Oilfield services behemoth Halliburton Company (NYSE:HAL) reported in-line first quarter profit after robust North American drilling activity on the back of oil pricing strength were offset by problems in Venezuela and frack sand delivery delays.

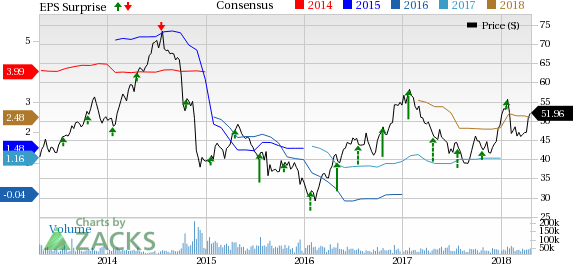

The world's second-largest oilfield services company after Schlumberger’s (NYSE:SLB) income from continuing operations (adjusted for Venezuela write-downs) came in at 41 cents per share, same as the Zacks Consensus Estimate. Moreover, revenues of $5,740 million missed the Zacks Consensus Estimate of $5,760 million.

However, Halliburton joined fellow oil services majors Schlumberger and Baker Hughes, a GE Company (NYSE:BHGE) , in affirming increased activity in U.S. shale, driven by strong oil and gas production in response to an improving crude environment.

Segmental Performance

Operating income from the Completion and Production segment was $500 million, significantly higher than the year-ago level of $147 million. The division’s performance was helped by continued growth in the North American land drilling business. Further, Halliburton experienced a bump in the Europe/Africa/CIS completion services, while stimulation activity in the Middle East were higher as well.

However, the segment operating income could not match our consensus estimate of $534 million. The shortfall could be attributed to cost inflation triggered by increased fracking sand pricing. Rising prices of sand – used to hydraulically fracture new wells – increased the expense associated with the drilling of a new shale well and put upward pressure on the cost of contractors like Halliburton.

As it is, Halliburton had to shell out more to purchase the sand from spot markets to minimize the impact on client completion timelines after extreme weather and rail shut-downs disrupted deliveries.

Meanwhile, Drilling and Evaluation unit profit improved from $122 million in the first quarter of 2017 to $188 million this year. The outperformance was on account of higher drilling activity in the Eastern Hemisphere and North America.

But the segment income was below the Zacks Consensus Estimate of $180 million. Results were hampered by lower activity – primarily across various product lines – in Latin America, especially Venezuela.

Balance Sheet

Halliburton’s capital expenditure in the first quarter was $501 million. As of Mar 31, 2018, the company had approximately $2,332 million in cash/cash equivalents and $10,428 million in long-term debt, representing a debt-to-capitalization ratio of 55.4%.

Zacks Rank & Stock Picks

Halliburton currently carries a Zacks Rank #3 (Hold), implying that it is expected to perform in line with the broader U.S. equity market over the next one to three months.

Meanwhile, one can look at a better-ranked oilfield service player like Flotek Industries, Inc. (NYSE:FTK) . Flotek Industries is a Zacks Rank #1 (Strong Buy) stock.

(You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.)

Flotek Industries provides a range of products and services to enhance returns for the oil and gas finders. The 2018 Zacks Consensus Estimate for this Houston, TX-based company is 32 cents, representing some 557.1% earnings per share growth over 2017. Next year’s average forecast is $52 cents, pointing to another 62.5% growth.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Schlumberger Limited (SLB): Free Stock Analysis Report

Halliburton Company (HAL): Free Stock Analysis Report

Flotek Industries, Inc. (FTK): Free Stock Analysis Report

Baker Hughes Incorporated (BHGE): Free Stock Analysis Report

Original post

Zacks Investment Research