At least we're seeing the early signs of such possibility in the analytics as well as in the resiliency of the trading flow. So here we go.

'Tis December. 'Twas by this time one year ago that I'd nixed the notion of Gold reaching "Twenty-Five Hundred by Twenty-Five December Twenty Twelve". And now as we cruise towards Christmas Twenty Thirteen, we're not anywhere near even Fifteen Hundred. My having been a naughty boy on Gold, (justifyably amorally rather than immorally), certainly St. Nick has a lurid lump of coal for my stocking and that's it. But perhaps his tone shall change in a year's time. On verra.

Prior to Gold's being maniacally sold smack on our StateSide Tax Day last April, (spanning that session alone from a high of 1495 to a low of 1335), I'd already received a clairvoyant note from someone tossing about very low Gold targets of 1300, 1200, 1100 and so forth. I remember replying that those would be exceedingly remote downside levels, such that were they ever to actually trade, we'd find ourselves living in a very murky world. A impossible retracement of hundreds of points to such low latitudes would only mean that money supplies would had to have shrunk, the industrialized world as we know it having recluded into a deflationary depression, dark, dreary and cold.

Cold indeed. Here in so-called "sunny California", by San Francisco standards 'tis rarely been this cold, our outdoor thermometer yesterday (Friday) morning reading just 36°F (2°C). Indeed at sun up, I'd stepped outside for some air to see the usual array of parked cars unusually covered in frost. But Gold seemed not cold, neither depressed, dark nor dreary. Oh to be sure, price is truly depressed in the broad-based sense, yet sentimental depression had every chance in the world to further send Gold lower in reaction to a very robust move up in our Economic Barometer due to a couple of hundred mostly part-time jobs having been created along with vibrant personal spending. Oh the ensuence of "tapering" must surely be imminent, so some say. Still, there remain two FOMC meetings to be chaired by Ben Bernanke before the torch is passed to Janet Yellen come 31 January. Shall Big Ben ruffle the Fed's feathers, or instead quietly shuffle off into the mist and leave Old Yeller as the economic taper shaper? Here's the Baro as it stands right now:

And yet despite the above economic rocket shot, Gold materially didn't crack a wit. Just as we'd ruminated a week ago about a spreading awareness at the "layman level" of Dollar debasement, upon yesterday's key data releases which sent the Baro straight up into the tapering supportive thermosphere, Gold had a plunging moment of panic -- but then dug its spurs sharply into the Bull, which in turn snorted sufficiently hard to blow the Bear back on its butt:

Whether the trading powers-that-be "upon further review" saw through the "fluff" of the November jobs data, or noted that personal income actually shrank in October, or reminded themselves that tapering is still monetary debasement, or simply put forth that Gold has already been more than punitively pulverized in 2013, the sentiment quickly shifted to "enough is enough", sending up Gold up a staggering 35 points in 30 minutes. To be sure, we've witnessed drops of such magnitude and rapidity this year, but rarely if nary the upside equivalent and then some. Yes the Shorts have had many a session in the sun during 2013, but 'tis a dangerous game in which to engage, especially given that All-Time Highs eventually will out.

I'd come into last week with with a very optimistic feel for Gold, as well as for Silver and the EuroCurrencies, only to awake Monday morning to see all eight of our BEGOS Markets components in the red. Terrifique. Nothing like a little Dollar "strength" (whatever that is) to wreck all the parties. But the resilience of Gold in yesterday's recovery from the session's low brought welcome relief.

Still for the week on balance, Gold was off -2%. However, here's an analytical tidbit you doubtless shan't find elsewhere, indeed one of several Gold Positives presented herein: Gold made a "lower low" for the sixth consecutive week.

"Hold it right there mmb: you're sayin' that's a positive?"

In a contrarian sense, yes, Squire. In combing back through all of the weekly data: since the turn of the millennium, never-to-date has there been a seventh consecutive weekly "lower low". And whilst our friend is the trend, which for the past two years is down, as we'll herein see there are both 1) a rising in Gold's "Baby Blues" and 2) a pending upside crossing for Gold's daily MACD (moving average convergence divergence). First however, here we've the present stance of the weekly Gold bars and, as ever-annoying, parabolic Short trend:

With respect to the declining trend, in paraphrasing a valued reader who wrote in this past week, 'tis so obvious to the pundits at large that the year's low of 1179 shall be tested, that it shan't happen. Indeed, markets have been known to thwart the confidence of the people. (A young strapping banker with whom I dealt a year or so ago was all chuffed to bits one day about his owning Apple at 650 so as not to miss out on the surge to 1000. I don't know if he rode Apple down the entirety of the -41% route from his entry price -- a percentage decrease worse than that of Gold from its All-Time High -- and is still hanging in there on the rebound; but he's since departed the banking stage). But as for Gold, again it had the ripest of chances to tank yesterday but did not so do. That tells me the sentiment is subtly shifting.

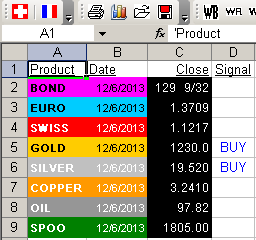

Moreover "they" have perhaps been right here looking over our shoulder for the past two sessions. At the end of each trading day, our computers macro-crunch in Excel all kinds of data for the BEGOS markets toward assembling the myriad of website exhibits and other internal reports, a snapshot portion of one of them as next shown. 'Tis a summary for the BEGOS markets as to what each one's 21-day linear regression trend consistency is suggesting as to pending trend change. On Monday for the Spoo (the S&P 500 futures contract) the readout below in column D said "Sell", (more on the S&P later). But on Thursday and as was reiterated yesterday, you can see next to both Gold and Silver the word "Buy":

Now let's go to those 21-day trend graphics themselves, featuring the baby blue dots that measure if trend consistency is re-enforcing or breaking apart. For both Gold and Silver, we can see the "Baby Blues", albeit ever so gently, beginning to rise. This is notably due to price extremes in just the last three days having traveled farther afield from the diagonal regression line. You might also discern that the last three closing "nibs" for both markets are above the trend line. But as for the Spoo on the left, its uptrend consistency is now coming unglued:

One might counter that the S&P put on a strong recovery yesterday. Stocks were due for a bounce as for each of the five prior round-the-clock futures sessions, the time-of-day high had preceded that of the low, (which for five days in-a-row is generally excessive). So: the rationale for the S&P to rally? Either the economic data was regarded as amply strong such as to warrant buying on sound fundamentals; else 'twas again regarded as "fluff" such as to warrant buying on the notion of further postponement of tapering. "Taper" is everything and indeed the only thing. For the S&P, valuation matters not: only talk of Taper. For Gold, monetary debasement matters not: only talk of Taper. My sense is the S&P is directly on course for the eventual "Look Ma No Earnings Crash" as we next view the coyote, not having simply run beyond the edge of the cliff, but indeed beyond of the edge of the planet so as to find himself floating amongst space junk -- both weightless and worthless:

As for Gold, per its 10-day trading profile, here's where we are now. A week ago Gold appeared nicely positioned above what we'd termed as a "fat finger of support" spanning the 1246-1241 zone. Whilst now below that at 1230, the lowest prominent apex in the profile is 1222; 'tis that level that we'd like to see hold:

From which here's to where we ought directionally go: UP. Similar to the 12-hour MACD chart for Silver presented a week ago, here we've what is currently Gold's best Market Rhythm study: the MACD on its Daily Bars. Again, rather than show the study itself of the averaging lines crossing one another, instead we colour the actual price bars: green for when the MACD is in positive disposition, (i.e. the study's histogram would be pointing up), and red price bars for the opposite case. We refer at the website to these studies as "rhythms" because they best measure the participative pace of the trading, i.e. the ebb and the flow. And at this writing, Gold's daily MACD is just now attempting a positive cross, the confirmation of which will depend on how Gold fares by the end of Monday's session. But if you look at the typical duration of the green and red price stints below, 'tis just about time for Gold's "rhythm" to go green:

So the signs are there for higher levels of Gold into year's end: a girding of sentiment, the unlikley event of a seventh consecutive lower weekly low, an early positive bent in the Baby Blues, some stabilization within the trading profile, and an almost emminent upside crossing in the daily MACD study. Of course, a week Wednesday we've the FOMC's final policy statement and press conference for 2013 ... and I'd still look for talk of taper to be tempered.

Besides, quantitative easing remains the all-inspiring support for the spritely UK economy these days, their services sector growth again showing strength, with companies even taking on extra staff to cope with rising workloads. (The Bank of England, of course, is doing its nurturing part by holding rates steady at their lowly 0.5% level, with gilt purchases still targeted for £375 billion).

Finally this bit on the bitcoin. So went the headlines: "China bars banks from bitcoin transactions [as the] government banned financial institutions from trading in bitcoin on Thursday, in what analysts said was a restrained first step towards regulating the digital currency that has exploded in popularity in China and soared in value." I applaud the concern. The Chinese love and understand the value and long-term ramifications for owning Gold and brilliantly haven't been afraid to load up on the yellow metal during this two-year price sale. The heck with all that other two-bit stuff: it really doesn't make a whole lotta cents (¢)...

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold To Trade Higher Into The End Of The Year

Published 12/09/2013, 12:09 AM

Updated 07/09/2023, 06:31 AM

Gold To Trade Higher Into The End Of The Year

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.