The situation in the Middle East is getting worse, and we’re likely moments away from a full-blown military operation. What’s gold likely to do?

In short, gold is likely to rally, but that is not the full or most useful reply.

Before getting to the analysis itself, I want to provide a bit of background on the markets in general and how it translates into the current situation. “Market buys the rumor and sells the fact.” is one of the Wall Street sayings.

This is the case, as the markets are forward-looking, and they keep discounting various versions of the future. As something becomes near-certain (and it’s generally known), it’s already discounted in the price.

Let’s keep in mind that people tend to get too emotional about things – this mechanism also applies to the markets. So, as people keep discounting the possible fact or event, they also exaggerate in their expectations. In consequence, the price might move too far relative to where it should move.

And then, when the fact arrives, or the event finally does materialize, the market gets more realistic, and the price moves back to where it “should” be. It’s then moving in the opposite direction to what “makes sense” based on the event itself.

For example, when the SLV ETF was launched many years ago, everyone and their brother were forecasting that the silver price would shoot to the moon due to the increased investment demand. It made sense. The silver price kept rallying before the ETF was launched. And you know what it did after the launch? Silver price topped shortly, and then it collapsed.

Why am I mentioning this today? Because the key driver behind gold’s recent decline is the fear and expectations of war in the Middle East.

At this point, it seems very likely that Israel will launch a military operation shortly. When this became very likely on Friday – after the warning from Israel – gold price truly soared.

Now, given what I wrote above about how prices, expectations, and events work, and knowing what happened to the silver prices after the key event materialized, what’s likely to happen to the prices of gold after the military operation starts?

The forecast for gold price is actually bearish. To be clear, gold is not that likely to decline right away, but it is likely to decline soon.

It’s usually very difficult to convince people about the above mechanism as it seems anti-intuitive, so let’s check what happened when we saw a previous war outbreak – and one on a much bigger scale.

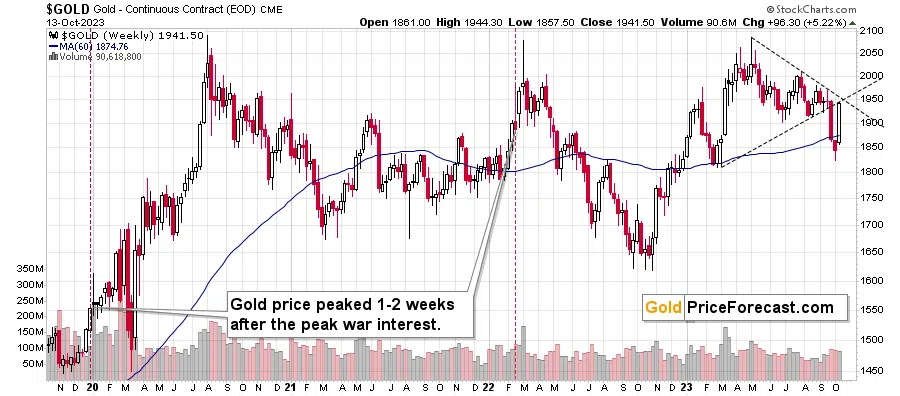

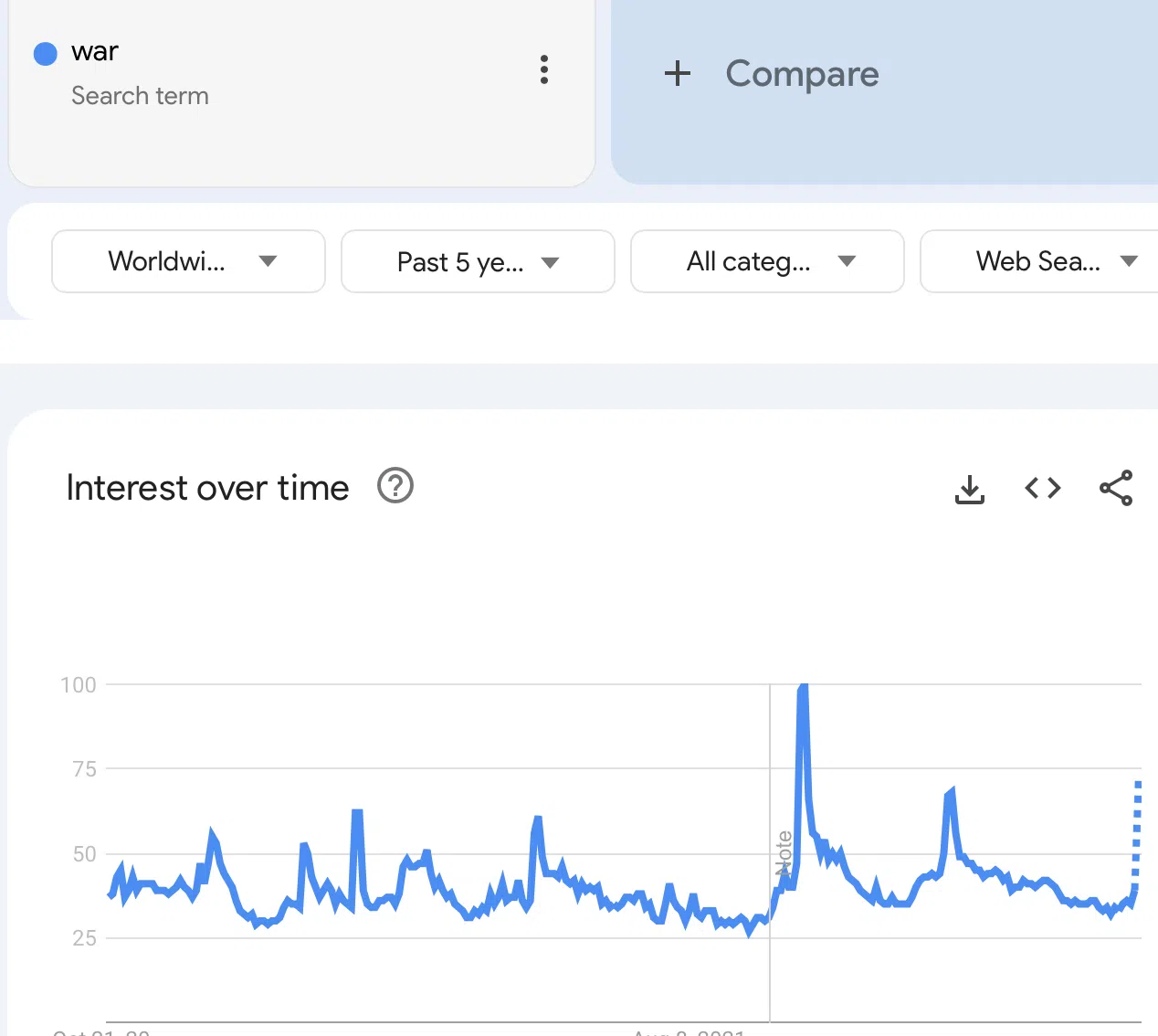

The Russian invasion of Ukraine was launched in late February 2022, and I marked that with a red dashed line. That was also when interest in “war” peaked – when there were many searches for “war” on Google (NASDAQ:GOOGL). Back then, gold topped in less than 2 weeks.

However, please note that the situation with Russia and Ukraine was vague – much more so than what we currently have in the Middle East, so the entire move from expectation or news to fact could be faster.

The area of conflict is much smaller in this case, but it doesn’t make it any less tragic, and it doesn’t make the fear and concern any smaller. The data confirms it as well.

This chart (the below charts are courtesy of Google Trends) shows that the number of searches about “war” is soaring right now.

It happened a few times in the past, and the biggest peak was in February 2022.

The analogy gets more interesting when we focus on the U.S. searches, and we focus on news only.

In this case, it’s obvious that the current situation is similar to just two times from the recent history – to February 2022 and to late December 2019.

I marked both cases on the first chart – featuring gold prices. What happened in both cases? Gold kept rallying for several days but for not longer than 2 weeks, and then it topped.

Then, in early 2020, gold price continued its upward trend (but after declining in the short term, and in 2022, gold price started a multi-month decline.

What’s likely to happen now? The fear/concern/expectations are already enormous, and the gold price is already after a rally. Did it top already? Most likely not (and it’s good that we took profits from our previous short positions in miners before gold truly shot up), as the momentum was extremely strong. However, it seems that we’re not far from the top.

The previous trend in gold was to the downside, which means that after the short-term top, the gold price is likely to decline once again – and the same is likely for silver and mining stocks.

How soon can the reversal take place? Probably several days or no longer than 2 weeks after the actual attack. Both could happen as early as this week.

The above is confirmed by the place where the two resistance lines cross (on the gold price chart). The vertexes of triangles created by such resistance lines tend to mark the times when the price reverses. The most recent move was to the upside, so it’s quite likely that the next several will happen either this week or the next week. What this technique doesn’t say is how high gold can rally before it reverses, and that’s a different question.

Given the very emotional nature of the recent price moves, it’s currently unclear how high gold can rally before it tops. Seeing gold top at about $1,960 would not be surprising, though.