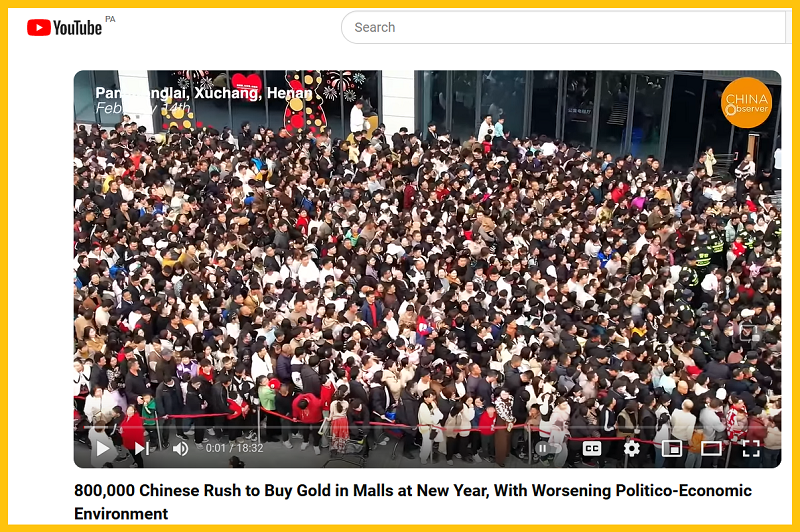

Feel the adrenaline rush of the gold bull era, in this incredible picture.

It defines what lies ahead for the whole world.

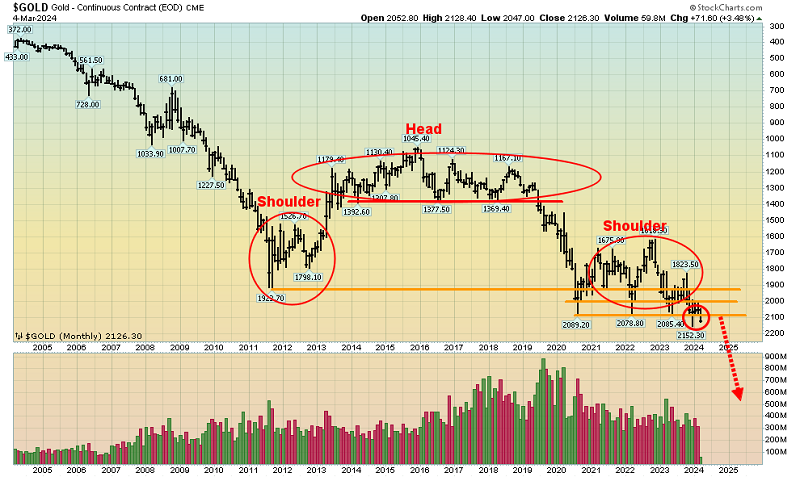

The key weekly chart for gold.

In the volatile fear trade for gold, line charts are important because they remove a lot of the excessive noise that often comes with candlesticks and bars.

An impressive broadening pattern breakout and inverse head and shouldering action is in play. The target is a minimum of $2200, with an “overshoot” to $2500 being possible too.

A week ago, I urged all gold bugs of the world to prepare for the US PCE inflation report to act as a “Golden Trigger” for gold, silver, and the miners and that’s exactly what has transpired!

Almost daily, more mainstream analysts are noticing the decoupling of gold from the US usury (rates) trade.

US rates are still incredibly low, especially given the outrageous growth of the debt of the US government and its closely associated entities.

Inflation is still sticky. The CPI, PPI, and PCE do not properly indicate the severity of the “boots on the ground” inflation being experienced by the average working-income citizen; grocery prices have not eased much, and the price of many items continues to rise.

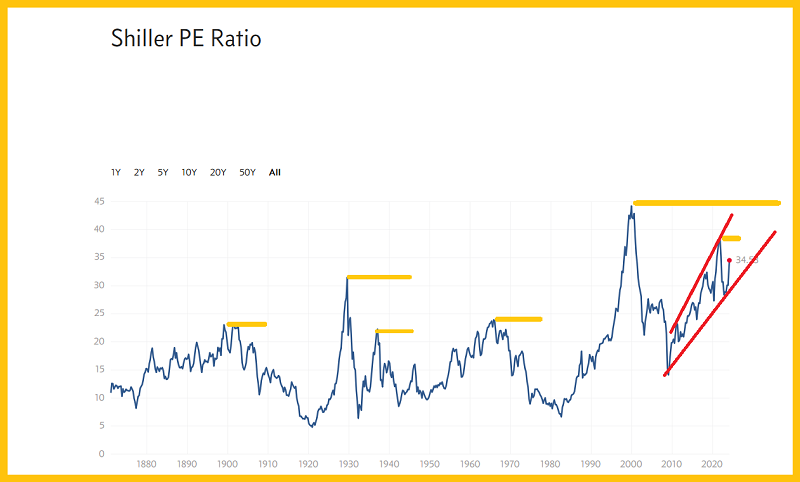

Stock market inflation is also in play. Basis the Shiller (CAPE) ratio, the US market is one of the most overvalued in history.

Rate cuts would make it even more overvalued perhaps the most overvalued of all time! Rich preppers like Zuckerberg are reportedly loading up bunkers with gold. US money managers are getting concerned that rate cuts could unleash a new round of (uncontrollable?) inflation and it’s likely to happen anyway.

The view of another key gold price chart. The weekly bars chart. Note the phenomenal action of the 14,5,5 series Stochastics oscillator at the bottom of the chart.

What about the dollar? The disturbing dollar versus gold chart. Support is failing (again) and a massive leg lower appears imminent.

A huge H&S bear continuation pattern is in play for the dollar, and if it plays out gold would be trading at its next major pitstop of about $3000.

There’s nothing that deranged chickenhawk and debt worshipper “Chucky Doll Joe” Biden can do to stop empire transition from the fiat-oriented West to the gold-obsessed East.

There’s nothing that “Super Trumpy Tarriff Taxes Man” can do either. Trump could end the horrifying woke joke schemes and he may even temporarily stop the wars, but he can’t stop the awesome fiat West to gold East transition from playing out in textbook fashion.

The only question that US government officials from both parties need to ask themselves today is whether they are ready to stop acting like fiat currency brats, act as adults, and embrace the awesomeness of gold!

Sadly, it’s unlikely that they make the transition, but their failure is spectacular news for all gold and silver enthusiasts.

Speaking of silver, the weekly chart. There’s a massive inverse H&S bull continuation pattern in play.

Like Rodney Dangerfield, silver hasn’t gotten the respect it deserves, but I’m predicting that 2024 sees that change.

The GDX (NYSE:GDX) daily chart. GDX could build an inverse H&S pattern right shoulder ahead of the US jobs report. That’s very bullish.

The view of an even more positive (and realistic) scenario. When a flagpole forms on a chart, a flag is likely to follow.

Like silver, gold stocks have also struggled versus gold, but they are now coming to life in a major way. Newmont’s CEO calls this price zone a “generational buy” and I’ll dare to suggest he may be understating the opportunity!

Here’s the bottom medium-term line: Huge numbers of “dumb money” call options were written around the $27 strike price zone for GDX. The smart money buyers bought the calls.

Now price has surged through that $27 line in the option writers’ sand and done it like a solid gold chainsaw ripping through a block of rancid fiat butter! There’s only one thing left to say to all the world’s gold and silver stock enthusiasts. Enjoy!