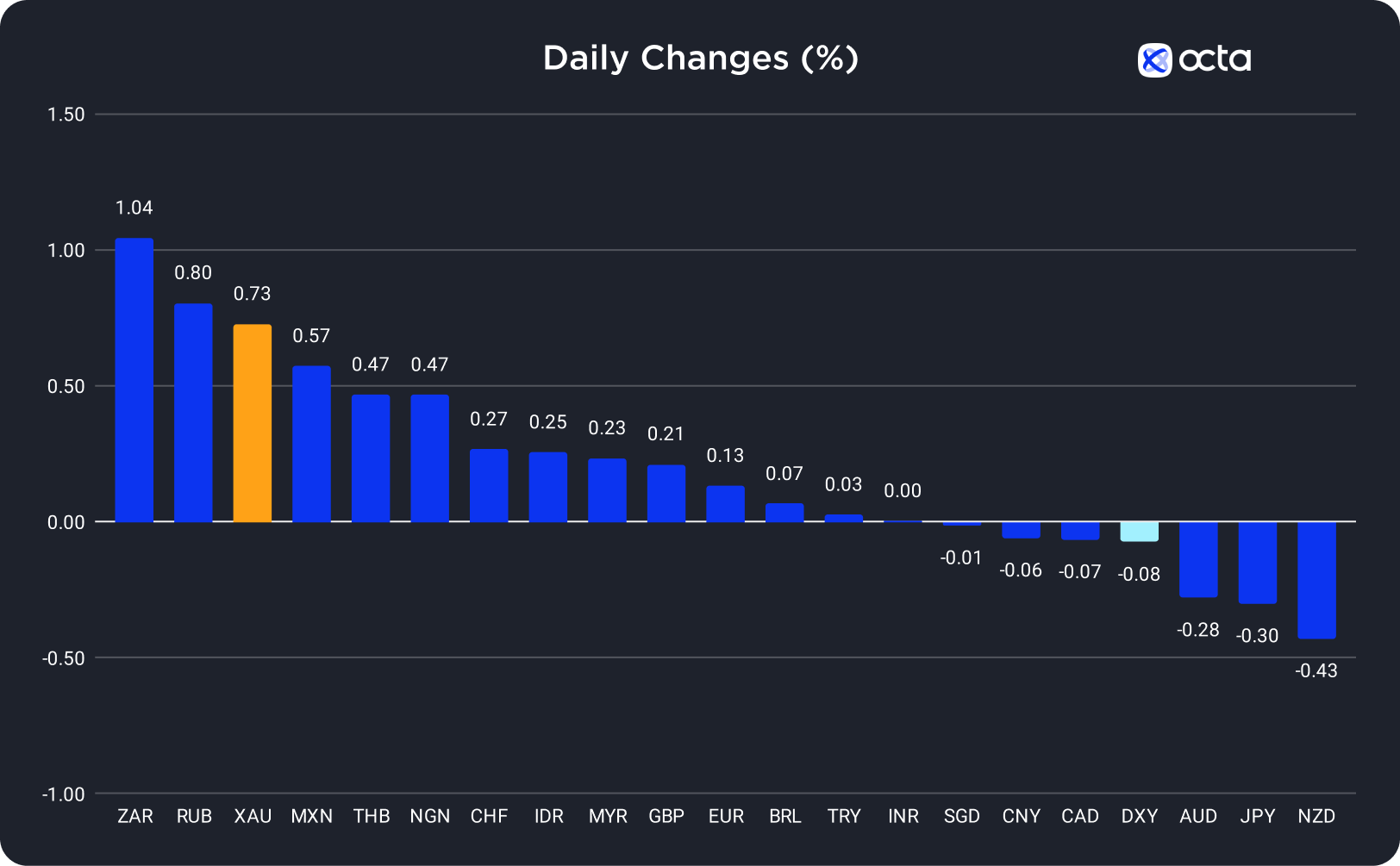

On Wednesday, the South African rand (ZAR) was the best-performing currency among the 20 global currencies we track, while the New Zealand dollar (NZD) showed the weakest results. The Swiss franc (CHF) was the leader among the majors, while the Chinese yuan (CNY) underperformed among emerging markets.

Gold Rose Strongly on Wednesday

Gold (XAU) reached a two-week high on Wednesday, surging by 0.73% despite higher-than-expected U.S. Producer Price Index (PPI) figures.

U.S. producer prices rose beyond expectations in September, but the underlying inflationary tendencies at the production level showed signs of diminishing. The US Dollar Index and US Treasury yields were close to a two-week low, improving the appeal of non-yielding gold. The Fed's September meeting minutes revealed policymakers were questioning the U.S. rate-hike trajectory. Thus, Fed officials decided to adopt a more cautious approach to the monetary policy. Also, policymakers' comments this week hinted at the less hawkish Fed stance.

Today, traders should focus on the U.S. Consumer Price Index (CPI) report at 12:30 p.m. UTC. If inflation figures exceed expectations, the chance of a rate increase this year rises, potentially boosting the US dollar and reversing the short-term bullish trend in gold. Meanwhile, lower-than-expected numbers may push XAU/USD towards 1,890.

"Spot gold may test a resistance zone of 1883–1888 USD per ounce, a break above which could open the way towards 1,895," said Reuters analyst Wang Tao.

The Rise in GBP/USD Paused After a Six-Day Rally

The British pound (GBP) gained 0.21% on Wednesday as the FOMC minutes showed that U.S. policymakers decided to adopt a cautious stance on monetary policy.

GBP has been rising for the past week due to the weakening US dollar as the market started to believe the U.S. base rate has peaked. Indeed, Fed officials have recently said that rising bond yields may allow them to stop tightening monetary policy. However, the Bank of England (BOE) may also have to reconsider its hawkish approach following the latest Gross Domestic Production (GDP) report, which showed a continuing decline in manufacturing in industrial production.

GBP/USD declined during the early European trading session after data showed that U.K. economic output expanded by only 0.2% in August. Fundamentally, the country continues to experience economic challenges, which put downward pressure on GBP. The International Monetary Fund (IMF) forecasts the U.K. will have the slowest economic growth in 2024 among G7 countries. Today, the key event for GBP/USD traders is the U.S. Consumer Price Index (CPI) report at 12:30 p.m. UTC. Higher-than-expected figures will almost certainly strengthen the bearish trend in GBP/USD. However, lower-than-expected numbers may push the pair above 1.23500.