The Healthcare sector has struggled since the August ’15, China-induced, beat-down on the major equity indices, which is exactly what typically happens when the market has a decent correction.

Biotech stocks, the Healthcare sector, and Apple (O:AAPL) have been leadership groups (with a 4% market cap weighting and a 6% earnings weight within the S&P 500, we can call Apple a “group”), although all three groups have begun to lag since the October ’15 bounce. Apple is still shy of its 200-day moving average even though the S&P 500 as an index traded back above its 200-day moving average this week. (Long Apple)

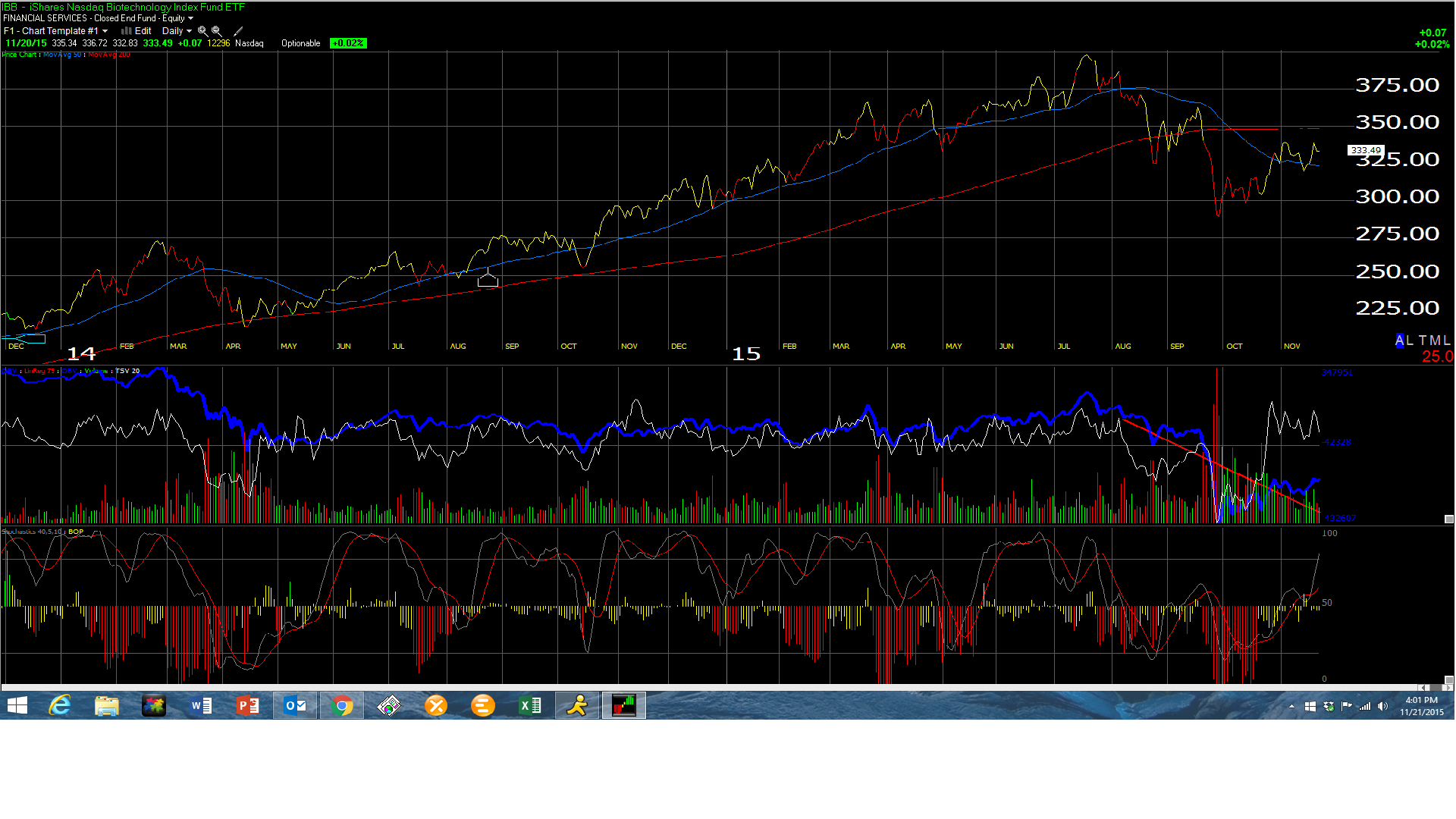

The attached chart of the iShares NASDAQ Biotechnology ETF (O:IBB) shows that it too is struggling below its 200-week moving average.

The first sentence of this post alludes to the fashion in which the stock market creates the next set of winners and losers within the indices: while leadership groups can certainly exit a correction and continue to lead as Technology and Financials did in the late 1990s, usually market corrections and the subsequent rally typically lead to a different configuration of winners and losers, and the August, ’15, “China Syndrome” correction was no exception, as Biotech and Apple now lag (if only slightly so far) the October – November bounce.

Healthcare sector by the numbers:

Here is the historical EPS and revenue growth for the Healthcare sector using both Thomson and Factset’s earnings data.

- The first data set is Thomson’s historical and projected EPS growth for the Healthcare sector. Note how 2016 projected is somewhat slower than 2015’s historical.

- The second data set is Thomson’s historical revenue growth: since Thomson does NOT show forward revenue estimates, the reader must look to the 4th data set which is Factset’s estimated revenue growth for Healthcare.

Both Thomson and Factset are projecting lower EPS and revenue growth for the Healthcare sector for the next 5 quarters.

However here is the catch: if we look at the Healthcare sector’s expected growth vs actual growth, the last 4 quarters:

- Q3 ’15:+4.3% growth expected as of October 1, +12.7% actual as of November 20, 2015

- Q2 ’15: +4.1% growth expected as of July 1, +11.6% actual growth for Q2 ’15

- Q1 ’15: +7.2% growth expected as of April 1 ’15, +17.6% actual growth for Q1 ’15

- Q4 ’14: +17.6% actual growth expected as of 1/1/15, vs +22.3% actual growth for Q4 1’5

The point to the above is that Healthcare has put up some solid earnings and revenue growth, even when expectations are subdued, so the forward estimates can be discounted to some extent.

Conclusion: About the time that the likely Democratic Presidential nominee Hillary Clinton came out and discussed price controls on some biotech drugs (during the late August ’15-early October ’15 10% correction for the S&P 500) Meg Terrell, CNBC’s biotech reporter, who in my my opinion has been a solid add to the CNBC coverage team, noted a study she obtained from a hedge fund that in Presidential election years, the Healthcare sector tends to under-perform the broader market, (assume S&P 500) pretty consistently over time.

That is the catch to the above analysis: even if Healthcare as a sector continues to grow at “above S&P 500 growth rates,” will the sector P/E compress in a Presidential election year, where the likely Democratic Party nominee should remain ahead in the popular polls?

Let’s face it: the Healthcare sector can become a whipping boy (girl?) in an election year, as candidates play to the populist themes.

Last week’s pre-announcement by United HealthCare (N:UNH) that they may be reconsidering some of the ACA exchange initiatives could be a harbinger for slowing growth in early 2016.

Right now, from a “relative performance perspective” with the historical performance of the sector in election years, UNH’s announcement last week, and even Pfizer’s (N:PFE) merger announcement with Allergan (N:AGN) yesterday morning, which, given the dilution of Pfizer’s stock should kill any upside for the shares over the next 12 months,

Biotech as a sub-sector of Healthcare is roughly 7% of total Healthcare revenue and 23% of total sector earnings growth.

There are some cracks starting to appear in the Healthcare sector, i.e. Biogen (O:BIIB) this Spring of 2015, UNH’s disappointment last week, and the Valeant (N:VRX) saga which we failed to mention.

Normally, when we write a sector analysis like this, I like to leave readers with a strong opinion one way or the other as to what we are thinking regarding the sector. A strong opinion is lacking right now, but given the “seasonal” trade, the potential for P/E compression, and the potential for slower growth, clients will remain underweight the sector for now. Clients' largest Healthcare holding as of today is Pfizer, which is down 5% in the last 5 trading days and 7.5% in the last month on the Allergan merger, and thanks to the dilution, will probably leave the stock as dead money over the next 12 months.