The answer may not come until later in the week.

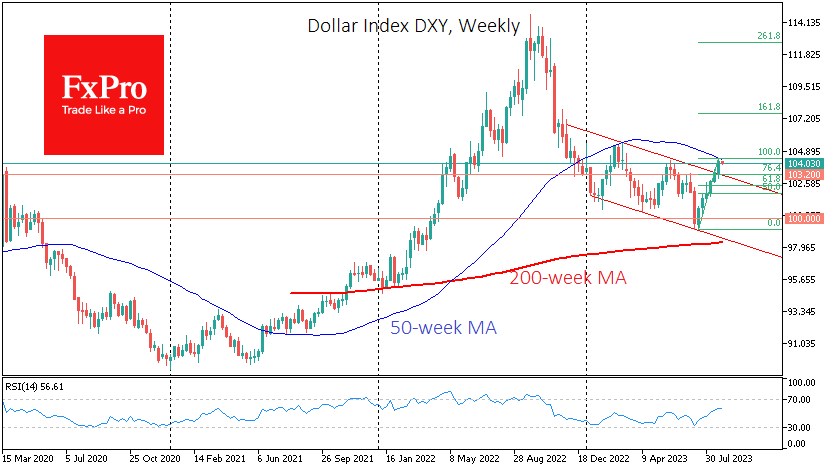

The dollar index finished with growth for the sixth week in a row, climbing on Friday to its highest since March and trading above 104.

The dollar formally broke a multi-month downtrend by climbing above the May highs. The trend breakdown is also indicated by the fact that the DXY last week rebounded solidly from the 200-day moving average and the previous resistance line of the descending channel.

Also, the 50-day moving average reversed to the upside last week, providing further evidence of a bullish trend reversal.

At the same time, the multi-week dollar rally created certain risks of a short-term correction, as the RSI index entered the overbought area, exceeding 70 on daily intervals. During the dollar's rally in the first nine months of last year, the dollar was running out of steam after entering overbought territory, but it could take anywhere from a week to three weeks.

If the dollar correction starts, the index may roll back to 102.1-102.4 from current levels, clearing the way for a new growth impulse.

If one looks beyond the short-term moves, the latest rise cleared the way for the dollar to make more critical highs near 105.3 before the end of the quarter. The DXY can return to 107.5 in the longer term, last seen back in November.

Speeches at Jackson Hole last week failed to stoke the fire of volatility in the markets, and now a meaningful trigger won't come until Friday in the form of the monthly labour market report.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Have Dollar Bulls Finally Won or Do Bears Still Have a Chance?

Published 08/28/2023, 10:31 AM

Updated 03/21/2024, 07:45 AM

Have Dollar Bulls Finally Won or Do Bears Still Have a Chance?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.