Are you still holding shares of Abercrombie & Fitch Co. (NYSE:ANF) and awaiting a miracle to take the stock higher in the near term? If yes, then odds are you might lose more money as chances are very slim that the stock which lost its value by nearly 25% since Aug 30, 2016, will take a U-turn in the near term.

“A stitch in time saves nine," implying that timely action may prevent a serious loss later on. Let’s delve deeper and try to find out what is taking this Zacks Rank #4 (Sell) company down the hill.

Ever since Abercrombie posted wider than estimated losses for the second consecutive quarter the company’s shares are moving towards South Pole. Abercrombie & Fitch Co.’s second-quarter fiscal 2016 adjusted loss per share of 25 cents was wider than the Zacks Consensus Estimate of a loss of 23 cents and the prior-year quarter loss of 12 cents.

Moreover, Net sales were also down nearly 4% year over year to $783.2 million and missed the Zacks Consensus Estimate of $789 million. A soft sales performance due to traffic headwinds at its U.S. flagship and tourist locations stores were primarily responsible for the quarter’s weakness.

Following the dismal second-quarter fiscal 2016, the company expects comps to remain challenging in second-half fiscal 2016, due to uneven results from flagship and tourist locations. Further, it anticipates foreign currency headwinds to hurt sales by nearly $25 million and operating income by $20 million in the fiscal second half, with the largest impact expected in the fiscal third quarter.

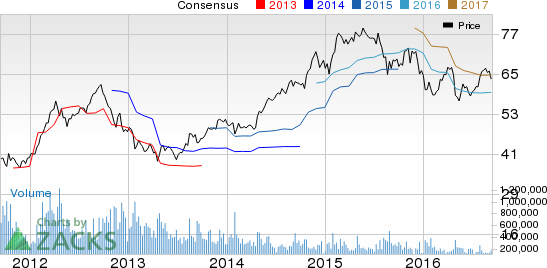

Let’s look at Abercrombie’s earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company. In the past 30 days, the company’s earnings estimates for fiscal 2016 have declined by 40.2% to 49 cents. On the other hand, over the same time frame, its earnings estimates for third-quarter fiscal 2016 have moved down to 21 cents from 44 cents.

Other Stocks to Consider

Better-ranked stocks worth considering in the same sector include The Children's Place, Inc. (NASDAQ:PLCE) , Nordstrom Inc. (NYSE:JWN) and Urban Outfitters Inc. (NASDAQ:URBN) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ABERCROMBIE (ANF): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

URBAN OUTFITTER (URBN): Free Stock Analysis Report

CHILDRENS PLACE (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research