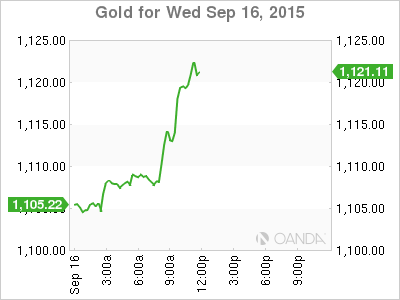

Gold prices are solidly higher and near the daily high in late-morning trading Wednesday. Short covering in the futures market and bargain hunting in the cash market are featured. Position evening ahead of the FOMC meeting’s conclusion Thursday afternoon is also seen in gold today. Buy stop orders were triggered in the futures market when December gold prices pushed above near-term technical resistance levels on the daily chart. A weakening U.S. dollar index and higher crude oil prices today are also bullish “outside market” forces helping to push gold prices higher. December gold was last up $15.60 an ounce at $1,118.10.