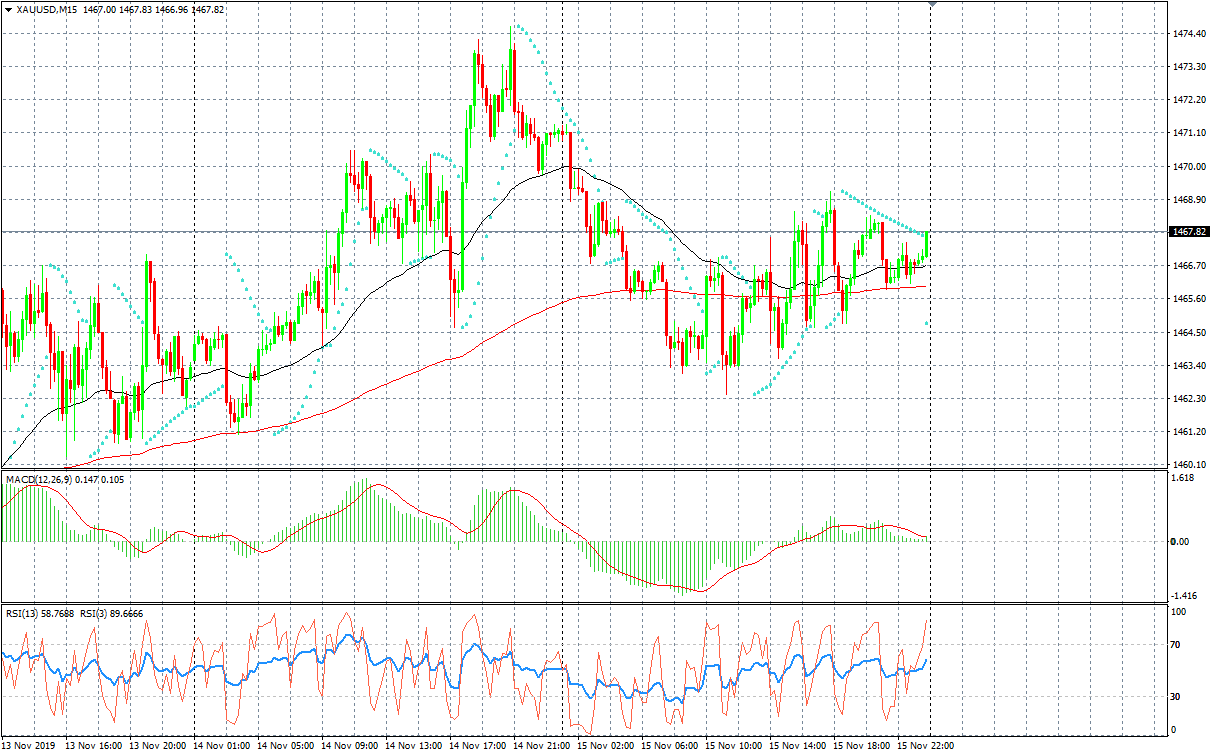

If you had told most of the current gold commentators that the yellow metal would close the week higher after a trade deal, you would have probably laughed out the door. But that's precisely what happened as gold closed 1% higher after a whippy week. For most of the week, prices were influenced to various degrees by Trump impeachment, the significant elections in the UK, Fed, and ECB policy decisions. But it was the toeing and froing of the trade war narrative that played the most prominent part in contributing to the gold $30 “round trip" week. But gold resilience in the face of adversity was impressive.

On Friday, Gold traded to a low of $1462.50/oz on the back of the headlines on the US-China trade deal. Gold is a bit of an anomalous as most had initially pegged Gold lower ($ 1450) on a tariff rollback trade deal. Still, with the tame US inflation environment keeping UST yields in check, gold did not have the blow-off bottom as a result of the trade deal.

Only if the markets believe ‘phase one' US-China trade deal would reverse the Fed into a hawkish outlook, then gold should move lower. But anything short of a significant chunk of tariffs getting rolled back, which the current deal falls short, means that this Phase 1 deal is less progress than the market had been expecting and should keep the Fed on a cautious lean.

Trade negotiations will continue, for now, escalation seems to be off the table, but the path to grand deal is still miles away. Therefore, Gold entered the weekend with a bid as the first phase leaves contentious issues unresolved, including the US demands that China curb subsidies to state-owned firms. So, expect more of the same trade talk gyrations influencing sentiment going forward that we have seen up until today.

At some level, the bulk of the near-term negative news for gold might finally be out of the way, so the market remains positioned for more disappointment on the US-China trade developments.

No one knows what the market will do in 2020, but that uncertainty alone with the S&P 500 trading near all-time highs and valuations starting to look stretched; it makes sense to begin to consider protection given the index has gained over 25% YTD.

With interest rates at historically low levels and the Fed on hold forever narrative all but capping UST yields, and if as expected, the US dollar weakness plays out in 2020, then gold should perform well. The recent history of gold seasonally doing well in January (+5.22% for 5yr trailing average) bolsters the case for a possible test of $ 1500 over the turn into 2020.

Major trade issues between the US and China remain unresolved. With impeachment risks elevated and with the Iowa Primaries in February starting off the voting for the presidency and providing early insight into who the nominee will be, the market could react negatively to either Warren or Biden nod.

Disappointment on the US-China trade developments and US political uncertainty should keep the Fed anchored to a cautious bias.

Despite upside risks to growth forecasts considering recent upbeat data developments, damage from previous tariffs is already making its way through the US economy. Gold stands to benefit from softer data in the months ahead, especially relative to more upbeat risk sentiment, which is likely only to affect gold at the margins due to higher equity markets.

My conversation with some of the best gold traders I have dealt with over the past few decades, who are agnostic to gold prices, along with myself, maintain a friendly attitude towards gold over the medium to long term. An environment of low rates, persistent macro uncertainty, and elevated equities makes a case for holding gold as a hedge and varier. This view could likely drive demand for gold higher into 2020 and lend support to the current medium-term uptrend. With the gold seasonality effect coming into the picture, investors may look back at the current price level with nostalgic longing at the end of Q1 2020.