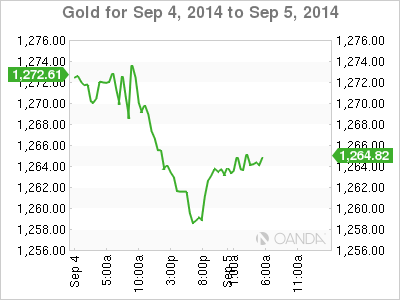

Gold prices have moved slightly higher on Friday, after opening the day near 3-month lows against the US dollar. In the European session, the spot price stands at $1265.72 per ounce. There was dramatic news on Thursday, as the ECB announced broad cuts to interest rates and plans to introduce quantitative easing. On Friday, US employment reports are in the spotlight, with the release of Nonfarm Employment Change and the unemployment rate.

After months of fighting in eastern Ukraine between government forces and pro-Russian fighters, Ukrainian President Petro Poroshenko on Wednesday announced a cease-fire in eastern Ukraine. Whether the latest attempt at a truce will last, however, is questionable, as the fighting continues. Russia has denied assisting the rebels, but both Ukraine and NATO have said that Russian forces are actively involved in the fighting. The crisis has severely strained relations between the West and Russia, and if the situation deteriorates, gold prices could move higher.

It's no exaggeration to state that Thursday was a shocker, as dramatic monetary action by the ECB sent the euro reeling below the 1.30 level. The markets had not expected any change to interest rates, but the ECB took the axe for the second time in three months, cutting the benchmark rate to a record low of 0.05%, down from 0.15%. As well, the deposit facility rate was lowered to -0.20% from -0.10% and the marginal lending rate dropped to 0.30% from 0.40%. ECB head Mario Draghi had more in store, saying that the central bank plans to implement an asset purchase program (QE). Draghi didn't elaborate, saying the ECB would provide more details in October. The interest rate cuts and QE scheme are intended to bolster anemic growth in the Eurozone and combat the growing threat of deflation.

US employment numbers were a disappointment on Thursday. ADP Nonfarm Payrolls slipped to 204 thousand last month, marking a 3-month low. This was well off the estimate of 218 thousand. Unemployment Claims edged higher to 302 thousand, above the estimate of 298 thousand. Will the official Nonfarm Payrolls follow suit with a weak reading? Last month's release missed expectations, and if the key indicator repeats with another weak reading, the high-flying US dollar could lose ground.

XAU/USD September 5 at 10:15 GMT

- XAU/USD 1264.88 H: 1265.72 L: 1258.43

XAU/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1210 | 1240 | 1252 | 1275 | 1300 | 1315 |

- XAU/USD edged lower in the Asian session but has recovered. The pair is steady in European trading.

- 1252 is an immediate support line. This is followed by support at 1240.

- 1275 is the next resistance line. The round number of 1300 is next.

- Current range: 1252 to 1275.

Further levels in both directions:

- Below: 1252, 1240, 1210 and 1186

- Above: 1275, 1300, 1315 and 1331

OANDA's Open Positions Ratio

XAU/USD ratio is pointing to gains in long positions on Friday, reversing the direction seen a day earlier. This is consistent with the pair's current movement, as gold has posted small gains. The ratio continues to have a substantial majority of long positions, indicative of trader bias towards gold moving to higher levels against the dollar.

XAU/USD Fundamentals

- 00:15 US FOMC Member Richard Fisher Speaks.

- 1:00 US FOMC Member Narayana Kocherlakota Speaks.

- 12:30 US Nonfarm Employment Change. Estimate 226K.

- 12:30 US Unemployment Rate. Estimate 6.1%.

- 12:30 US Average Hourly Earnings. Estimate 0.2%.