Five major fundamental and technical events need to occur for me to issue a major buy alert for Gold and Silver stocks, and to act on that alert myself.

The good news is that all five events are in play today.

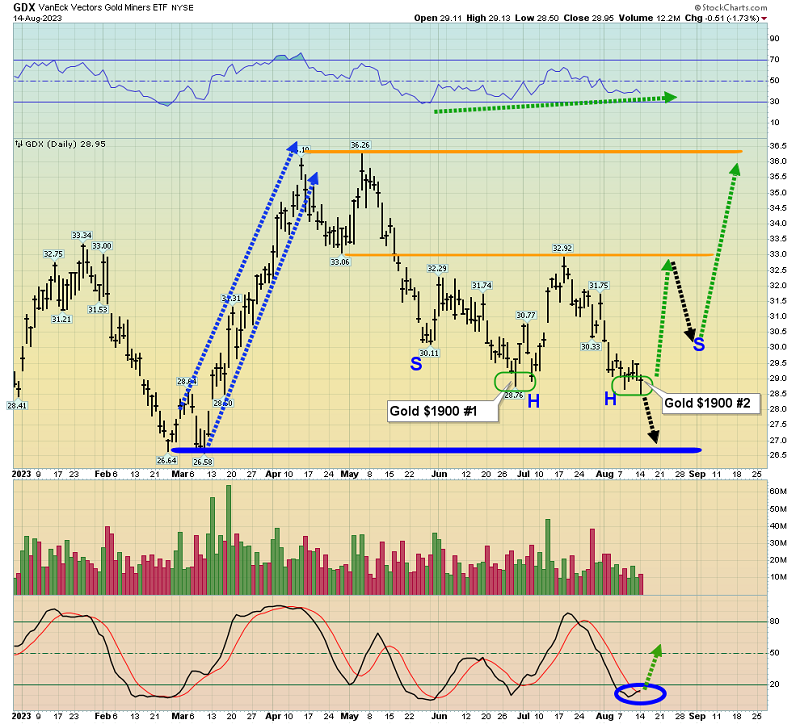

The first one. Gold has arrived at my $1900 major buy zone, as I suggested it would.

The second one. The interesting gold-stock sentiment chart, the BPGDM.

Note that when gold first arrived at $1900 in late June, the BPGDM was above the 30 zone. I issued a buy alert, but only for gold bullion, and not for the mines.

Now, the BPGDM has gone “sub 30”, the second of the five events needed… to make the miners a buy.

Investors should feel glum in the buy zone, and that seems to be the general gold bug mood today. I feel glum too, as I always do when it’s truly time to buy.

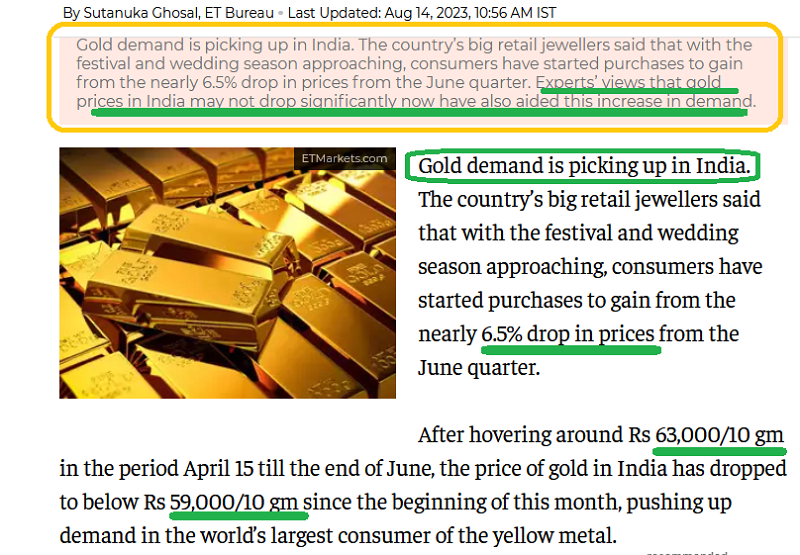

A look at the third indicator to buy. Without India’s “titans of ton” citizens stepping forwards to buy, investors are walking a very thin tightrope if they try to go it alone.

The great news this week is that India is returning to the gold stores and buying with zest.

A fourth event that needs to occur is for interest rates to run into resistance, and the 4.33% high of Oct 2022 fits that bill quite nicely.

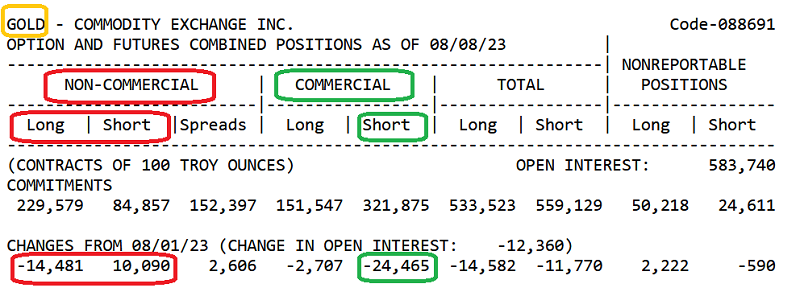

The fifth item that needs to be in place is significant loss booking of long positions on the COMEX, by hedge funds.

It should be accompanied by equally significant profit booking on short positions by commercial traders.

This is clearly occurring now, and both the funds and commercials are acting with “gusto”.

What about the growing dangers in the US banking system and the general meltdown in China? Could there be another “2008 again” situation at hand?

That’s possible, as is anything. In 2008, the big concern was deflation and imploding OTC derivative contracts. Now, a lot of these contracts are run through clearinghouses. Inflation is a much bigger problem than deflation.

A stock market meltdown now would likely see gold only dip slightly and put it into my massive $1850-$1800 buy zone.

Also, Chinese citizens are already buying gold aggressively as their economy disintegrates. Their buying could increase exponentially if they see US stock and real estate markets in America begin to melt into the abyss like their own. Here’s the bottom line:

If savvy Western gold stock bugs own plenty of gold bullion and a good amount of US fiat cash, a 1929-style US markets meltdown is going to be less worrisome than a dead fly.

The president of the United States is of course, “Chickenhawk Joe”, and he appears to dance with glee as millions of Ukrainians are ruined by his macabre scheme to ruin all the citizens of Russia. The children of Niger have few pencils, paper, and books in their schools, let alone computers. Ominously, the Chickenhawk does nothing… except chant for more war.

A horrifying number of citizens around Lahaina have just burned to death. The death toll could hit 1000 or more. The town is a wasteland featuring criminals out of a Mad Max movie roaming the streets and terrorizing the survivors. It should be inconceivable that a sitting president refuses to fly to Lahaina to comfort the victims, but when dealing with the most hideous man in the nation, his despicable actions are not just conceivable, but probable.

I warned US gold bugs that Trump’s failure to restore gold as money would be one of his un-doings and… his failure to pardon both Assange and Snowden would be the other. He should have offered them the position of joint “Secretary of Freedom” for America. He failed to act on both fronts and now incredible blowback is here:

The RICO act was used to dismantle much of the mafia in American cities, but the US “Creep State” is using it to turn America into a single-party state focused on debt, war, urban mayhem, and the elimination of citizen freedoms. The bottom line is clear: Buy gold!

With all five of my gold buy signals in play at the same time, the entire $29-$25 zone for GDX (NYSE:GDX) is now an aggressive accumulation zone for investors.

In 2008, most gold bugs appeared to be overly focused on shorting an imploded stock market they thought would fall further. I urged them to focus on my big five indicators at the massive $728 buy zone for gold. Today’s market bears only partial similarity to the start of the 2008 crash, and $1900, $1850, and $1800 are my thunderous buy zones… for hardcore gold stock marines!