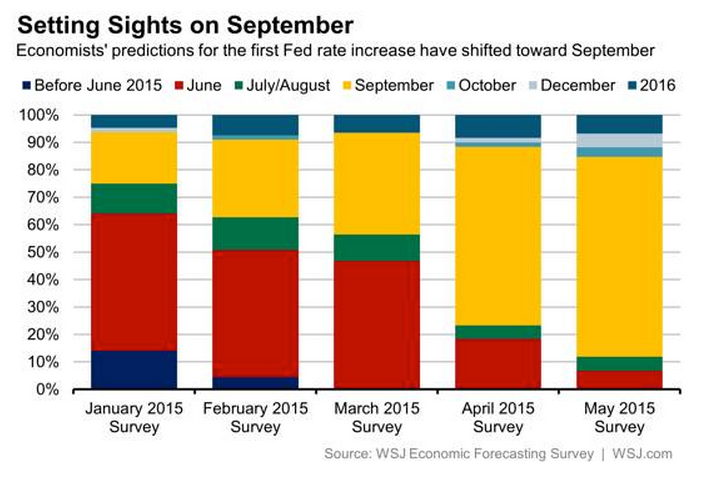

This Great Graphic comes from the Wall Street Journal. It shows the evolution of market expectations for the first Fed rate hike from the monthly survey it conducts. At the start of the year, many economists, like ourselves, thought that a June hike was the most likely scenario. However, the weakness of Q1, and especially the poor job growth in March, spurred a rethink.

This latest survey was conducted after the April jobs report was released a week ago. It found that nearly three-quarters (73%) expect a rate hike in September. We also think that is the most likely scenario.

Yellen said on more than one occasion that the Fed can boost rates at meetings that are not followed by a scheduled press conference. About 8% of those surveyed by the Wall Street Journal take the Chairwoman's remarks at face value and expect a hike in July or October when no press conference is scheduled. Reports indicate that in April the Fed tested a plan for a system to do precisely that. Still, we suspect Yellen's comments were more about underscoring the Fed's data-dependency rather than a true policy signal.

Indeed, if during the day of July 29, investors learn that an unscheduled press conference has been called for that afternoon, they will quickly conclude that the Fed will announce a rate hike and anticipate the news. To maximize the Fed's freedom, and avoid such a scenario, we have recommended that the Federal Reserve adopt the practice of the ECB and BOJ in having a press conference after every meeting. We argue that this is consistent with the evolution of the Fed's communication and increased transparency. Still, it does not appear imminent.

The Wall Street Journal found that about 7% of the respondents think that Evans and Kotcherlakota will carry the day and there will be no lift off this year. Interestingly, the survey also found that 70% found that the greater danger was waiting too long to hike while 30% thought the risk was going too early.

The Fed's bar to a move is not that there has to be overwhelming evidence that wages have begun rising and/or that inflation is moving toward the target. Rather, it is "reasonable confidence" that the Fed's mandates will be achieved in the medium term. In the way that the Fed thinks about such things, as long as the labor market continues to improve -- meaning that the slack continues to be absorbed -- officials will anticipate that labor costs will rise. Headline inflation, they would argue, converges to core inflation over time and core inflation is driven by wage growth.

Weekly initial jobs claims point to continued improvement in the labor market. The four-week average is a little below 272k, which is the lowest in more than 35 years. As recently as mid-March, it stood above 300k.

Many Fed officials, including the leadership, recognized the headwinds facing the US economy but anticipated that the impact was temporary. These included weak oil prices (dampening headline inflation with some, albeit limited, spillover into the core rate) and USD strength. The dollar has fallen against all the major currencies since the March FOMC meeting, save the New zealand dollar (owing to a shift in expectations toward a rate cut as early as next month. Oil prices have also rebounded. The price of light sweet crude has risen around 28% since the March FOMC meeting.

Some feared that the weakness in other major economies would drag the US economy down, which would deter the Fed from hiking. Instead, the lower interest rates, oil and currency depreciation appear to have bolstered the eurozone economy and Japan. Both of whom grew faster than the US in Q1 and may do it again in Q2.