“Mr. Gold, you have disappointed us! But, really, you dropped almost four percent in the third quarter of this year.” This is what many analysts could say. But we warned our Readers against being bullish in the current macroeconomic environment. We invite you to read our today’s article about the gold market in Q3 2018 and find out what happened – and what are the implications for the end of the year.

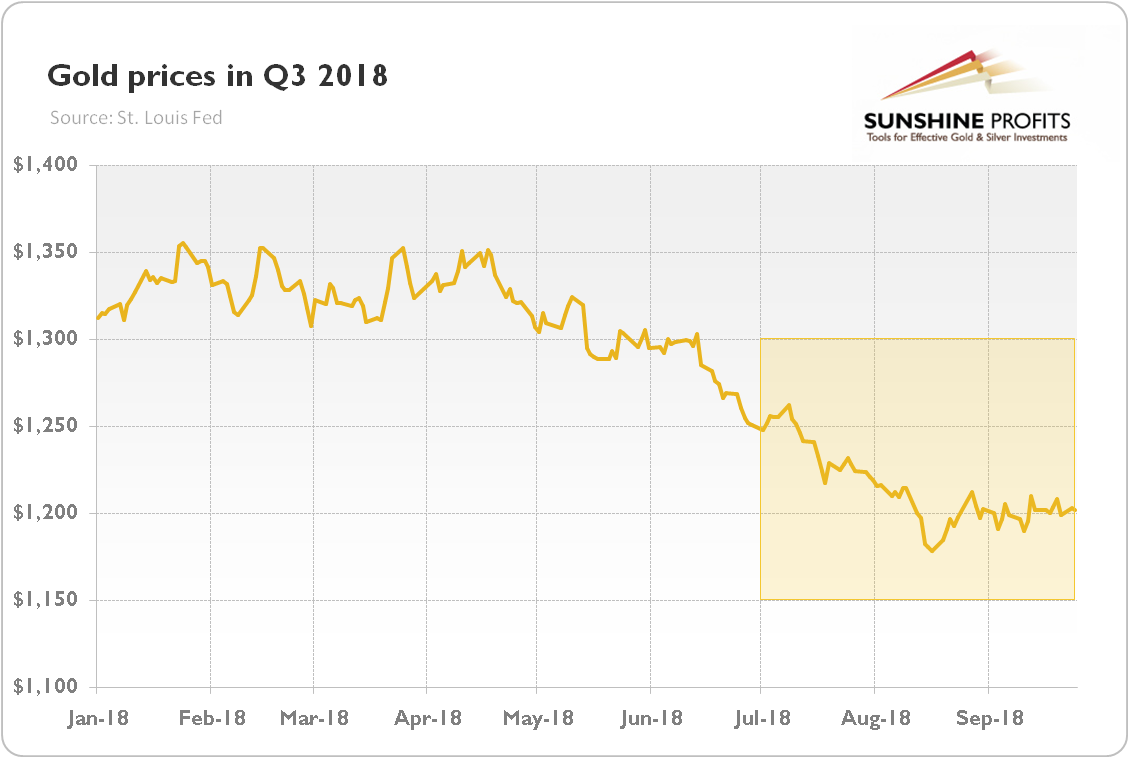

Almost four percent. Over the three months. So bad. But we have been warning our Readers for some time. For example, in the previous edition of the Market Overview, we wrote that “our conclusions remain rather bearish for the medium term”. And indeed, as one can see in the chart below, the price of gold declined about 3.8 percent in the third quarter of 2018 (until the September FOMC meeting).

Chart 1: The price of gold in U.S. dollars in Q3 2018 (London P.M. Fix, in $).

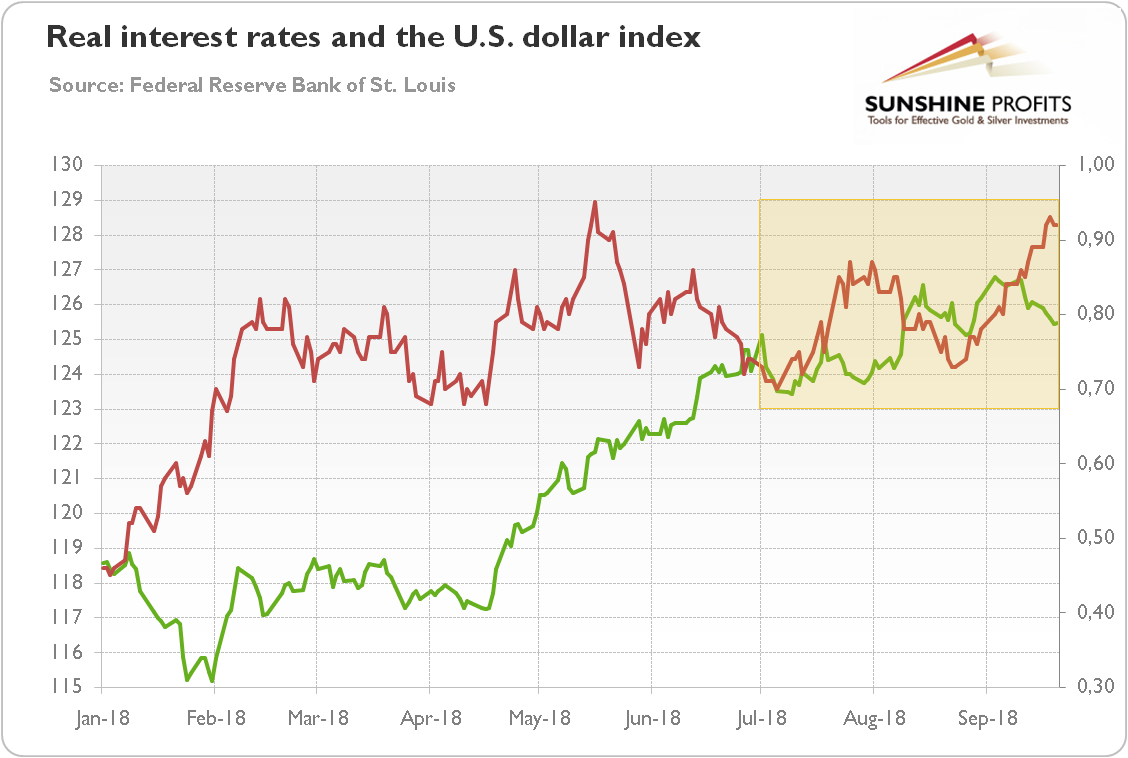

What happened? To find the answer, look at the next chart. As one can see in the chart below, the US dollar continued its upward trend. It was a headwind for gold. And the real interest rates, after pullback in May and mid-June, increased. It was a very important development, as the yellow metal has been dragged down earlier mainly by a stronger greenback. When both dollar and real interest rates act in tandem, the downward pressure on gold could only be larger.

Chart 2: The U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) and the U.S. dollar index (green line, left axis, Trade Weighted Broad U.S. Dollar Index) in Q3 2018.

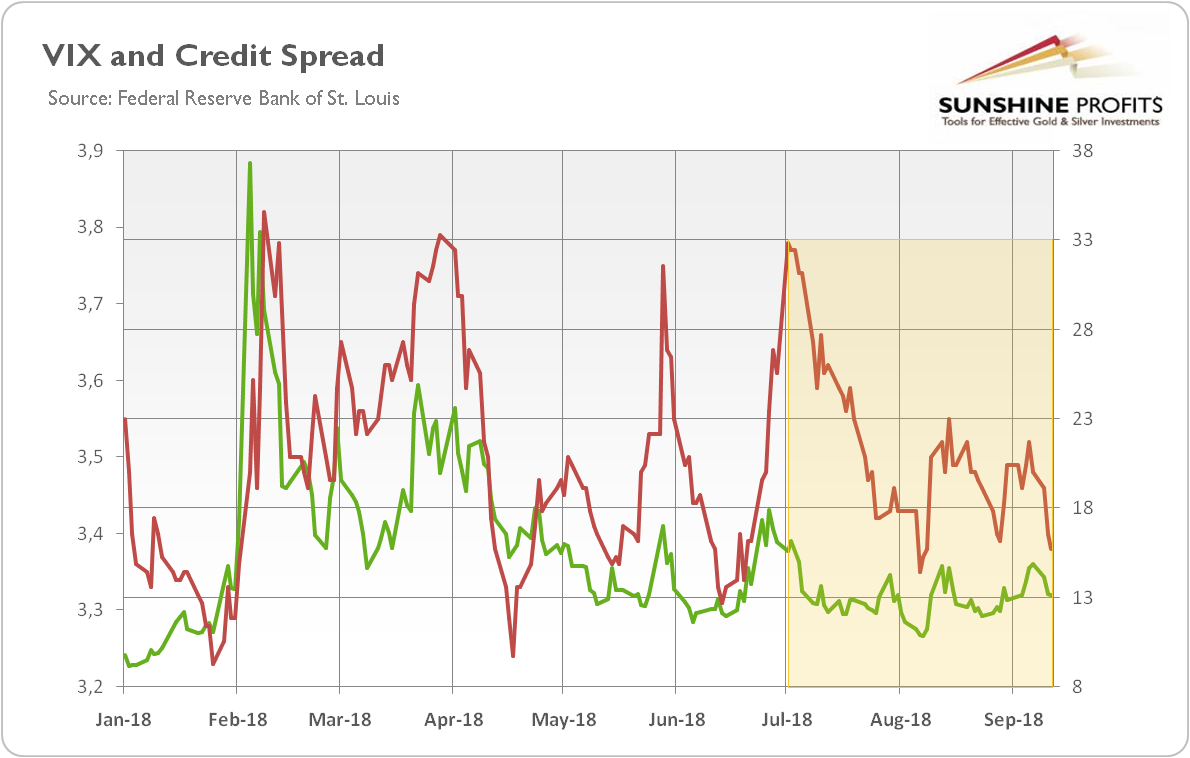

The risk premium also did not help gold. As the chart below shows, both the VIX and the credit spreads were stable or even declined in the third quarter of 2018. And what is important, the indicators of risk premium dropped despite all the hype around the trade wars.

Chart 3: The market volatility reflected by the CBOE Volatility Index (green line, right axis) and the credit spread reflected by the BofA Merrill Lynch US High Yield-Option Adjusted Spread (red line, left axis) in Q3 2018.

Great, we know now what happened last quarter. But what are the perspectives for gold in the remainder of the year? Well, we keep our negative medium-term forecast in power. The reason is that fundamental drivers of the gold prices are now in bearish territory. The risk premium is constrained, while both the US dollar and real interest rates are on the rise. The Fed is set to continue its policy of gradual tightening. And we believe that – given the current composition of the FOMC, the relative strength of the US economy and traders’ more dovish expectations that the Fed’s projections – hawkish surprises are more likely.

The potential support may, thus, only come from the US fiscal policy. It’s true that an increase in federal debt may help gold, but only when it will bring a decline in economic confidence. But this is not the current case, as the expansive fiscal policy is mainly the result of lower taxes (which rather pleased investors). And generally traders seem to like that monetary policy is no longer the only game in town. Hence, until the next crisis will not hit, when the excessive indebtedness will become a real problem, the gold bulls should not count on the fiscal policy.

Hence, the only hope is another global downturn. The tenth anniversary of Lehman Brothers’ bankruptcy favors such meditations. To some extent, we agree with Steven Saville, who wrote that “the current US economic boom is like the cartoon character that has run over the edge of a cliff, but hasn’t looked down yet”. Sooner or later, the next recession will come. There ain’t no such thing as a free lunch – and we would be very surprised if the central banks’ monetary machinations will not cause deplorable results.

But we bet that it will happen later rather than sooner. The cartoon character can continue running – after all, why to even look down if the financial conditions are still easy? But perhaps this metaphor is not very adequate .You see, the current recovery is probably the most hated expansion in the post-war history. Our character has been too cowardly not only to run over the cliff, but to run at all. How can you fall if you crawl on the ground?

The bottom line is that gold has to wait for its moment of glory. The commercial banks have lower leverage, healthier capital and better liquidity positions. So the current expansion could continue further, especially if entrepreneurs maintain higher capital spending. It does not mean that we don’t expect the next crisis at all. The global economic system is safer, but not safe enough, especially in Europe, where many banks remain weak. When the turmoil arrives, gold will reach a bottom and start to rally. But – unless the September FOMC meeting turns out to be a dovish surprise – we do not expect significant upward moves in the gold market this year. That is unless we see a powerful slide and then a rebound.