Gold is becoming a major source of high quality collateral with its multi dimensional intrinsic aspects. Its lack of third party credit risk and counter cyclical behavior make it an ideal negotiable tool for this purpose.

According to the World Gold Council, Gold is increasingly being used in the financial system as a source of high-quality collateral. Its lack of credit risk and counter cyclical behavior make it ideal for this purpose. The European Market Infrastructure Regulation (EMIR) now permits Central Counter party Clearing Houses (CCP) throughout Europe to accept gold as collateral. Gold’s use as collateral at commercial banks is also growing. Gold could also serve this function in the public sector, enhancing the credit quality of government bonds and lowering bond yields.

On a video interview Natalie Dempster, Director of Government Affairs, World Gold Council commented:

“The Eurozone’s gold reserves stand at over 10,000 tonnes, and it is well known that some of the countries worst affected by the crisis, including Portugal and Italy, are responsible for a significant proportion of these assets. These reserves have served those countries well over the years, not least over the last decade, thanks in part to gold’s unique wealth preservation characteristics. Nevertheless, the question is rightly being asked as to the role that these gold reserves can, and should, play to help alleviate the problems now facing the Eurozone and the individual member states within it.”

Italy is looking to gold as collateral alternative for austerity.

According to the World Gold Council, 85% of its citizens and 91% of Italian business leaders agree that gold has a major part to play in the country’s economic recovery.

According to Natalie Dempster, the Council’s Director of Government Affairs:

“Italy holds more than 2,000 tonnes of gold in its national reserves, but selling it is not the answer and the Italian people recognize that. The proceeds would have limited impact on the overall public debt position. A higher value option is to use gold as collateral and effectively produce five times its value, without selling it. The World Gold Council calculations show that by deploying the gold as security for sovereign bonds Italy could raise over 20 per cent of its total two-year borrowing requirements.”

Commissioned by the World Gold Council, the independent research firm of Ipsos MORI completed the following study:

- 77% of citizens and 82% of business leaders agreed that the “current state of the Italian economy was a key factor” in their voting behavior.

- Both survey groups favored an economic policy which seeks to stimulate growth, with 59% of the general public and 60% of business leaders favoring such an economic policy.

- A further 36% of citizens and 25% of business leaders preferred an approach which blends both growth initiatives and austerity measures.

- Confidence in the near-term outlook for the Italian economy is limited, but there is greater optimism among business leaders, 51% of whom are confident that an incoming government might improve the economy. Conversely, 71% of citizens surveyed were not confident any government could improve the economic situation in the near future.

- 88% of citizens and 87% of business leaders would back plans to make better use of national assets, to ease the nation’s debt burden and spur economic growth and employment, with 52% and 61% respectively supporting the use of national gold reserves to reduce the country’s debt costs. Just 4% would explicitly back any plans to sell the nation’s gold reserves.

On a recent interview with Eric Sprott ( Sprott Asset Management with more than $10 billion under management) he said:

“But to answer your question, I’ve written articles answering your question; do the Western central banks have any gold left, because as you’ve pointed out, we have seen that non Western central banks have been the most aggressive people in terms of buying gold, and I’m referring to Russia, China, Mexico, S Korea, Latin American banks. If they are doing it, one of the countries, was it Peru that bought gold recently? I always try to put myself, if I was looking in on what the Western central banks are doing, and I’m referring to the Bank of Japan, the Bank of England, The European Central Bank [ECB] and the Fed, and you’re looking at what is happening and presuming that you are not a money printer, I think you would be thinking there is only one result that can happen from this money printing, and that is the value of the currency will go down.”

In our September 2012 MAAG, titled, “Do Western Central Banks Have Any Gold Left???“, we reconciled the annual change in demand for gold between 2000 and 2012 to be almost 2,300 tonnes. We went on to hypothesize that given the massive change in demand, the only suppliers large enough to fill the gap between supply and demand were the Central Banks. Now, our long search for the “smoking gun” to prove our hypothesis appears to have finally materialized.”

On this interview he continued:

"I think that is why you are seeing the type of activity we have where I’m pretty sure the number will be at least 500 tonnes of Central Bank buying, and interestingly that contrasts with, they used to sell 400 tonnes a year, which is a 900 tonne change in what central banks are doing per year in a 4,000 ton market. Who is not buying the gold that’s been buying it all along, because the supply has never increased in the past 12 years, and I’ve argued that there’s at least a 2,400 tonne shortage a year of physical gold and that the Western central banks have to be supplying that gold, because the physical things you can count, the paper stuff who knows what is going on in the paper markets?”

Latin American central bankers increasing gold reserves

In a report published here I explored the fact that Latin American central bankers are shifting the idea to increase their gold reserves as a protective measure against the U.S. Dollar future risk as the world’s reserve currency.

“We bought some gold,” Alexandre Tombini, central bank governor, confirmed to journalists recently in Brasilia.

The shift by Mexico and now Brazil could prompt some of their neighbors to reconsider gold as well.

As the rest of Latin American central bankers continue to increase their gold reserves, it is simply another confirmation of gold becoming more accepted as a protection asset or insurance against Latin American currency risk and relationship to the U.S. dollar as the world’s reserve currency.

I also commented:

“With the U.S. economic prospects of increasing debt obligations, the potential for another recession and no signs of any economic policy that would support the U.S. dollar long-term fundamentally, we can expect more emerging economies like Brazil, Mexico or Colombia to consider moving more of their fiat currency reserves into gold.”

In taking into account all the fundamental data points mentioned above I asked Eric if we were in for a short squeeze in the paper market for gold and silver? He said:

“ I think we are in for a shortage of physical gold. I mean the data I look at, one just wonders how long can these Western central banks keep doing this. Sooner or later you run out of gold. They only have so much gold, and it was estimated they had as little as 18,000 tonnes back in 2000, I would think they might be running on fumes these days.”

Gold ETFs now rival central banks in holdings

GLD, the largest gold ETF on the market, is also one of the biggest funds in terms of value of the assets it manages. That makes it “incredibly influential in the overall investment marketplace — not just the gold market,” according to David Beahm, executive vice president at precious-metals investment firm Blanchard & Co. It has holdings valued at around $63 billion. Gold ETFs now rival central banks in holdings,” he said.

Physically-backed gold ETFs as a group are the fourth-largest holder of gold, falling just behind the U.S., Germany and the International Monetary Fund and ahead of Italy and France, said Lydon, who is also president of investment advisory firm Global Trends Investments.

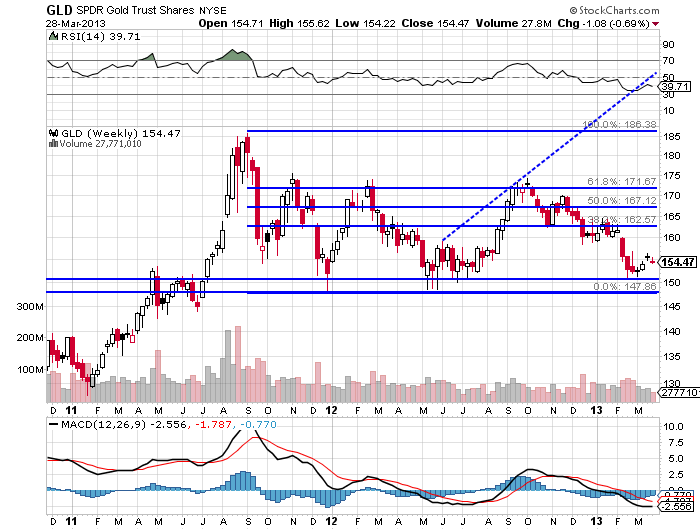

Let’s take a closer look at the gold GLD ETF and the price of gold futures and see if we can identify some live trading opportunities for next week.

The GLD SPDR Gold Trust Shares closed at 154.57. The market closing below the 50 day MA (157.20) is confirmation that the trend momentum is bearish. A close above the 9 MA (157.20) would negate the weekly bearish trend to neutral. With the market closing above the VC Weekly Price Momentum Indicator of 154.30, it confirms that the price momentum is bullish.

Look to take some profits, if long, as we reach the 154.84 and 155.11 levels during the week. Buy corrections at the 154.26 to 153.95 levels to cover shorts and go long on a weekly reversal stop. If long, use the 153.95 level as a Stop Close Only and Good Till Cancelled order.

If this week’s lows in gold are not violated by closing below this level on a weekly basis, we can build a strong argument that the lows are in and the foundation is in place to support a bigger and stronger move to the upside.

If the lows of this week hold, it will support a rally into the following Fibonacci targets short-term:

1. 162.57

2. 167

3. 172

A close above 172 puts into perspective the upper end of the target zone of 186. A weekly close above this level would set the stage to challenge the highs (186) made in September 2011.

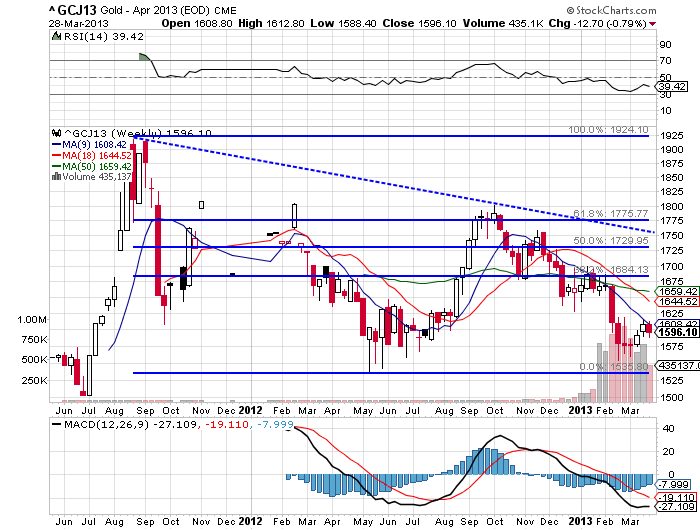

The April gold futures contract closed at 1596. The market closing below the 9 day MA (1608) is confirmation that the trend momentum is bearish. A close above the 9 MA (1608) would negate the weekly bearish short-term trend to neutral. With the market below the VC Weekly Price Momentum Indicator of 1599, it confirms that the price momentum is bearish.

Look to take some profits, if long, as we reach the 1610 and 1624 levels during the week. Buy corrections at the 1585 to 1574 levels to cover shorts and go long on a weekly reversal stop. If long, use the 1574 level as a Stop Close Only and Good Till Cancelled order

If this week’s lows in gold are not violated by closing below 1588 on a weekly basis, we can build a strong argument that the lows are in and the foundation is in place to support a bigger and stronger move to the upside.

If the lows of this week hold, it will support a rally into the following Fibonacci targets short-term:

1. 1684

2. 1730

3. 1776

A weekly close above 1776 puts into perspective and set the stage to challenge the highs (1923) made in September 2012.

Disclaimer: Trading Derivatives, Financial Instruments And Precious Metals Involves Significant Risk Of Loss And Is Not Suitable For Everyone. Past Performance Is Not Necessarily Indicative Of Future Results.