Greece received approval for its long awaited bailout package from lawmakers, but Asian markets traded mixed on the news. The Nikkei eased .2% to 9463, as Mazda shares tumbled 10% after announcing it would raise $2 billion in a share offering. The ASX 200 advanced .8%, the Hang Seng edged up .3%, and the Shanghai Composite climbed .8%. Korea’s Kospi closed flat, as significant losses in ship builders offset gains in other sectors.

European markets declined, as the Greek debt deal failed to inspire investors. The DAX shed .6%, the FTSE dropped .3%, and the CAC40 slid .2%.

The Dow briefly crossed the 13000 mark for the first time since May 2008, but failed to hold those gains as US stocks ended mixed. The Dow settled at 12966, up 16 points, the S&P 500 inched up .1% to 1362, while the Nasdaq slipped .1% to 2949.

Currencies

The Australian Dollar dropped .7% to 1.0666, despite the spike in metal prices, as the US Dollar gained. The Pound slipped .4% to 1.5784, the Canadian Dollar declined .3% to .9966, and the Yen eased .1% to 79.72. The Euro and Swiss Franc closed flat.

Economic Outlook

Wednesday’s key report will be existing home sales, which analysts expect to rise to an annualized rate of 4.66M. Also due are weekly mortgage applications.

Asia Gains, West Slips, on Mixed Economic Data

Equities

Chinese manufacturing climbed to its highest level in 4 months, encouraging markets around the region. The Nikkei advanced 1% to 9554, with exporters gaining as the Yen moved back above the psychologically significant 80 level. The Shanghai Composite rallied .9% to 2404, the Hang Seng edged up .3%, and the Kospi rose .2%. In Australia, the ASX 200 erased early losses to close flat.

Meanwhile, European markets skidded on weaker than expected economic data. The service sector’s PMI data unexpectedly contracted, slipping to 49.4 from last month’s 50.4 reading. The DAX slumped .9%, the CAC40 dropped .5%, and the FTSE eased .2%.

Fitch cut its rating on Greece to C from CCC, explaining that a near term default is highly likely, despite the recent bailout efforts.

US stocks traded moderately lower as well. The Nasdaq shed .5% to 2933, the Dow slipped 27 points to 12937, and the S&P 500 declined .3% to 1358.

Currencies

The Dollar traded mostly higher against global currencies. The Pound sank .7% to 1.5668, the Australian Dollar fell .3% to 1.0635, and the Swiss Franc lost .2%. The Yen declined .7% to 80.29. The Euro inched up .1% to 1.3244, after trading in a narrow range all day.

Economic Outlook

January’s existing home sales data was strong, rising by 4% to a 1.5 year high. However, the gains were based on a steep downward revision of December’s data, so the results fell shy of expectations. Mortgage applications declined last week.

Report Suggests Europe Headed for Another Recession

Equities

Asian markets traded mostly lower on Thursday, as doubts over Europe’s economic health weighed on stocks. The Kospi slumped 1% as heavyweight Samsung Electronics tumbled 3% in a broad tech drop. The ASXX 200 slipped .2%, ending a 4-day winning streak, and the Hang Seng closed down .8% to 21381. China’s Shanghai Composite managed a gain of .3% and the Nikkei rose .4% to 9596.

European markets traded mixed as DAX declined .5% to 6809, the FTSE gained .4%, and the CAC40 traded flat. A European Commission report indicated that Europe is headed for a second recession, with an expected contraction of .3% over the next year. Shares in Belgian bank, Dexia, slumped 6.5%to 6.5% after saying it may go out of business.

US stocks advanced, as stocks recovered from early losses. The Dow added 46 points to 12985, the Nadaq climbed .8% to 2957, and the S&P 500 rose .4 to 1363.50.

Currencies

The Euro rallied .9% to 1.3367 despite the negative outlook for the region. , The Swiss Franc climbed .9% as well, and the Australian Dollar rose .7% to 1.0706. The Pound and Yen both gained .4%, to 1.5736, and 79.98 respectively. EUR/USD X" title="EUR/USD X" width="527" height="297">

EUR/USD X" title="EUR/USD X" width="527" height="297">

The Euro Gained another .9%, adding to its Recent Rally

Economic Outlook

Weekly unemployment claims were flat from last week at 351K, marginally better than forecast. The OFHEO home price index rose by .7% more than the .2% expected.

Upbeat Economic Data Pushes S&P 500 to Multi-Year High

Equities

Asian markets advanced on Friday, following Wall Street’s gains on Thursday. The Nikkei rose .5% to 9647, the Kospi climbed .6%, and the ASX 200 gained .5%. China’s Shanghai Composite rallied 1.3% to 2440, while the Hang Seng inched up .1% to 21507.

In Europe, shares closed mostly higher, encouraged by strong earnings results from Telecom Italia, which rose 7.3%. The DAX advanced .8%, the CAC40 gained .6%, and the FTSE closed flat. Deutsche Bank jumped 4.6% after Merill Lynch upgraded the stock to “buy”.

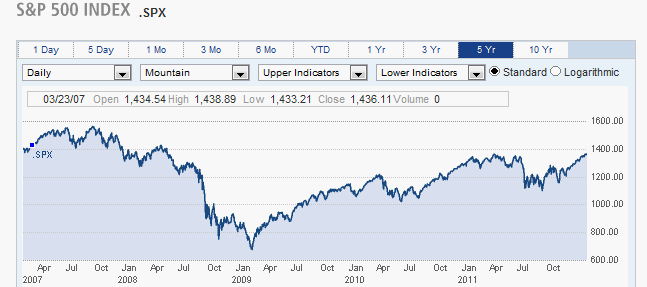

US markets posted smaller gains, and the S&P 500 closed at its highest level in 3.5 years. The S&P 500 rose .2% to 1365.50, the Nasdaq edged up .2% to 2964, and the Dow closed flat at 12983.

S&P 500 Closes at Highest Level in 3 1/2 Years

Gap shares sank 4% after reporting a sharp drop in 4th quarter income. Salesforce.com rallied 9% on solid earnings data, and garnered several analyst upgrades.

Currencies

The Yen fell 1.5% to 81.20, as the recent downtrend intensified. The Dollar traded lower against its European counterparts, as the Pound advanced .8% to 1.5872, while the Euro and Swiss Franc climbed .6%. The Australian Dollar and Canadian Dollar both eased .3%.

Economic Outlook

Consumer sentiment rose to 75.3 a significant jump from last month’s 72.5 reading, hitting its highest level since February 2011. New home sales clocked in at 321K, 5K more than expected, but slightly lower than last month’s gain of 324K.

Stocks Trade Mixed

Equities

Asian markets traded mostly lower on Monday, as the recent spike in oil prices took its toll on stocks. The Nikkei declined .1% to 9633, although exporters gained as the yen continued to slide against the dollar. The Kospi slumped 1.4%, the ASX 200 dropped .9%, and the Hang Seng shed .9% to 2128. The Shanghai Composite bucked the downtrend, rising .3% to 2447, a 3 month high.

European markets closed lower as well. The CAC40 sank .7%, the FTSE fell .3%, and the DAX eased .2%. German Chancellor, Angela Merkel, said there was no guarantee Greece’s bailout package would succeed, dampening spirits. Banks fell 1.4%, with Societe Generale dropping 3%.

US stocks overcame early losses to close modestly higher. The Dow rose points to 12996, erasing a 100-point loss from earlier in the day The S&P 500 advanced .2% to 1369, and the Nasdaq inched up .1% to 2967.

Currencies

The Dollar rose against most European currencies amid uncertainty for the region. The Euro and Swiss Franc slid .4% to 1.3397 1.1119, and the Pound declined .3% to 1.5820. The Australian Dollar gained .5% to 1.0758, and the Yen bounced .6% to 80.54. The Canadian Dollar rose fractionally to .9991.

Economic Outlook

Pending home sales blew past forecasts, climbing 2% to its highest level since April 2010.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Greece Secures Bailout Package

Published 03/22/2012, 06:24 AM

Updated 05/14/2017, 06:45 AM

Greece Secures Bailout Package

Equities

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.