The price of gold is up massively this week on a combination of fundamental factors. On one hand, the Fed is now widely expected not to hike interest rates anymore. This is good for non-yielding assets and commodities. In addition to this, the war that broke out between Israel and Hamas sent investors to seek shelter in the oldest safe-haven known to man. All told, gold has gained nearly 5% so far this week.

You can read more or less the same paragraph as the one above in every market-related media or website. What you can find only in a good Elliott Wave source, though, is that “the habit of the market is to anticipate, not to follow.” In other words, we treat news and events as nothing more than the triggers for a price move, which was supposed to happen anyway.

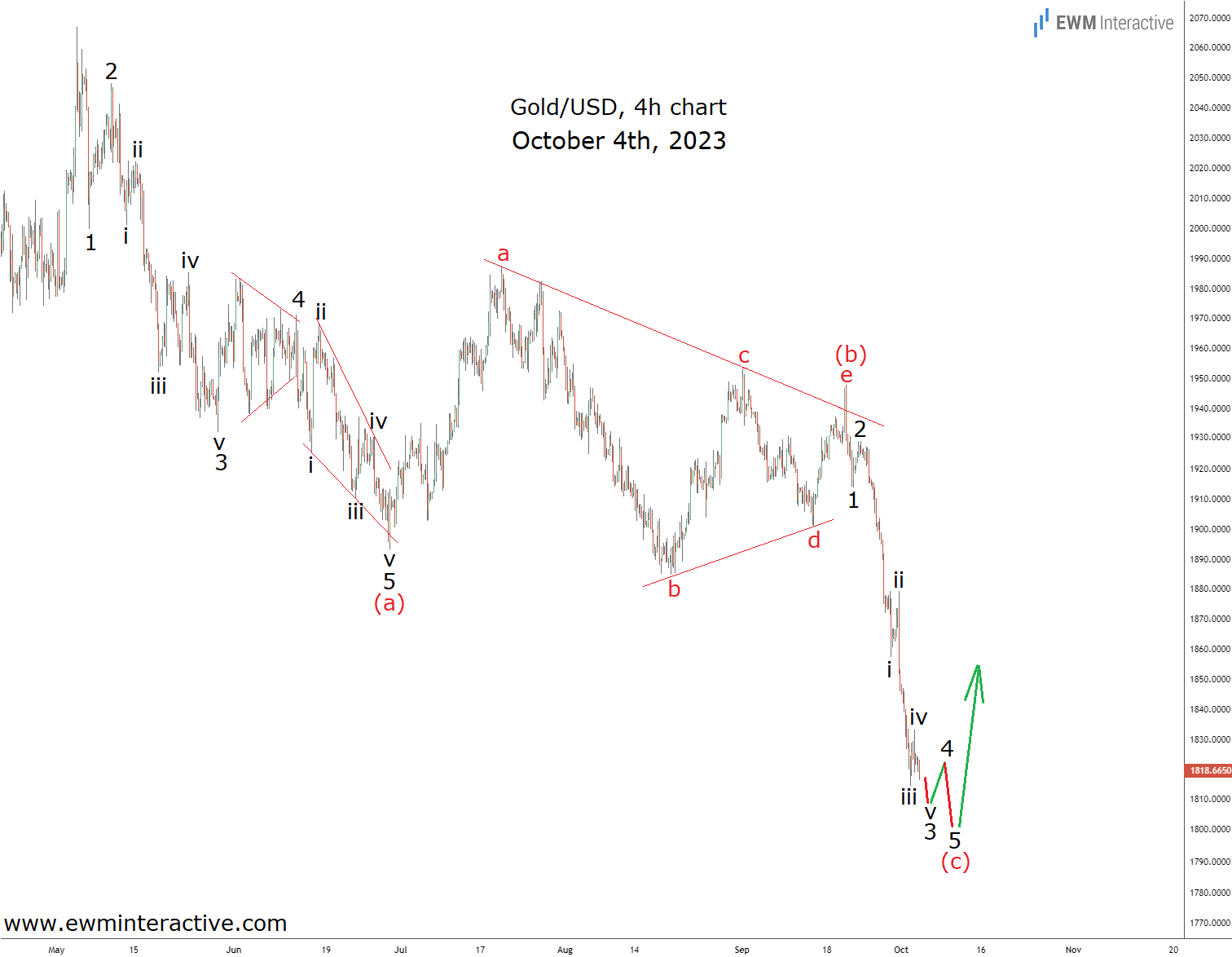

The Elliott Wave patterns recognizable on gold‘s price charts were sending a bullish message long before Hamas’ terrorist attacks. Let’s back up this bold claim with some evidence. The chart below was originally published on our website on September 25th, 2023, just before the crash from $1925 to $1810. It reveals a textbook sequence of patterns, which no experienced analyst can miss.

Gold‘s 4-hour chart revealed that the developments from the top at $2067 have produced two very distinct patterns. First, there was a clear five-wave impulse to the downside, labeled 1-2-3-4-5 in wave (a). The five sub-waves of wave 3 were also visible. Wave 4 was a triangle, followed by an ending diagonal in wave 5.

This impulse was followed by a big a-b-c-d-e triangle correction in wave (b). The Elliott Wave theory states that triangles precede the final wave of the larger sequence. For instance, there was a triangle in wave 4 of (a), which was followed by the final wave 5 of the impulse. After that, a bullish reversal occurred in wave ‘a’ of (b). The same way, a triangle wave (b) indicated that we can expect one last selloff in wave (c) to conclude the decline from $2067, before the bulls can return.

How big was wave (c) going to be was impossible to tell, but initial targets near $1850 made sense. This didn’t mean we were immediately going to start buying at that level. It only meant that gold was likely to drop by at least that much. The problem with not knowing were exactly the reversal is going to form is easily solved by simply waiting for the reversal to actually take place before initiating a position. Patience is a virtue, indeed.

So, as long as gold was trading below the top of wave ‘e’ of (b) at $1948, the bears were still in charge and aiming at $1850, if not lower. As it turned out, we weren’t bearish enough. By the time of our Wednesday update on October 4th, gold had already dropped below $1820

Wave (c) was still supposed to evolve into a five-wave impulse, although now a bigger one. Waves 1, 2 and 3 seemed to be in place already, so we didn’t think there was much left of this selloff. Instead, we thought that the bullish reversal was just around the corner.

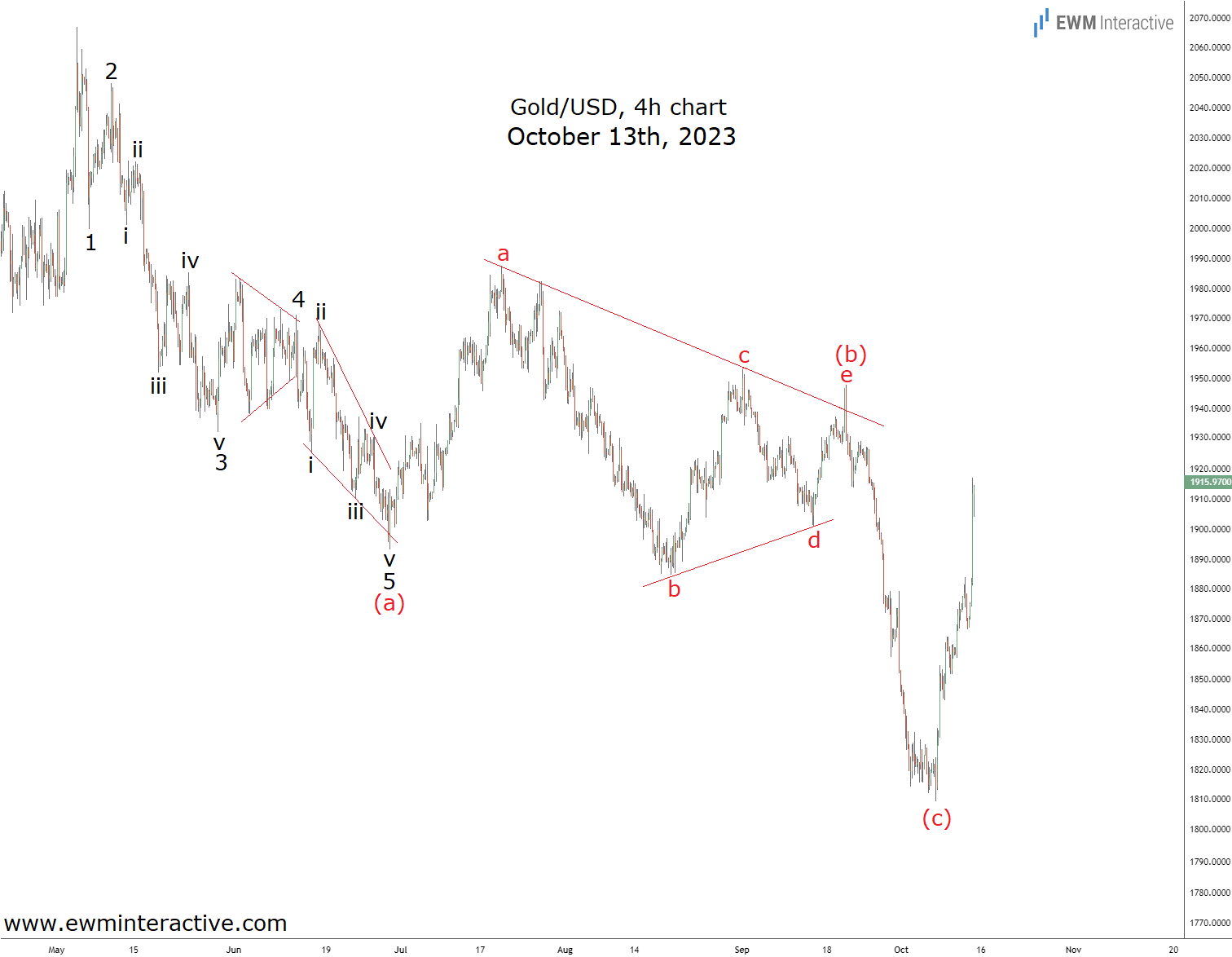

That was three days before the Hamas attacks on Israel. By the end of the trading week on Friday, October 6th, the reversal was already in place. Needless to say, when we published our EW Pro analysis of gold in the morning of October 7th, we had no idea of the grim scenes that were going to unfold in Israel later that day. Nor did we know that it would mark the beginning of the biggest military conflict in Gaza in decades.

The market, however, somehow sensed that something was going to push the price of gold significantly higher. And it had made its expectations clear through the Elliott Wave patterns it had already drawn. Prior to the start of trading on Monday, October 9th, the price of gold had already bottomed in the week before.

Gold had bounced up from $1810 on Friday, October 6th, to close the week at $1832. This was a big enough recovery for us to conclude that wave (c) was already over. The entire (a)-(b)-(c) zigzag correction from the top at $2067 was now complete and it was time for the bulls to show up again. And show up they did in spectacular fashion. Albeit for all the wrong reasons.

Given the circumstances of the new week, the bears never stood a chance. The price shot up immediately after the markets opened on October 9th and it never looked back. As of this writing, the bulls have recouped almost all of the losses they suffered in wave (c).

When Ralph Nelson Elliott discovered the Wave principle in the 1930s, he explained that the market doesn’t wait for the news to arrive in order to decide what to do. Instead, it somehow anticipates it and sets up the stage accordingly. In the case of a specific stock, it can brace for a good or bad earnings report. When it comes to a currency pair, it often senses a weak GDP report or strong inflation data. Unfortunately, sometimes it can sense a human tragedy ahead. Not that it actually understands any of it. It only knows that something is coming. This is exactly what just happened with gold.

Or did it? We think that Elliott Wave patterns will always form. The human tragedies, however, don’t need to happen. The future is not carved into stone and the responsibility to prevent them is entirely ours as a species. At a time when we’re constantly pushed to pick sides, we’d like to remind you that there are people on both sides of the Israel-Gaza conflict. Regardless of which god do you pray to, religious extremism should’ve stayed in The Dark Ages