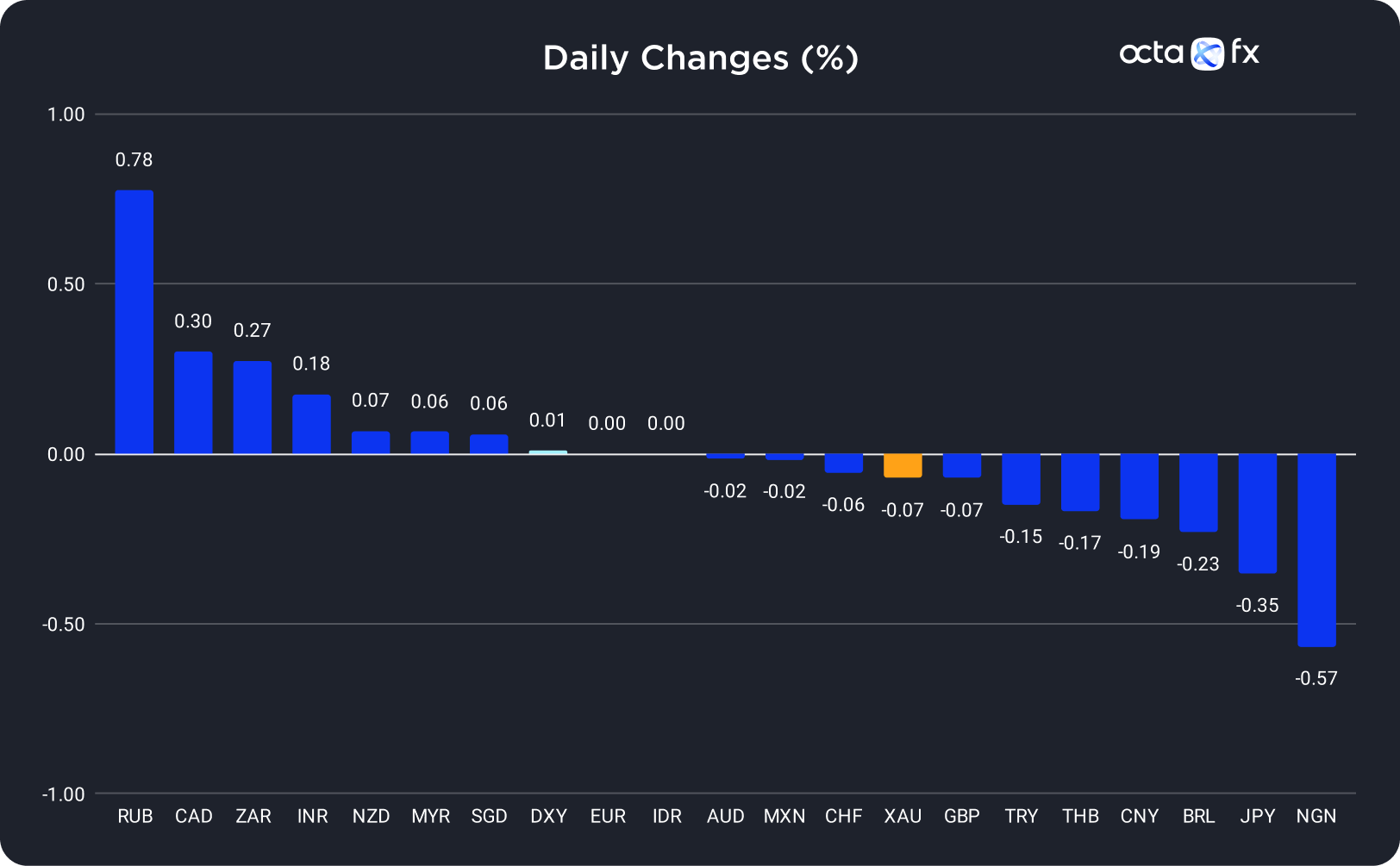

On Friday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Nigerian naira (NGN) showed the weakest results. The Canadian dollar (CAD) was the leader among majors, while the Japanese yen (JPY) underperformed.

Gold Rose Sharply on Monday Morning as the US Dollar Fell

Friday was uneventful, so gold continued moving within a range of 1,915–1,930 and finished the day essentially unchanged.

Last week lacked important economic reports, so investors still wonder whether the Federal Reserve (Fed) finished raising interest rates or not. This week will offer plenty of macroeconomic data releases, possibly clarifying the Fed's rate hike path. Now, the probability of another rate hike in November is around 40%, supporting the US dollar and putting downward pressure on precious metals. However, there is some safe-haven buying in gold. Thus, if this week's reports show high inflation in the U.S., XAU/USD may still hold above the 1,890 mark.

XAU/USD rose sharply in the Asian session as the U.S. dollar plunged after Kazuo Ueda, the Bank of Japan's governor, said the Central Bank could soon end its negative interest rate policy. In addition, the US dollar retreated due to better-than-expected Chinese data, easing investors' fears of a global recession. Today, the news calendar is light, so XAU/USD will probably trade within 1,925–1,933. 'Spot gold may retest a resistance at 1,930 USD per ounce, as its bounce from the 6 September low of 1,914 could have extended,' said Reuters analyst Wang Tao.

BOJ Governor Said the Regulator May End Its Ultra-Loose Monetary Policy

The Japanese yen (JPY) lost 0.35% on Friday, hitting a 10-month low.

Earlier today, the USD/JPY plunged below the important 146.500 level in response to the comments from Kazuo Ueda, the Bank of Japan (BOJ) governor. Yomiuri newspaper reported that Ueda wants the BOJ to end its ultra-loose monetary policy and raise the base rate. The newspaper highlighted that the Central Bank could have enough data by the end of the year to decide whether it can end negative rates. Investors reacted to the statement by selling the U.S. dollar and buying the Japanese yen.

USD/JPY continued to fall during the Asian session but didn't break below the 146.000 level. Japan will release its latest BSI Manufacturing Index and Producer Price Index at 11:50 p.m. UTC today. If the figures are stronger than expected, bears will get the fundamental impetus to pull USD/JPY lower, probably towards 144.700–144.000.