Gold Non-Commercial Speculator Positions:

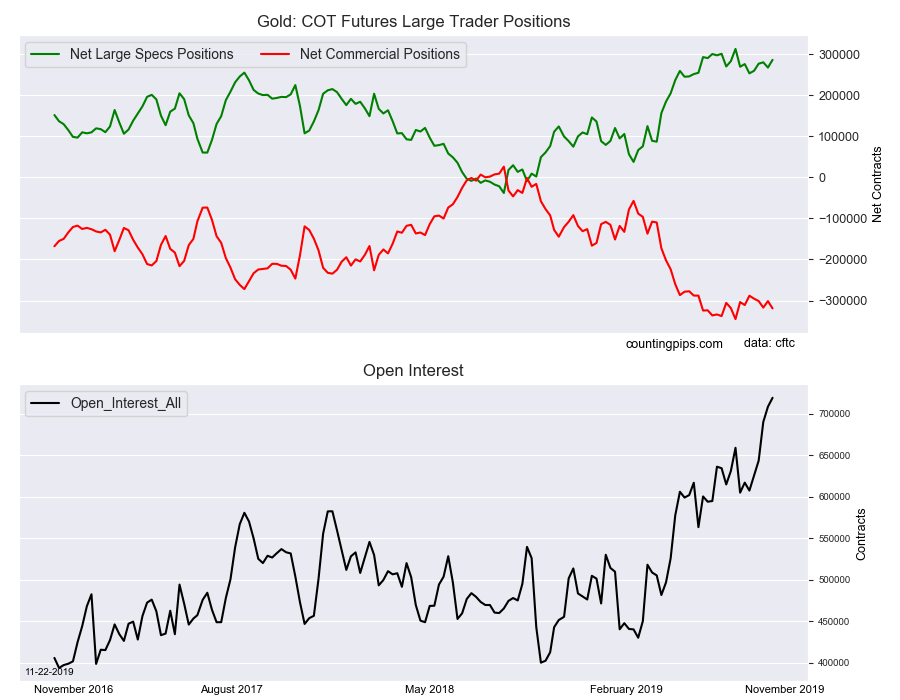

Large precious metals speculators continued to increase their bullish net positions in the Gold futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Gold futures, traded by large speculators and hedge funds, totaled a net position of 285,859 contracts in the data reported through Tuesday November 19th. This was a weekly rise of 18,793 net contracts from the previous week which had a total of 267,066 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 14,107 contracts (to a weekly total of 337,296 contracts) while the gross bearish position (shorts) declined by -4,686 contracts for the week (to a total of 51,437 contracts).

Gold speculators added to their bullish bets by over +18,000 net contracts this week and now by a total of +32,832 contracts in the past five weeks. Gold positions have been above the +250,000 net contract level for eighteen straight weeks, dating back to late July. Further gains in positioning could see bullish bets back over the +300,000 net contract level for the first time since September 24th when the net position totaled +312,444 contracts.

Gold Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -319,095 contracts on the week. This was a weekly fall of -17,627 contracts from the total net of -301,468 contracts reported the previous week.

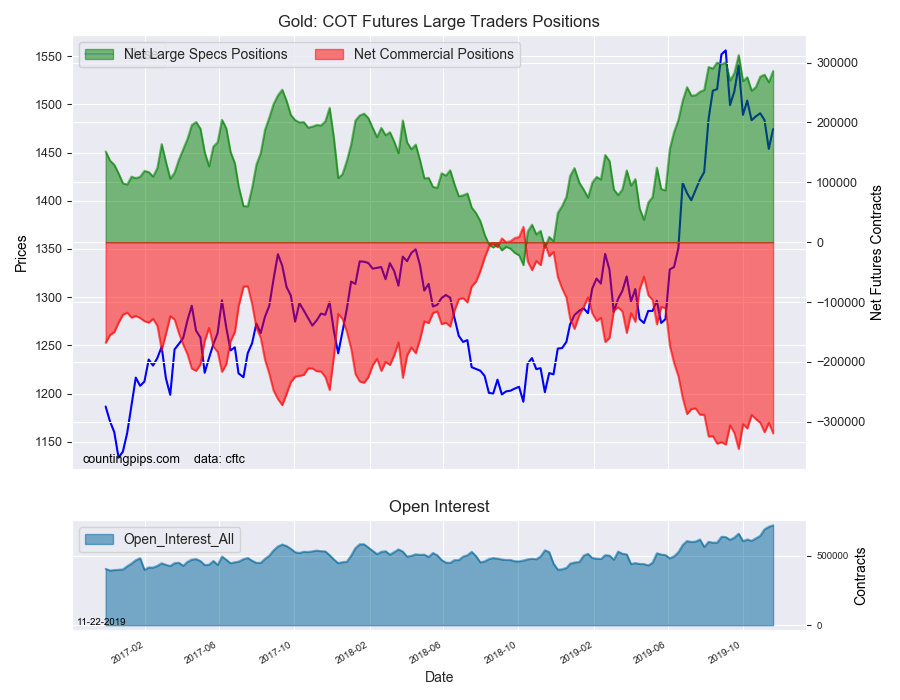

Gold futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Gold futures (Front Month) closed at approximately $1474.30 which was an uptick of $20.60 from the previous close of $1453.70, according to unofficial market data.