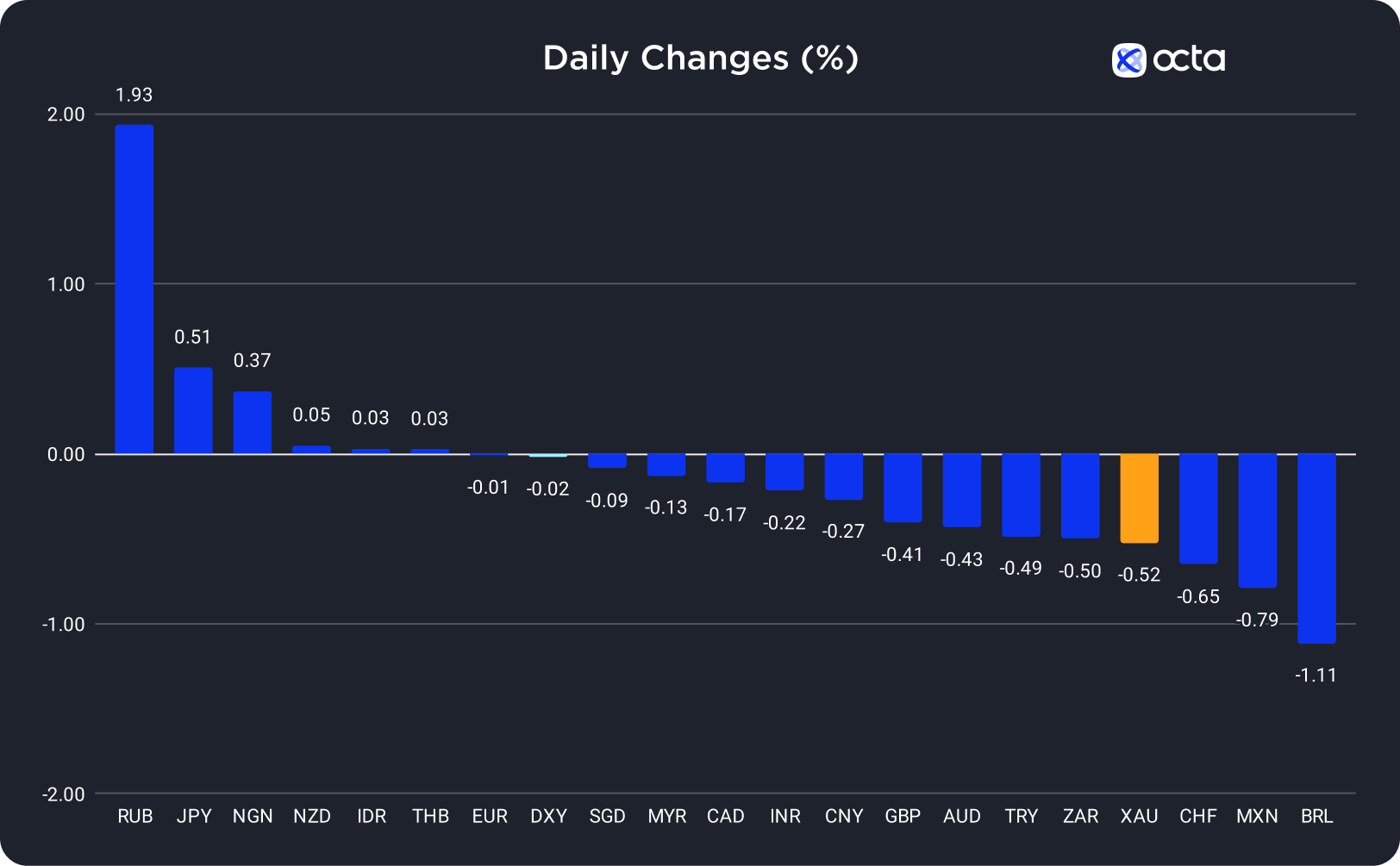

On Thursday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Brazilian (BRL) showed the weakest results. The Japanese yen (JPY) was the leader among majors, while the Swiss franc (CHF) underperformed.

Gold Decreased Sharply After Better-Than-Expected U.S. Jobless Claims Report

Gold declined for the third consecutive day on Thursday as the U.S. Treasury yields set a new multi-year high after the Federal Reserve (Fed) said more rate hikes are possible this year.

On Thursday, XAU/USD decreased sharply to 1,920 as better-than-expected U.S. Initial Jobless Claims data highlighted the ongoing tight labor market, increasing the probability of a rate hike in November. Long-term sentiment remains bullish in gold, and investors maintain their long positions as the U.S. economy continues to slow down. However, following the recent hawkish statement from Fed Chair Jerome Powell, rising US Dollar Index (DXY) and Treasury yields keep gold prices under bearish pressure in the short term.

XAU/USD was rising during the Asian session but remained below the important 1,930 level. Two conflicting factors are currently driving the gold price. Investors prefer to buy gold to hedge against economic uncertainty, but higher interest rates put downward pressure on non-yielding metals. Today, traders should focus on the release of the U.S. Purchasing Managers' Index (PMI) at 1:45 p.m. UTC. Lower-than-expected figures will positively impact XAU/USD—potentially pushing the price above 1,930. However, the bearish trend in XAU/USD may continue if numbers are higher than anticipated. 'Spot gold may retest support of 1,913 USD per ounce, as suggested by a wedge and a retracement analysis,' said Reuters analyst Wang Tao.

The BOJ Decided to Keep the Base Rate Unchanged

The Japanese yen (JPY) increased sharply on Thursday, anticipating the Bank of Japan's (BOJ) changing its ultra-loose monetary policy by altering the yield control curve. However, USD/JPY reversed during the Asian session after BOJ Governor Kazuo Ueda said the central bank didn't hurry to launch its massive stimulus program.

The BOJ didn't change its ultra-loose monetary policy and kept the short-term interest rate target of −0.1% and around 0% for the 10-year bond yield. The regulator also said it will continue supporting the economy until inflation constantly stays above 2%. BOJ Governor Kazuo Ueda commented that by the year's end, the central bank will have enough data about prices to determine whether to end its negative rate policy. The market is now pricing in a minor probability of a rate hike later this year.

USD/JPY rose during the Asian session and continued increasing during the early European trading session. USD/JPY now trades near a one-year high as the Federal Reserve (Fed) maintains its hawkish stance, while the BOJ is still not ready to launch a tightening cycle. Today, traders should pay attention to the release of the U.S. Purchasing Managers' Index (PMI) at 1:45 p.m. UTC. Disappointing figures may fuel speculations that the Fed will rethink its hawkish approach to monetary policy, putting downward pressure on USD/JPY. However, if PMI figures come out better than expected, the pair may move towards 149.000.