Greggs' (LON:GRG) trading continues to be impressive, with better-than-expected like-for-like revenue growth in Q319 of 7.4% (against tougher comparatives) offset by lower-than-expected new space growth. In aggregate, trading is in line with expectations, therefore our forecasts and valuation are unchanged.

Total revenue growth in line with expectations

Greggs’ Q319 company-managed store like-for-like revenue growth of 7.4% (after 10.5% in H119) is slightly ahead of management’s expectations at the interim results, ie a two-year growth rate of c 10%, which implied growth for Q319 of c 6.5%. This is attributed to ongoing strength in customer numbers due to product innovation. The contribution from new store growth is slightly behind expectations with 56 net new openings year to date, due to slightly slower growth from franchise partners, although this is down to phasing and these openings will happen in FY20. As a result, the company expects around 90 net openings in FY19, versus the 100 expected at the interims.

New initiatives and trials progressing well

Greggs is at the start of trials for extended opening hours with c 60 stores open (from zero at the interims) until 9pm (6pm previously), which will extend to c 100 stores by the year end. The hot food range continues expanding to capitalise on the investment in hot food cabinets, with returning old favourites in the autumn range (spicy chicken and pepperoni bake) complemented by new additions including a hot peri peri chicken baguette. The online delivery trials with JustEat and Deliveroo are described as encouraging and the new distribution centre will be commissioned before the year end, as expected.

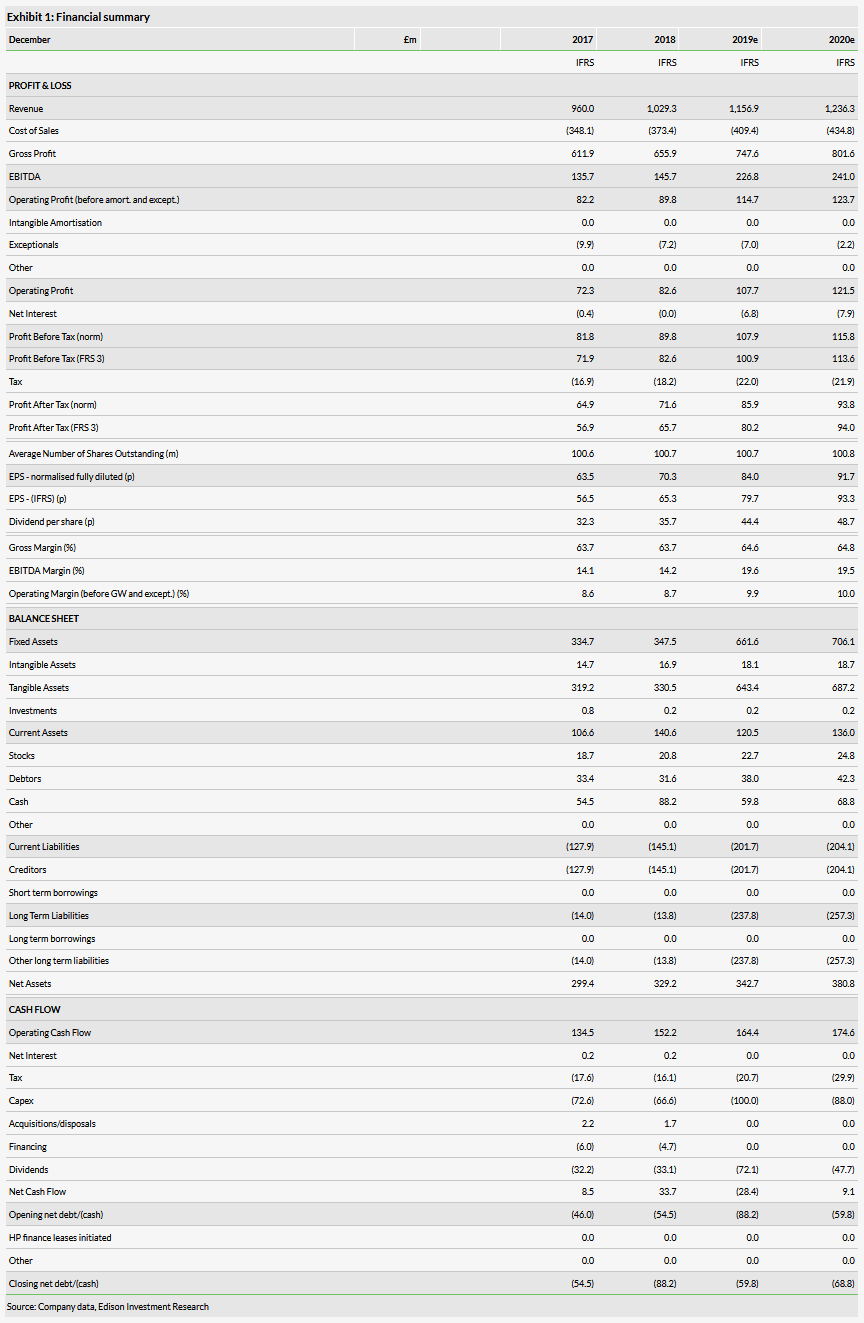

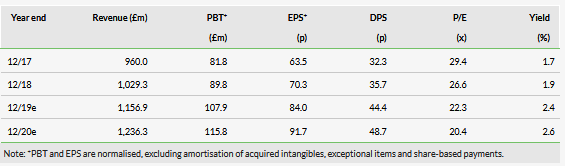

Forecasts: Continue to assume moderating growth

Our forecasts for FY19 and FY20 are unchanged with the better-than-expected like-for-like performance offsetting the lower-than-expected new space performance and no changes to input cost inflation assumptions. We continue to assume a moderation in the rate of like-for-like growth to 4% in Q419, against tougher comparatives and a 30bp deterioration in gross margin in H219 given input cost inflation flagged at the interims.

Valuation: No change to our DCF-based valuation

Our DCF-based valuation remains unchanged from 2,028p, which was updated at the interim results. This implies a P/E for FY19 and FY20 of 24.1x and 22.1x.

Share price performance

Business description

With 2,009 shops, eight manufacturing and distribution centres and 23,000 employees, Greggs is the UK’s leading ‘food-on-the-go’ retailer. It uses vertical integration to offer differentiated products at competitive prices.