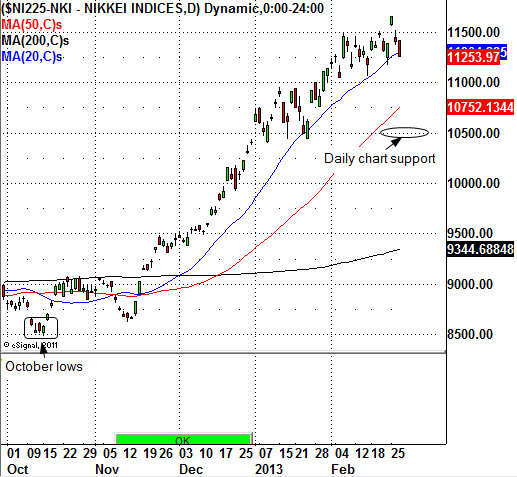

One of the hottest stock markets in the world has been the Japanese stock market. The highly followed Nikkei 225 Index has rallied higher by 3200.0 points since mid-October. Anytime an index surges higher by more than 35.0 percent in such a short span of time it does make traders and investors wonder how much further this index can trade before pulling back or staging a meaningful correction.

Traders and investors should now expect a pullback and possibly a correction to take place in the highly followed Japanese stock market. Recently, Japan's Finance Minister Taro Aso stated that he wanted to get the Nikkei 225 Index to reach 13,000 by the end of March. Devaluing the Japanese Yen (Japan's currency) is the tactic that the Japanese government and Bank of Japan (central bank) are using to inflate their stock market. While it has been working it does not come without repercussions. Anytime any country devalues their currency it will ultimately lead to inflation. As many of you know, Japan has been fighting deflation for nearly 20 years now, so I guess they are thinking that they need to really inflate their markets.

As a technical trader we know that markets can only travel so far before pulling back. It does not matter how much money printing and inflationary tactics are taking place. At certain technical points markets will pullback or consolidate before moving higher. You see, institutions that are long the Nikkei 225 Index will simply want to lock in some gains and this will cause the markets to pullback regardless of any government effort to prop up the market.

It looks as if the Nikkei 225 Index has now reached a level where a pullback or possibly a correction should occur. The Nikkei should have near term daily chart support around the 10,500 level. This is a level where the Nikkei 225 index could see a decent bounce according to the charts. Another way to play the Japanese market is to use the iShares MSCI Japan Index Fund (EWJ). Some leading Japanese ADR's that trade in the United States could also be affected. Leading Japanese stocks such as Sony Corporation (ADR) (SNE), Panasonic Corporation (ADR) (PC), Toyota Motor Corporation (ADR) (TM), and Canon Inc. (ADR) (CAJ) could pullback if the Nikkei 225 Index declines.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Has The Japanese Stock Market Peaked Yet?

Published 02/28/2013, 12:09 AM

Updated 07/09/2023, 06:31 AM

Has The Japanese Stock Market Peaked Yet?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.