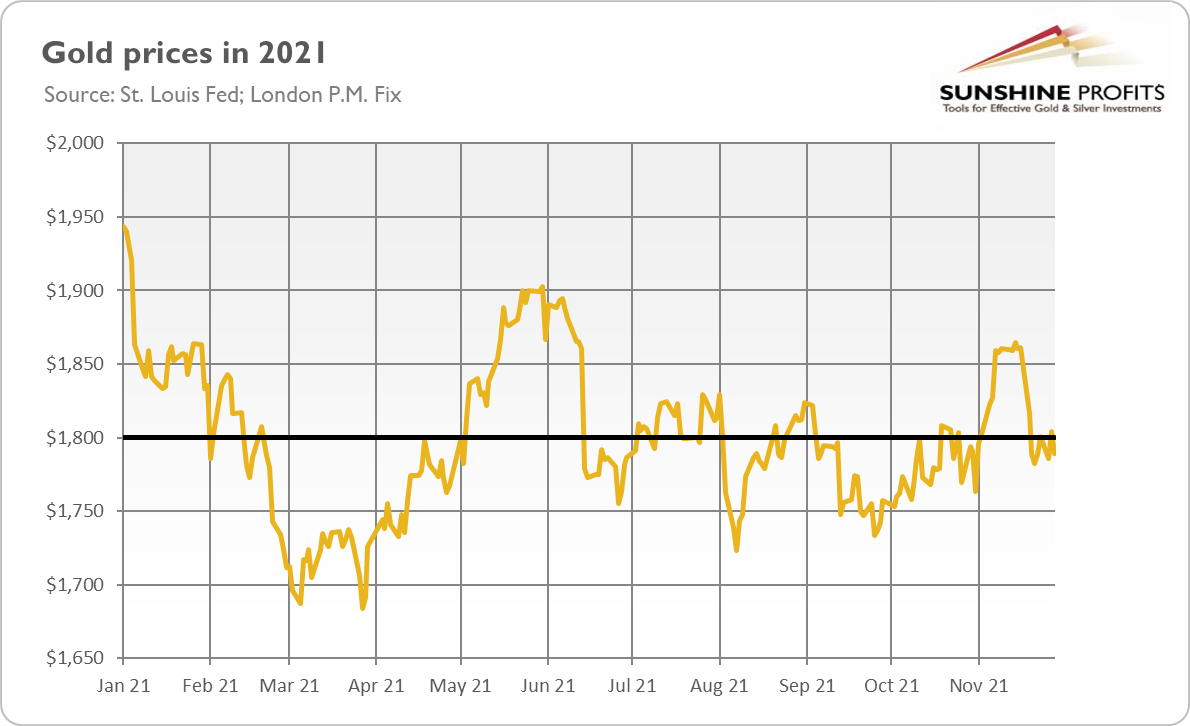

Indeed, the London price of gold dropped on Wednesday below $1,800, as the chart above shows. Hence, gold’s inability to stay above $1,800 is disappointing, especially in the face of high inflation and market uncertainty. Investors seem to have once again believed that the Fed will be curbing inflation. Well, that’s possible, but my claim is that despite a likely acceleration in the pace of the taper, inflation will remain high for a while.

I bet that despite the recent hawkish tilt, the Fed will stay behind the curve. This means that the real interest rates should stay negative, providing support for gold prices. The previous tightening cycle brought the federal funds rate to 2.25-2.5%, and we know that after an economic crisis, interest rates never return to the pre-crisis level. This is also what the euro-dollar futures suggests: that the upcoming rate hike cycle will end below 2%. The level of indebtedness and financial markets’ addiction to easy money simply do not allow the Fed to undertake more aggressive actions. Will gold struggle in the upcoming months then? Yes. Gold bulls could cry. But remember: tears cleanse and create more room for joy in the future.