GBP/JPY Daily Outlook

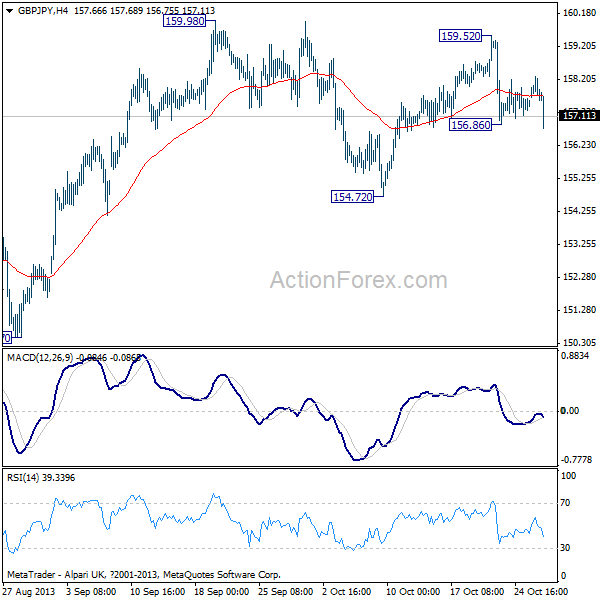

Daily Pivots: (S1) 157.40; (P) 157.84; (R1) 158.12;

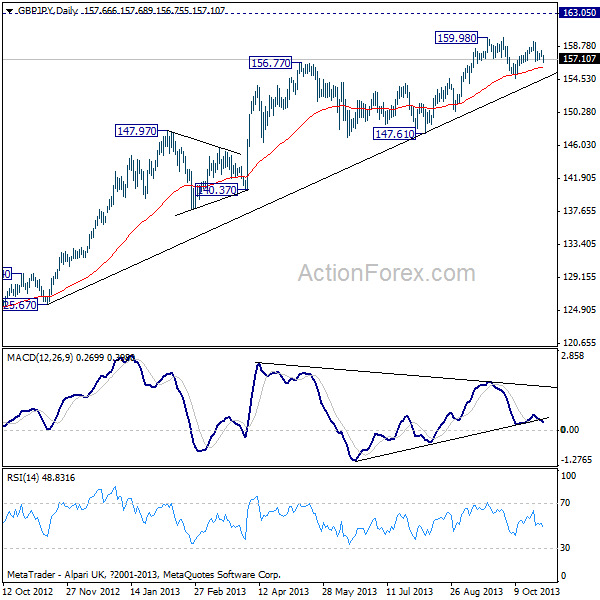

The break of 156.86 minor support suggests that fall from 159.52 is resuming and intraday bias is mildly on the downside. But outlook is unchanged before breakout from 154.72/159.52 range. Near term upside momentum remains very unconvincing. Hence, while above 159.52 will extend recent rally, we'd expect strong resistance below 163.05 resistance to bring larger reversal eventually. Decisive break of 154.72 will be an early sign of reversal and would turn near term outlook bearish for 147.61 support.

In the bigger picture, considering bearish divergence condition in daily MACD, the uptrend from 116.83 might be close to completion. Break of 147.61 will confirm medium term topping and bring correction back to 140.37 support and below. In case of another rise, we'd now expect strong resistance from 163.05 to limit upside. GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600">

GBP/JPY Hourly Chart" title="GBP/JPY Hourly Chart" width="600" height="600"> GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

GBP/JPY Daily Chart" title="GBP/JPY Daily Chart" width="600" height="600">

EUR/JPY Daily Outlook

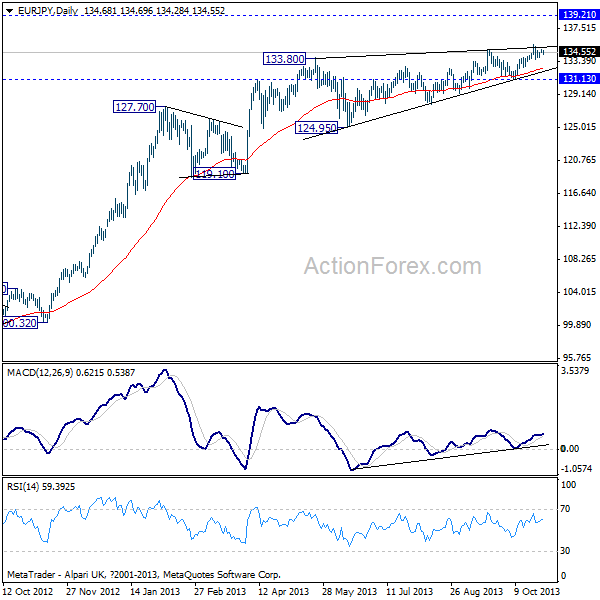

Daily Pivots: (S1) 134.48; (P) 134.71; (R1) 134.87;

Intraday bias in the EUR/JPY remains neutral first. Near term upside momentum remains unconvincing. And, the EUR/JPY could be in the final stage of a diagonal triangle from 124.95. Hence, while above 135.50 will extend recent rally, we'd expect strong resistance below 139.21 resistance to bring larger reversal eventually. Meanwhile, on the downside, decisive break of 131.13 will be an early sign of reversal and turn near term outlook bearish for 124.95 support and below.

In the bigger picture, upside momentum in the EUR/JPY remains rather unconvincing as seen in the daily and weekly MACD. While further rally cannot be ruled out for the moment, the cross would likely face strong resistance from 139.21 and 61.8% retracement of 169.96 to 94.11 at 140.98. The up trend from 94.11 should be close to forming a medium term top and turn into consolidation. Break of 127.96 will confirm topping and should bring correction back to 119.10 support. EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600">

EUR/JPY Hourly Chart" title="EUR/JPY Hourly Chart" width="600" height="600"> EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" width="600" height="600">

EUR/JPY Daily Chart" title="EUR/JPY Daily Chart" width="600" height="600">