What a difference 24h can make, huh? Gold Futures rallied visibly on Monday, only to give it back on Tuesday. Same with miners. What’s next?

Exactly the same thing that was likely before yesterday’s session. One of the things that indicated that decline was silver’s outperformance – this indication rarely fails to deliver. It’s surprising for those, who are new to the silver market, but it’s true – the white metal tends to fake strength relative to gold right before the entire sector turns south. We saw that once again.

That was fake strength. Fake weakness was what we recently saw in the US Dollar Index.

On July 14, when the USD Index was after the daily close at 99.49, I wrote the following:

And the thing is that the USD Index IS likely to reverse and soar very soon.

Slightly lower than expected CPI and lower than expected nonfarm payrolls didn’t justify a decline this big. The market simply wanted to decline as it seems that the market participants are still in denial and expect the Fed to start cutting interest rates shortly once again. And it can’t without limiting the demand. The move lower in the USD Index just made this task harder for the Fed as the U.S.-produced good just got much cheaper for foreign buyers.

On a technical front, each move below 101 (and 100 is even more profound support as it’s an extremely round number) was quickly reversed and followed by a rally. And since we now also see a strong buy signal from the RSI (we haven’t seen it this low in well over a year!), it’s very likely that we’re seeing a bottom in the making right now.

That’s exactly what happened. That was a fake weakness, and it ended up being one of the most bullish monthly price patterns imaginable – we saw a monthly hammer reversal candlestick.

And you know what happened after the previous monthly reversal?

The USD Index launched a powerful rally, even though the reversal that we saw back then (in early 2021) was not even as clear as the one that we saw in July 2023. The VanEck Junior Gold Miners ETF (NYSE:GDXJ) – proxy for junior mining stocks – topped when the USD Index reversed in early 2021, and it simply kept on declining with periodic corrections.

The point is: Higher GDXJ prices were never seen since that time, even though the general stock market moved higher since that time, which “should have” contributed to the miners’ rally.

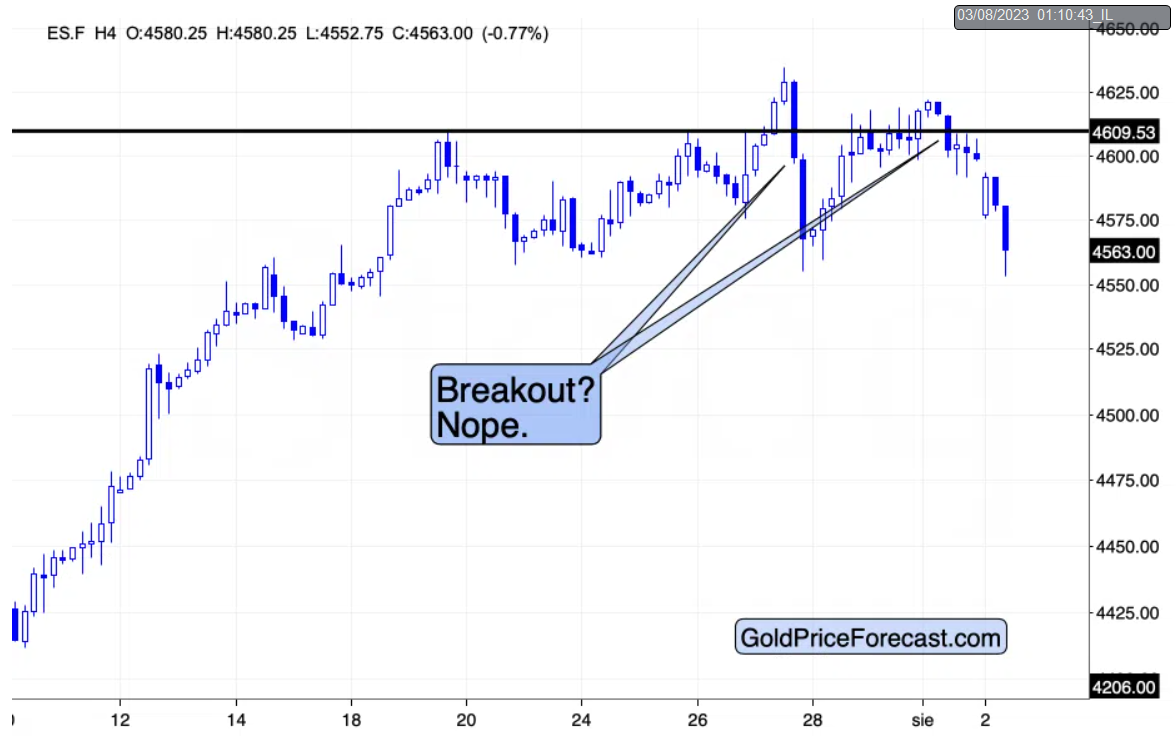

Speaking of stocks, please take a look at what happened in them yesterday and what’s happening in the S&P 500 in today’s pre-market trading.

The above chart features daily price changes (each candlestick is one trading day), and the below chart features the 4-hour candlesticks.

The S&P 500 futures formed a clear shooting star reversal in late July, and it can also be viewed as a failed attempt to move above the mid-July high. Stocks attempted to move above this level also in early August, and they failed once again. Today’s early decline suggests that the rally might be over.

Why is this important for mining stocks?

Because they moved lower substantially yesterday, while stocks moved lower just a little. So, if stocks are going to move lower in a really significant manner (and it’s likely to happen either very soon or soon, anyway), then miners are likely to truly plunge.

As a reminder, the history is rhyming for junior miners and the action that followed the vertical, red lines are very similar. These lines were not placed randomly – they market the days when the nonfarm payroll statistics arrived below expectations. In both cases, junior miners first rallied, and then they formed important tops.

That was also the case recently, and the current decline is in perfect tune with what we already saw.

Yes, the economic/geopolitical situation is not the same as it was in April 2023 or in mid-2022, but it doesn’t matter. What matters is that the statistics were below expectations. This is the key part because missed expectations trigger similar emotions regardless of the statistics themselves. And since price moves are ultimately triggered by humans that are taking emotional decisions (they might be good and justifying those emotional decisions with logic, but emotions always play a huge role in making decisions on average), the same patterns will continue to work over and over again.

Because neither fear nor greed nor other emotions will disappear regardless of which party wins elections, how high-interest rates get, and so on. That’s why applying technical analysis while making XAU/USD price forecasts makes sense now, and it made sense decades ago. And it will continue to make sense in the future.

What does history’s tendency to rhyme tell us – gold investors – right now? That’s we should brace ourselves for more turmoil this year, as the soaring USD Index and declining stocks don’t bode well for gold price’s outlook. And in particular, the above combination is likely to drive junior mining stocks lower.

This, in turn, means that the huge profits that we recently reaped in the FCX recently are likely to be joined by massive profits from the current short positions in the junior mining stocks and in the FCX.