- Gold surges as Israel carries ground operations inside Gaza

- Geopolitics and Harker weigh on Fed rate hike expectations

- Oil rallies as fears of supply disruptions due to the war heighten

- S&P 500 and Nasdaq slip as geopolitics offset strong earnings results

Gold shines as Israel-Hamas tensions flare up

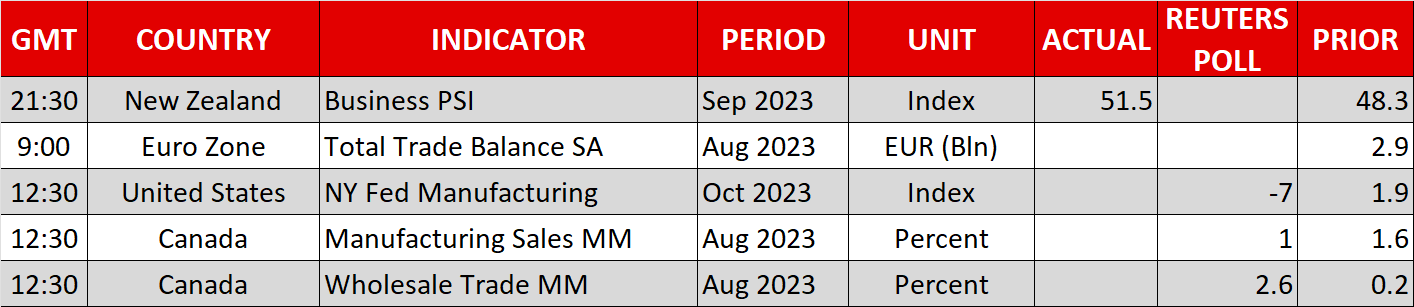

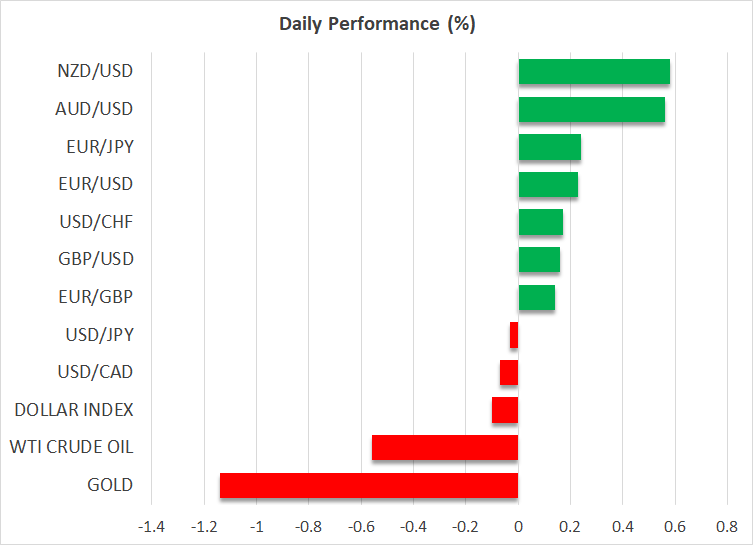

Gold surged more than 3% on Friday as the escalating conflict between Israel and Hamas forced market participants to seek safety.

On Friday, Israel’s infantry carried out raids inside the Gaza Strip, warning residents of the northern half of Gaza to flee to the south. This was the first shift from missile attacks to ground war, a week after Hamas rampaged through southern Israel,

For the financial community, this was a clear risk-off alert, with market participants rushing into every asset they consider as a safe haven. Even the yen gained against its US counterpart, but with the BoJ maintaining its ultra-loose stance, the dollar/yen pair remained close to potential intervention levels around 150. Bonds were probably also a choice, evident by the slide in Treasury yields, which were detached from the US dollar, as the world’s reserve currency wore its safe-haven armor as well.

Having said all that, gold was the safe haven of choice, with the precious metal briefly surpassing the $1,930 zone. Although it is pulling back today, the geopolitical uncertainty remains elevated and further escalation may result in another rally, and perhaps take the price closer to the $1,985 region, which acted as strong resistance between May and July.

Philly Fed President Harker says they are probably done

Another reason why gold was the better haven choice may be the reduced expectations of another hike by the Fed. Although Thursday’s hotter-than-expected CPI data allowed some market participants to raise again bets of another increment before the end credits of this tightening crusade roll, the escalating conflict in the Middle East and dovish remarks by Philadelphia Fed President Patrick Harker forced them to scale those bets back.

With Harker saying that he believes the US central bank is probably done raising interest rates and that holding them steady will let monetary policy do its work, investors are now assigning only a 32% probability of another 25bps increment, while they expect interest rates to end 2024 at around 4.7%, well below the Fed’s own projection of 5.1%.

So, with most investors holding the view that interest rates will not rise further and that they will be cut next year, the non-yielding gold regained its shine. Even if the greenback continues to attract safe-haven flows due to the intensifying Israel-Hamas war, the lowering of the implied Fed rate path may keep any further dollar gains in check. For the US currency to resume its prevailing uptrend, incoming data and Fed rhetoric may need to start favoring one more rate increase and/or less rate cuts for next year.

Oil skyrockets on concerns of supply disruptions

The Canadian dollar was also among the currencies that outperformed the US dollar on Friday, despite not being classified as a safe haven. On the contrary, the loonie is considered a risk-linked asset. However, Friday’s risk aversion turned out to be positive for this currency, as oil prices skyrocketed again, with both WTI and Brent benchmarks gaining almost 6%.

The possibility that the conflict could involve oil-producing countries may have increased after Israel’s decision to invade Gaza, heightening fears of supply disruptions even as Saudi Arabia pledged last Wednesday to help stabilize the market.

On Saturday, Iran warned that if Israel does not stop its war crimes, then the situation could spiral out of control. Taking that into account, if Iran decides to directly be involved, the US could reinforce its sanctions on the nation’s oil exports, even as it softened its stance this year due to efforts to improve diplomatic ties with Tehran.

Therefore, although Friday’s rally suggests that the involvement of other nations may be factored into the market to some extent, should those fears turn into reality, an actual impact on oil supply could easily send WTI prices back up to the $95.00 territory and even higher.

Wall Street cares about geopolitics as well

On Wall Street, despite the Dow Jones gaining slightly on Friday, both the S&P 500 and the Nasdaq slipped, with the latter losing more than 1%, even as the market lowered its implied Fed rate path and even as big commercial banks announced better-than-expected quarterly profits.

This suggests that investors are currently more focused on the war in the Middle East rather than the earnings season, but this could well change when tech giants begin to report and needless to say, conditional upon no further escalation in geopolitical tensions. On that matter, Tesla (NASDAQ:TSLA) and Netflix (NASDAQ:NFLX) will make their numbers public on Wednesday after the closing bell.