Gold is showing little movement on Monday, trading at a spot price of $1206.20 an ounce in the North American session. Earlier in the day, gold touched below the symbolic $1200 level. In the US, markets are closed for Memorial Day, so there are no US releases. Due to the holiday, we can expect light trade on Monday. On Tuesday, the US releases CB Consumer Confidence.

On Friday, the US released Preliminary GDP for the first quarter. The key indicator, which can be viewed as an economic report card, posted a gain of 0.8%, matching the forecast. This was an improvement above Advanced GDP, which came in at 0.5%. Still, the economy slowed down considerably compared to the fourth quarter of 2015. The export sector has been hurt by the strong US dollar and weak global demand. Oil prices remain low, which has taken a sharp toll on the oil industry. Elsewhere, the UoM Consumer Sentiment report improved in April, climbing to 94.7 points. This marked the indicator’s highest level in 11 months, although it was short of the estimate of 95.7 points.

Gold prices continue to fall, as speculation grows that the Federal Reserve may soon raise rates for the first time this year. The metal has slipped 6.9% in May, as the US dollar has gained ground on renewed market sentiment that the Fed may press the rate trigger this summer. The Fed minutes and recent hawkish statements from Fed policymakers have raised the odds of a rate hike in June. Still, the Fed will be hard-pressed to raise rates if key indicators don’t show improvement, particularly inflation numbers. Last week, FOMC member John Williams reiterated that he expected the Fed to raise rates two or three times in 2016. However, there appears to be a gap between the hawkish message some FOMC members are sending out and market sentiment, as many analysts are projecting only one rate hike this year. The guessing game as to what the Fed has in mind is likely to continue into June, but it’s safe to say that another rate move will be data-dependent, so stronger US numbers will increase the likelihood of a quarter-point hike at the June policy meeting.

XAU/USD Fundamentals

Monday (May 30)

- There are no US releases on the schedule

Tuesday (May 31)

- 10:00 US CB Consumer Confidence. Estimate 96.1

*Key releases are highlighted in bold

*All release times are EDT

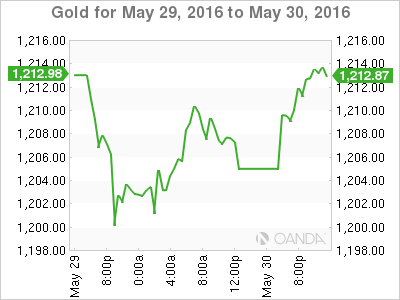

XAU/USD for Monday, May 30, 2016

XAU/USD May 30 at 13:00 EDT

Open: 1207.59 Low: 1199.37 High: 1210.94 Close: 1206.20

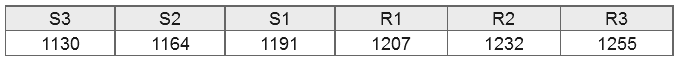

XAU/USD Technical

- XAU/USD has shown limited movement in the Monday session

- 1207 was tested in support earlier and remains fluid

- 1191 is providing support

- Current range: 1191 to 1207

Further levels in both directions:

- Below: 1191, 1164 and 1130

- Above: 1207, 1232, 1255 and 1279

OANDA’s Open Positions Ratio

XAU/USD ratio is showing long positions with a strong majority (67%), indicative of trader bias towards XAU/USD breaking out and moving to higher levels.