- Gold faces a complex scenario amid rising rate-cut expectations and a potential pushback by the Fed.

- However, the long-term outlook remains bright for the yellow metal.

- Investors should watch out for dip-buying near key support levels.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

Gold and silver started Monday’s session a touch higher, before easing off their best levels at the time of writing.

With the rates market refusing to reduce the aggressive rate cuts it has priced in for the Fed, gold investors are facing a tricky situation.

If the Fed pushes back against those expectations more forcefully moving forward, this could undermine gold. But it is not all about the Fed. The long-term outlook on gold remains as positive as any time.

Rate cut probabilities rise even further

A two-day rally on Thursday and Friday helped gold finish modestly higher last week. Interestingly, those gains came despite the much-anticipated US CPI data showing higher-than-expected inflation in December.

Despite the hotter CPI data, the market’s pricing of a March rate cut by the Federal Reserve rose somewhat by the end of the week to around 75% probability. Correspondingly, bond yields dropped, and up went gold and silver.

At the start of this week, markets are now 80% sure of a rate cut in March, according to the CME’s FedWatch tool as rate expectations remain disjointed from data in the US.

Fed officials pushing back against a sooner rate cut has so far fallen on deaf ears as FOMC’s Bostic found out, who thinks rates need to stay on hold until at least summer.

A total of 168 basis points of easing is indicated by the Fed funds futures. That is at least 6 rate cuts of the standard 25 basis points.

Thus, it is possible we could see a stronger pushback against such an aggressive easing expectation by the Fed Chairman Jay Powell himself at some point, which remains a key risk facing gold and other dollar-denominated risk assets.

This may have been why managed funds and large speculators reduced their long exposure to gold futures last week, at the fastest pace since February.

So why is gold holding up so well?

It is not all about the Fed’s policy and interest rates. Other influences are helping to keep gold in demand.

The hot CPI data from last week serves as a reminder that inflation is not fully defeated yet and fiat currencies are continuing to lose their value in real terms.

Gold, often seen as a hedge against inflation, has potentially benefited from that report. What’s more, the deteriorating situation in the Middle East is making gold even more appealing, given that many investors deem the metal to be a haven asset.

Gold technical analysis and trade ideas

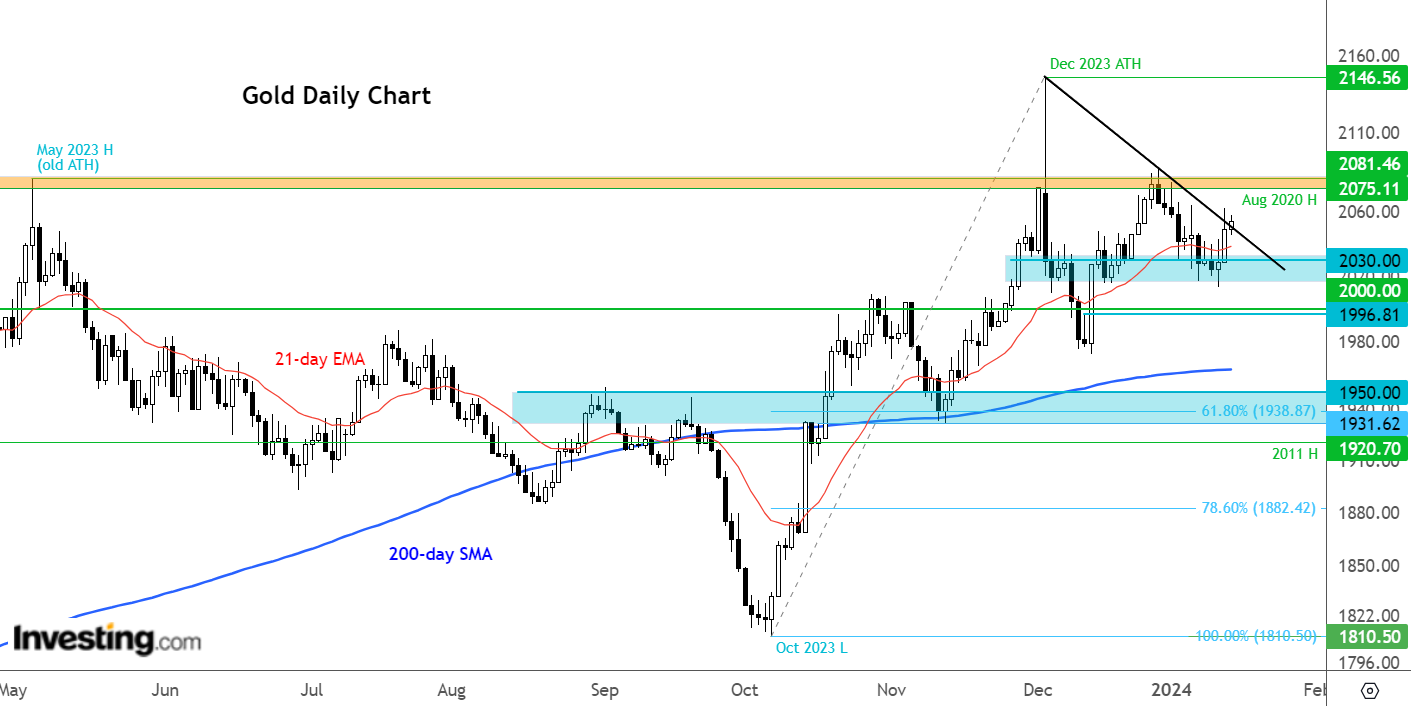

The technical outlook on gold remains positive for the time being. Since bottoming at $1810 in October, gold has now firmed several higher lows and a couple of higher highs, one of which being a fresh record high set in December.

Meanwhile, gold climbed above the 200-day moving average in mid-October and it has since held above it. The shorter-term 21-day exponential moving average also crossed and has since held above, the 200 MA later that month.

But the breakout to a new record in December failed to hold above the prior resistance area of $2075-$2080, muddling an otherwise bullish technical backdrop.

Stating the above facts helps us focus on the directional bias of gold in a non-subjective way.

With the longer-term trend being unquestionably bullish, traders may therefore wish to look for dip-buying strategies near support unless they thrive with counter-trend strategies, which requires a whole set of specific skills and mindset to master.

With that in mind, if gold can take out its short-term bearish trend line around the $2055 area decisively, then we may see follow-up technical buying towards that $2075-$2080 resistance area next, above which there are no other major reference points until the December peak of $2146.

Meanwhile, the bears would need to see a clear reversal pattern around current levels to give them confidence that December’s price action was indeed a false breakout reversal and therefore a near-term top in gold prices.

If we see such a bearish pattern emerge in the next few days then we can entertain shorting ideas again.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.