The cheating on OPEC oil production quotas will begin almost as soon as the Saudis turn their taps back on, says Helima Croft, global head of commodity strategy at RBC Capital Markets.

While that might be true, the difference is US supply is unlikely to ramp up at the same time, thereby creating a perfect storm for crude futures.

Key members of the Saudi-led and Russia-assisted OPEC+ alliance meet via a web conference Wednesday to debate the group’s current and future production.

Ahead of the meeting, the Organization of the Petroleum Exporting Countries touted its compliance with agreed production cuts at 108%—more than the 9.7 million barrels a day it pledged to cut back in April.

“Roll Back The Cuts, And The Cheating Will Start”

Be that as it may, RBC Capital’s Croft said she feared smaller producers within OPEC will start cheating again on their production quotas if the group decides to roll back on cuts.

"Can they maintain the same level of conformity, or will it start to break down when we start to have more barrels coming back?" Croft, one of Wall Street’s best-known oil analysts, said in an interview with Business Insider.

“I don't think we're going to get unrestrained output again. I just think that the potential cheating comes back always in a situation where they're easing cuts."

In April, the Saudis led a push that saw the 23-nation OPEC+ exporter group, which includes Russia and other non-OPEC members such as Oman and Kazakhstan, cut output by 9.7 million barrels a day, as the COVID-19 pandemic triggered a collapse in oil demand.

Now, Riyadh and most participants in the coalition support a loosening of the curbs, according to an OPEC official, who was speaking on conditions of anonymity. Under the Saudi proposal, OPEC+ would relax its current restrictions on supply by 2 million barrels a day to 7.7 million barrels a day.

In its decision on whether to raise production just three months after the worst blow to oil demand in history, OPEC had to weigh up not only on how resilient demand for crude might be in a second wave of COVID-19, but also the strength of a comeback in US shale output.

Tame US Oil Output Might Just Swing It For OPEC

Shale has been a long-time nemesis of OPEC, but became the group’s unlikely ally, albeit in name only, after President Donald Trump's peace pipe back in April.

And all indications are things might just work out for OPEC+.

There are two factors on the US front that might the group maintain compliance and not sink oil prices.

The first is the record low number of US oil rigs in operation now. That will take appreciable time to rebuild and make an impact on production.

The second is an environmental ruling by a US district court that could have long-term repercussions on the Bakken pipeline that serves the heart of America’s shale oil.

Under the court ruling last week, the Dakota Access Pipeline, which carries crude oil from the shale basin to the refineries of the Midwest and the Gulf Coast, was ordered to shut down and be emptied by August, while a lengthy environmental review is conducted. A US Appeals Court said on Tuesday the pipeline can continue to operate while the court battle runs on, Reuters reported.

Before the coronavirus pandemic devastated the US oil industry, daily output in North Dakota—the nation’s No. 2 oil producer behind Texas—was at a near-record 1.45 million barrels daily. The state’s output has slipped since to below 1 million barrels daily, as energy prices and demand have remained weak.

The order to shut down the $3.8 billion, 1,172-mile Dakota Access Pipeline came just after the builders of the Atlantic Coast Pipeline—Duke Energy (NYSE:DUK) and Dominion Energy (NYSE:D)—said they were scrapping that project due to ongoing delays and increasing cost uncertainty.

US Shale Threat Might Have Been Overplayed

Nick Cunningham, an independent oil analyst blogging on Oilprice.com, said the threat of a major comeback in US shale oil production may have been overplayed.

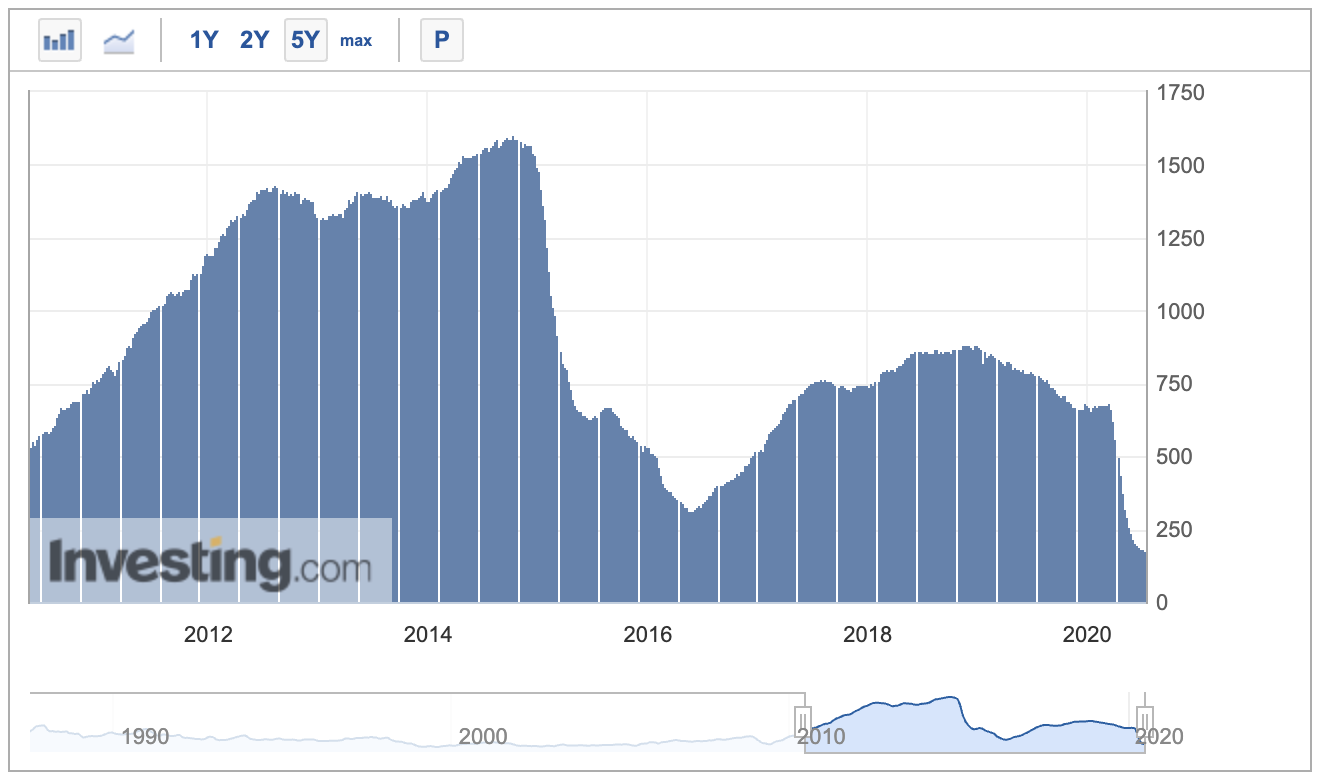

In the past, any tightening up of the oil market simply created more room for aggressive shale drilling, Cunningham wrote, but the US rig count has remained at historic lows these past few months, despite crude prices roaring back to around $40 from below zero back in late April.

”As steep decline rates take hold, it appears unlikely that US production will come back in any significant way this year or next,” he surmised.

Adding to Cunningham’s thesis was a projection this week by the US Energy Information Administration that crude output from America’s seven major shale formations was expected to decline by about 56,000 barrels per day in August to about 7.49 million bpd, the lowest in the two years.

Watch The Virus

In the end, any OPEC wager on higher production might depend on how demand for crude fares amid the coronavirus pandemic.

RBC Capital’s Croft said:

“The path to $60 a barrel is: stronger signs of demand and really clear indicators that COVID-19 is not going to have that kind of detrimental impact on demand that we might have if there is a second wave of coronavirus."

"It might be too soon to declare victory in terms of the demand picture."

Disclaimer: Barani Krishnan does not own or hold a position in the commodities or securities he writes about.