Gold price rallied this week, and this got many heads turning. Rightfully so?

Let’s check the details and see what really happened.

Having said that, let’s take a look at gold’s rally.

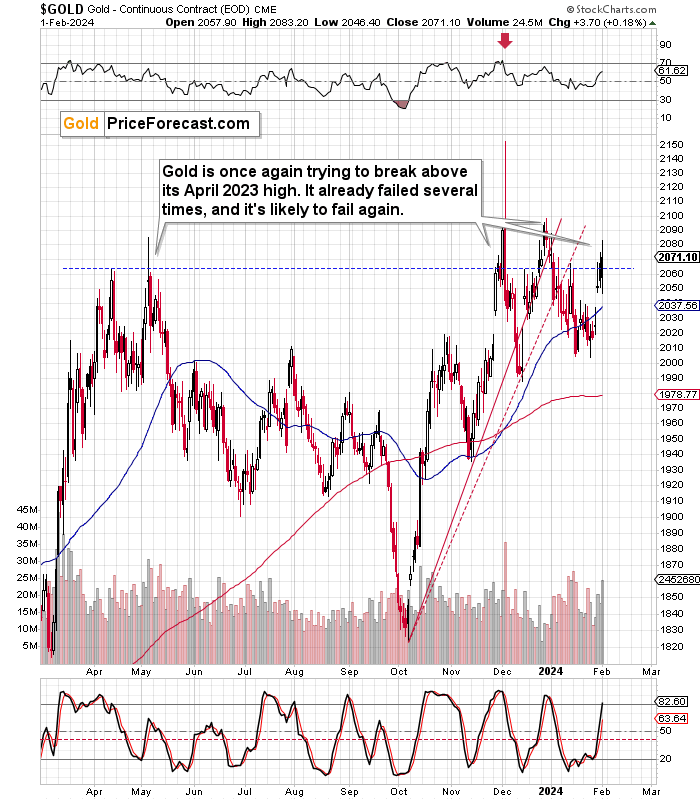

Gold moved above its April 2023 high. Again.

Historical Patterns: A Look Back

This is the fourth time that it happened if we don’t count the tiny early-January attempts.

All those moves have been invalidated, and the gold price fell in the aftermath.

Why would this time be any different? Is the USD Index moving much lower here? No, that seems particularly unlikely.

So, yes, the current attempt to move higher is likely to be invalidated as well, but the above chart is not the only reason for it.

Enter the sentiment context.

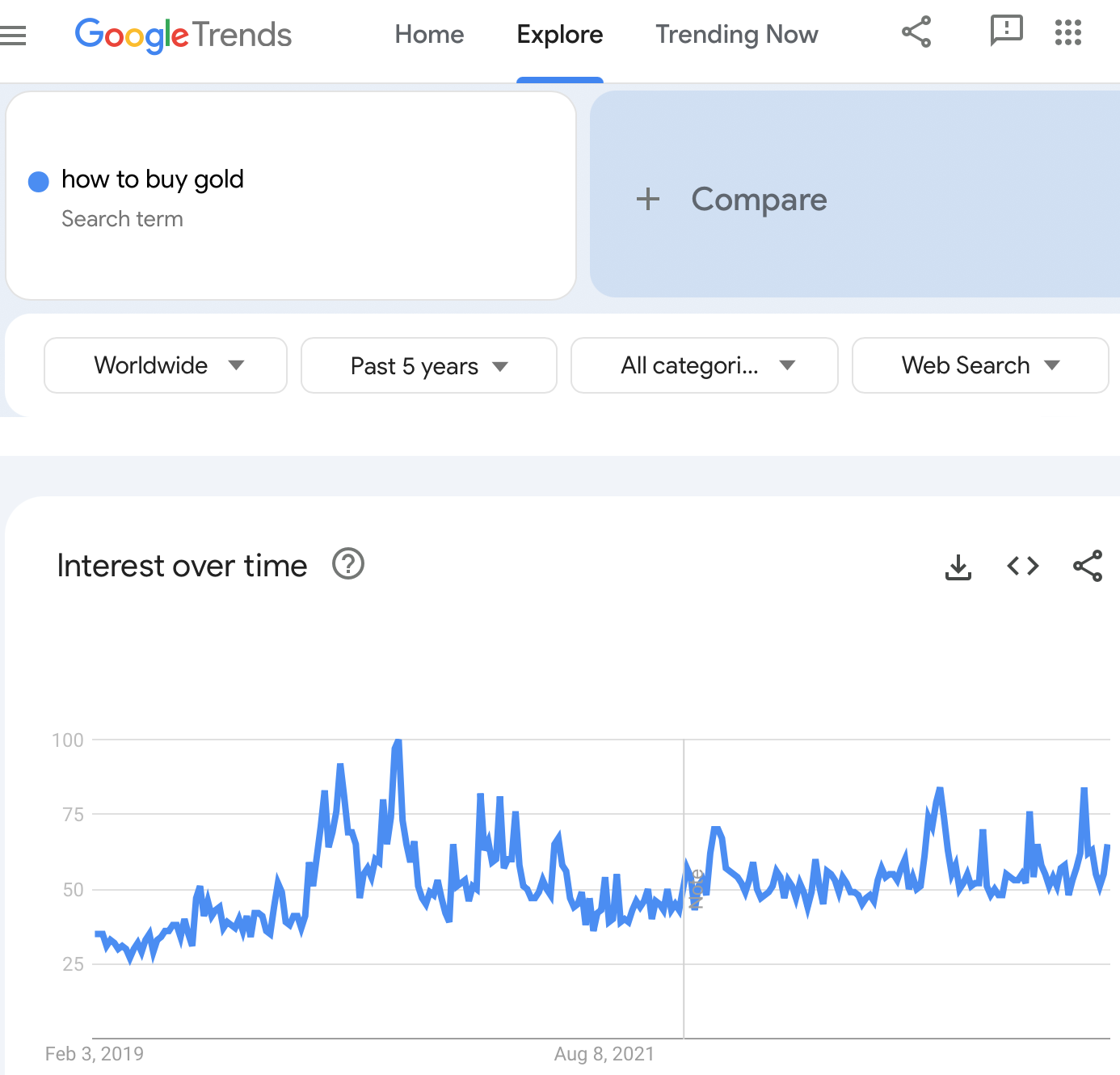

As you can see on the above Google (NASDAQ:GOOGL) Trends screenshot, the searches for “how to buy gold” soared in the recent weeks, and it’s not the first time that it happened.

Makes one wonder. What happened to gold price in those other cases?

After all, whatever circumstances triggered this jump in the interest in the topic, they are taking place all over again. I don’t mean the state the world is in – I mean the sentiment among gold investors. By estimating the latter, we can also estimate what’s likely to happen to the price, because. The history tends to rhyme, and people’s emotional reactions to what the market is doing remain more or less the same, regardless of the details of the fundamental situation.

So, what happened to gold price on those occasions?

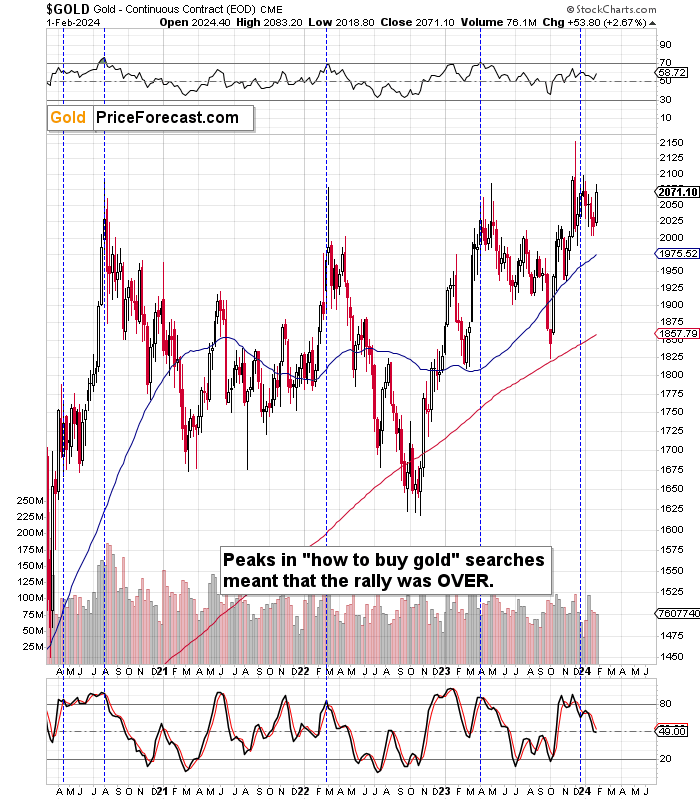

I marked the peaks in interest in the “how to buy gold” phrase with blue, dashed lines and in three out of four cases those were the MAJOR tops. Ones that were followed by hundreds-of-dollar declines in the price of gold.

The only remaining case was when it was still the end of a short-term rally and the start of a pause (that took gold about $100 lower, anyway). This time was truly exceptional, though, because it was right after the covid-scare bottom – it was not a regular course of action.

So, I’d say that in all “regular” cases, the huge increase in interest in buying gold translated into huge declines in the following months. After all, people tend to buy at the tops – that’s exactly what this sentiment analysis proves.

The IMMEDIATE aftermath, though, was not necessarily bearish. It was the case in mid-2020 and in 2022, but in early 2023, we saw an initial decline and then another move up, during which gold tested its sentiment-peak price top. And THAT was the final top. It took several weeks between the initial and final top.

What we see now is just like what we saw in early 2023. Gold dipped after the peak in sentiment, and then it moved up once again. Mining stocks underperformed back then by not moving to new high while gold did, and miners are underperforming once again as well.

With this context, it’s clearer that gold’s attempt to move above its April 2023 high is going to be unsuccessful.

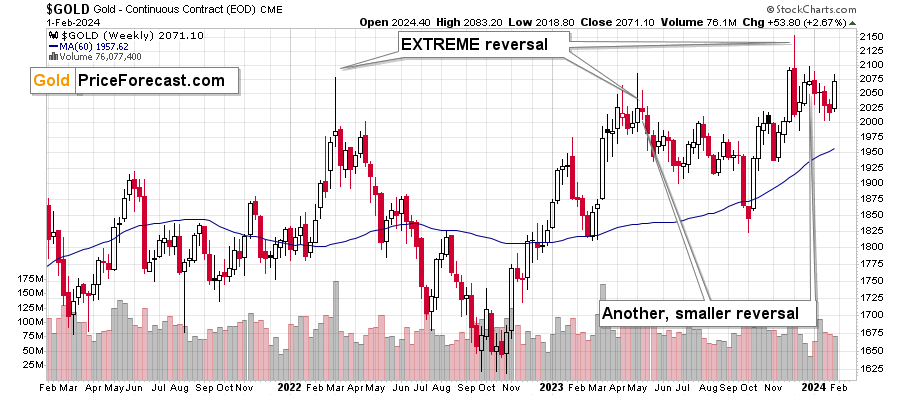

And, Do you remember about gold’s powerful weekly reversals?

I wrote about them yesterday in my gold price forecast for February 2024, but it won’t hurt to write about them again, as the implications are so important.

A Powerful Signal

In short, weekly reversals are very powerful events. Seeing them after a rally implies a reversal and the start of a big downswing. The decline might not be apparent at first, as the price might move back and forth, but eventually, it slides. We saw that kind of performance in early 2022. Gold price topped, then it moved back and forth, and then it declined – hundreds of dollars.

We saw the same thing recently. So, will gold really be able to stay above its April 2023 high? I doubt it.

This excessive move higher – and its likely invalidation – create a great trading opportunity and given where stocks and the USD Index are (and how weak miners are), those might be the final days to take advantage of it.

As always, I will keep my subscribers – informed.