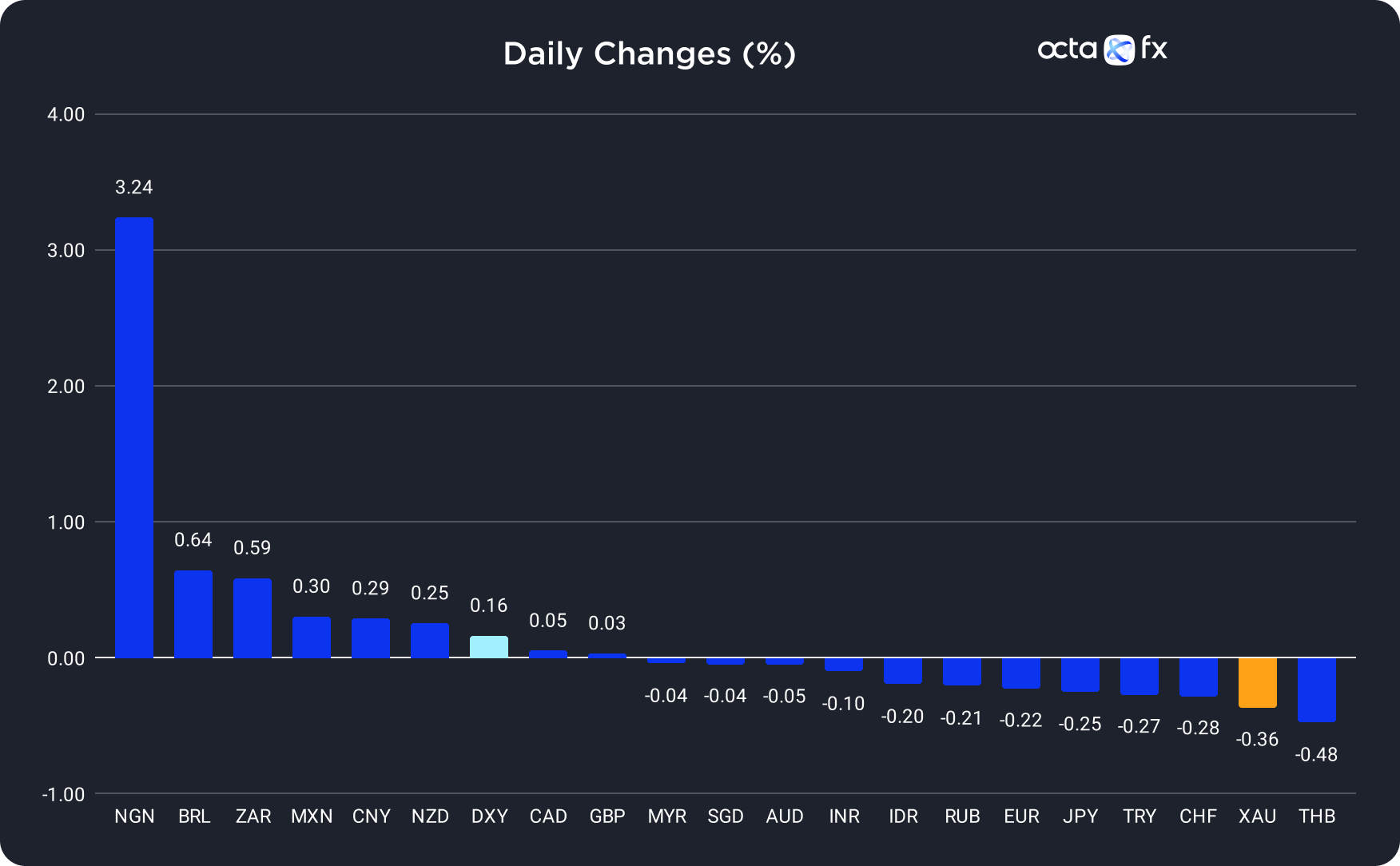

On Wednesday, the Nigerian naira (NGN) was the best-performing currency among the 20 global currencies we track, while the Thai baht (THB) showed the weakest results. The New Zealand dollar (NZD) was the leader among majors, while the Swiss franc (CHF) underperformed.

Gold Dropped After the U.S. Inflation Figures Came Out Higher Than Expected

The gold price declined by 0.36% on Wednesday as the US dollar rose after higher-than-expected U.S. inflation data.

The U.S. Labour Department data showed that headline and core Consumer Price Index (CPI) in August rose by 0.6% and 0.3%. However, the market expected inflation to increase by 0.6% and 0.2%. Although the headline figures aligned with the forecast, core inflation was higher than anticipated, increasing the chances that the Federal Reserve (Fed) might continue lifting rates. According to the CME FedWatch Tool, the probability of another 25-basis-point rate hike in November or December is now above 40%. As for next week's Fed monetary policy meeting, the market believes the regulator will keep the base rate unchanged. U.S. interest rate expectations are affecting the gold price greatly. 'Precious metal investors are less worried about higher inflation and more focused on the opportunity costs associated with holding a non-interest-bearing asset in a rising rate environment,' said Chris Gaffney, the president of EverBank World Markets.

XAU/USD continued to decline slowly during the Asian session. Today's macroeconomic calendar is full of events, so traders should be cautious. Firstly, the European Central Bank (ECB) will announce its interest rate decision at 12:15 p.m. UTC. Any signs that the ECB sticks with a hawkish stance will likely add extra bearish pressure on precious metals. Secondly, the U.S. will release several important economic reports at 12:30 p.m. UTC. Investors would monitor the Producer Price Index (PPI), Retail Sales, and Jobless Claims data. Any indication that the U.S. economy remains resilient and price pressure isn't easing will increase the probability of another rate hike from the Fed and put downward pressure on XAU/USD.

The ECB Will Announce Its Interest Rate Decision Today

On Wednesday, the euro lost 0.22% as the U.S. dollar rallied after the higher-than-expected U.S. Consumer Price Index (CPI) numbers.

The U.S. CPI report didn't disrupt market expectation of a pause in the rate-hiking cycle at the Federal Reserve's (Fed) policy meeting next week. However, the inflation report increased the probability of a rate hike in November and December. Another report showing the pace of inflation—Producer Price Index (PPI)—will be released today at 12:30 p.m. UTC. If the PPI figures come out higher than expected, EUR/USD will likely continue falling.

However, the main event for the euro is today's interest rate decision by the European Central Bank (ECB) at 12:15 p.m. UTC. The decision will certainly cause a lot of volatility. According to Reuters, the market is pricing in a 65% chance of a 25-basis-point (bps) rate hike. Indeed, several ECB officials recently said the base rate will have to stay elevated for longer to tame sticky inflation. Therefore, if the ECB doesn't lift the rates and gives hawkish forward guidance, the net impact on EUR/USD will be very bearish. 'The ECB may prefer one last hike to boost credibility and keep the market guessing about more to come rather than allow the rally in real yields to gain momentum,' wrote Citi analysts in a note.