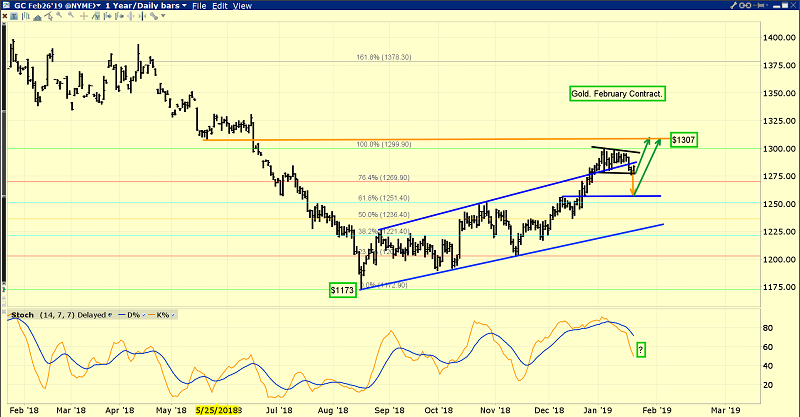

Is the price correction in gold already over?

I told investors to prepare for a modest and healthy correction from the $1300 area, and that’s happened.

Gold hasn’t even reached the first Fibonacci retracement line after staging a magnificent rally from the $1173 area. That’s a sign of immense technical strength.

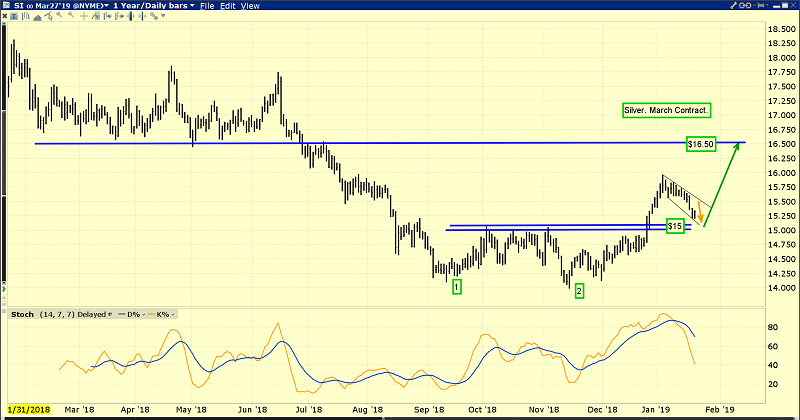

Silver has carved out a beautiful double bottom pattern. It’s now staging a textbook pullback to the neckline of that pattern.

Whether the precious metals market correction is over or has a bit further to go is not important. What matters is the fundamental picture. That picture is healthy, and it’s about to get exponentially healthier.

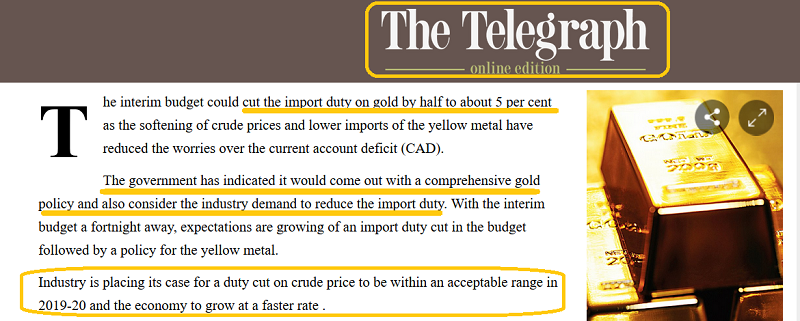

The odds of an import tax cut in the world’s most important gold market are higher now than at any point since the taxes were ramped up in 2012-2013.

“You need the Indians to buy oil or gold." - Jeff Currie, Global Head of Commodities Research, Goldman Sachs (NYSE:GS), Jan 16, 2019. Jeff says, “Buy commodities.”

While senior citizens in the Western gold community may long for what is essentially a remake of the 1970s fear trade-oriented gold market, today’s gold market is mainly about the rise of gold as a respected asset class. That’s being created by the ongoing rise of China and India as economic titans.

Today’s Western fear trade for gold is more like icing on that cake than the centre stage price driver that it was in the 1970s.

In a nutshell, a “goldaholic army” of three billion Chindian citizens is becoming wealthier at a very fast pace. That’s creating annual gold demand growth of 6%-8% that is essentially relentless. Mine supply can’t seem to grow more than 2%.

It’s becoming a “no-brainer” that the gold price will rise consistently for decades to come, and probably for the next two centuries.

The current price correction in gold is likely almost entirely due to the actions of Indian dealers operating on both China’s SGE and in Mumbai. They are in “quiet mode” ahead of the February budget that is expected to bring a significant cut in the import tax.

In their eyes, there’s simply no point buying gold now when they can likely get it 5% cheaper in just a few weeks. Also, a duty cut would create a positive vibe amongst Indian citizens similar to the vibe created by Donald Trump’s MAGA program.

The “minor” difference, of course, is that India is a gold-oriented emerging empire with the best citizen demographics and the strongest GDP growth in the world. The bottom line: The current price correction in gold is probably the healthiest and most stable since the price corrections of 2003-2004.

While today’s gold cake is Chindian, the icing is pretty tasty too. Only 37% of America’s business leaders are optimistic. Top bank economists almost universally predict US corporate earnings growth will fade from the 20%+ level to single digits and GDP will slide towards 1% by year-end.

US politicians promise citizens and corporations that enormous tariff taxes will “Make ‘Em Great”. This, while US blue collar workers are struggling with wages that are still below 1968 levels in real terms. These workers don’t need walls around an entitlements-themed ecosystem. They need serious tax cuts (all the way to zero) and they are just not happening.

A single corporate tax cut to only the 20% level is not enough to make America great again, especially when there’s no corresponding chop in the size of government. Income tax, property tax, and capital gains tax need to be eliminated and replaced with a goods/service and financial transaction tax. That would reduce the size of the government dramatically and bring trillions of investment dollars roaring into the country.

America could easily become a super-sized version of Switzerland, but in the eyes of its biggest hedge fund manager Ray Dalio, the country is instead staging an almost macabre debt-obsessed dance that ends with Inflationary depression!

America’s terrible population demographics and entitlements-oriented society are a giant drag on long term GDP growth. Business leaders know they can’t supply the government and the entitlements-obsessed citizens with anywhere near the amount of capital required to maintain this bizarre system.

That’s spurring US institutional interest in gold, and it’s happening as India’s government is about to follow China’s lead and endorse gold as a respected asset class.

Gold is becoming an asset class like stocks and real estate that is not owned as a market “hedge” but for long term capital appreciation.

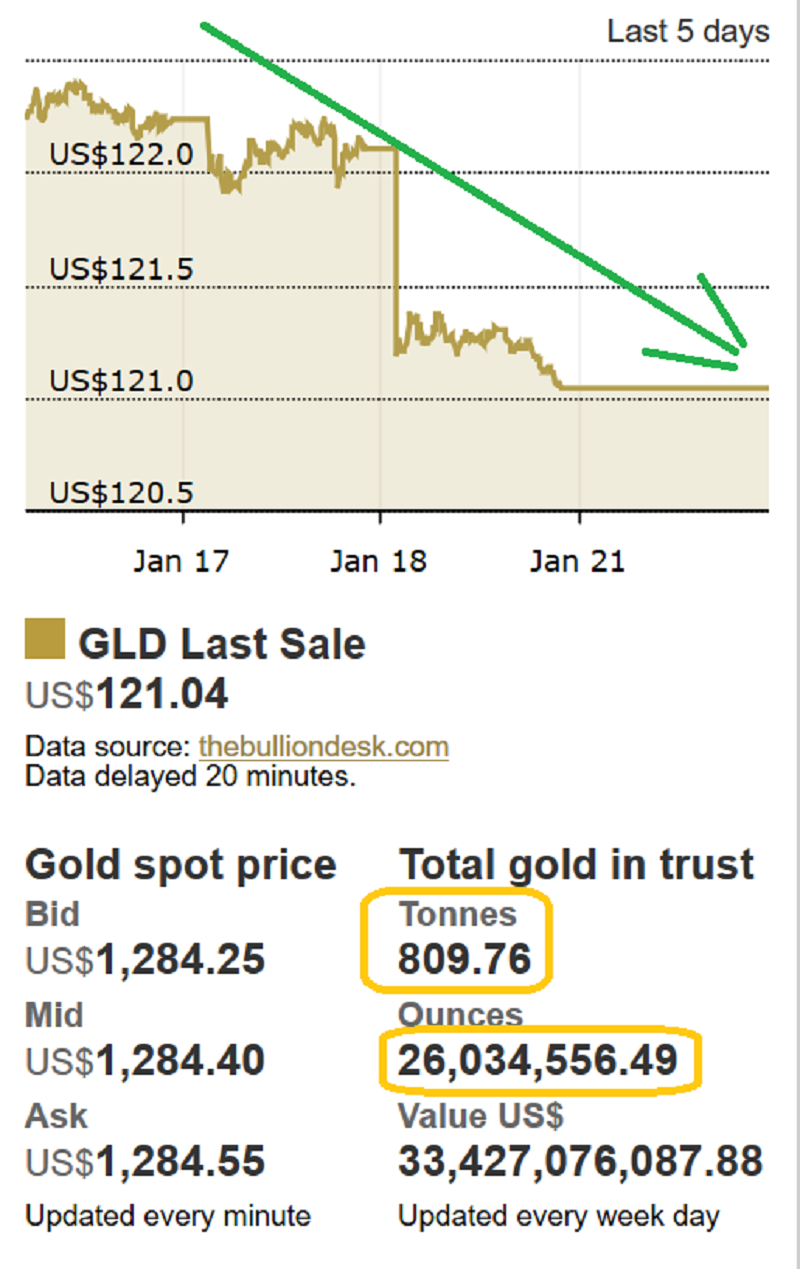

Western institutional money has flowed into the key SPDR gold bullion ETF as the price has softly corrected from the $1300. That’s another sign of a very healthy market.

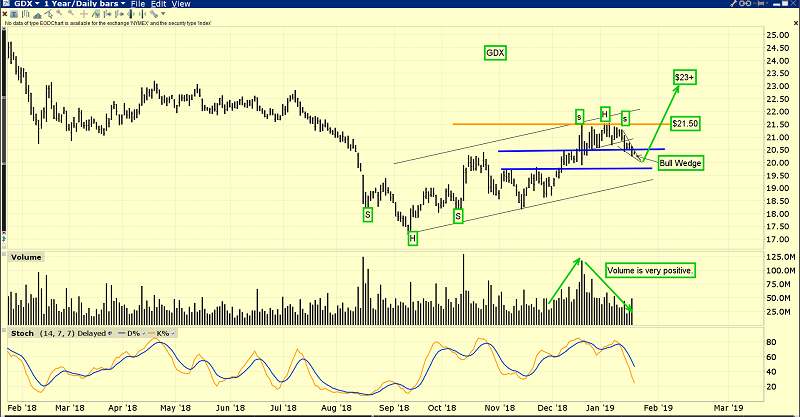

As with gold, the correction in most gold stocks could be over! Note the bull wedge in play and the soft volume on the recent price decline. Now there’s a spike in volume and that could mark the end of price softness. A sell-off in the US stock market seems imminent, and I told gold stock enthusiasts in August to expect solid action from GDX (NYSE:GDX) in a stock market meltdown. That’s exactly what transpired… and the same thing is likely about to happen again!

Risks, Disclaimers, Legal:

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?