- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Growth Continues To Crush Value This Year For U.S. Equity Factors

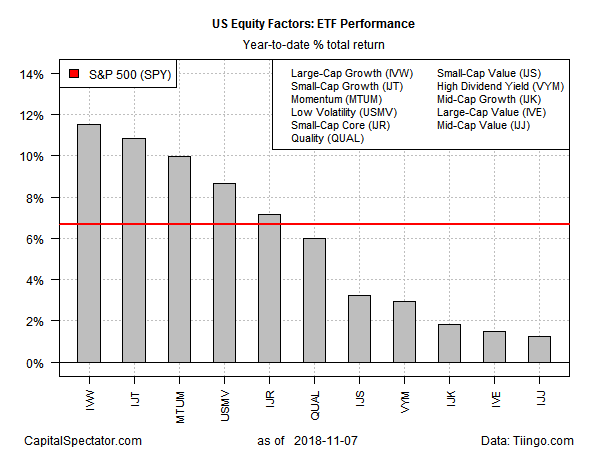

The sharp swings in the stock market in recent weeks haven’t dented the year-to-date performance edge that’s prevailed for large- and small-cap growth stocks in the US over their value counterparts, based on a set of exchange-traded funds through yesterday’s close (Nov. 7).

Large-cap growth still holds the lead for The Capital Spectator’s set of US equity factor ETFs so far in 2018. The iShares S&P 500 Growth (NYSE:IVW) is up a strong 11.5% year to date. Running slightly behind in second place is iShares S&P Small-Cap 600 Growth (NASDAQ:IJT), which is ahead by 10.9% so far in 2018.

Value, by comparison, is far behind in this year’s equity factor horse race. Dead last for year-to-date results at the moment: iShares S&P Mid-Cap 400 Value (NYSE:IJJ), currently posting a slight 1.3 gain. The second-weakest performance this year: iShares S&P 500 Value (NYSE:IVE), which is ahead by 1.5%.

Meanwhile, the broad market this year is up 6.7%, based on the SPDR S&P 500 (NYSE:SPY).

Despite the surge in market volatility over the past month, the growth factor has proven to be resilient in holding an edge over value, at least so far. But note that the latest rebound in equity prices generally has given large-cap value stocks a strong lift. Consider, for instance, that iShares S&P 500 Value (IVE) yesterday extended its rally to close just a hair below its 50-day moving average.

It’s too soon to say if this is an early clue that value’s fortunes vis-à-vis growth are set to rebound. In any case, the latest pop for big-cap value is an encouraging sign for thinking that undervalued stocks may be set to generate firmer performance in the months ahead vs. the track record in recent history.

Related Articles

If there was a "Stock of the Year" award, it would certainly go to Nvidia (NASDAQ:NVDA). As a result of the continued AI boom, the market cap of this semiconductor manufacturer...

A data provider tracks the stocks trades of members of Congress An asset management firm created two ETFs tracking how Congress members invest The Democratic and...

Below we can see how the top stocks in the S&P 500, as tracked by the Invesco S&P 500® Top 50 ETF (NYSE:XLG), have gained 22.5% in 2024. That easily beats the SPDR®...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.